The European Union (EU) is moving ahead with tariffs on imported Chinese solar panels in an effort to protect its own module makers.

European Commission (EC) Trade Head Karel De Gucht will recommend the EC impose anti-dumping (AD) charges similar to those imposed last year by the U.S., according to Reuters.

The tariffs will average 47.6 percent for most of the 100-plus Chinese manufacturers found by the EC to have been involved in the dumping but will vary by the extent of the manufacturer’s dumping and the extent of their cooperation with the EC’s investigation, according to the Wall Street Journal, which reviewed the preliminary document.

Suntech Power Holdings (NYSE:STP) and its subsidiaries will be charged tariffs of 48.6 percent, LDK Solar (NYSE: LDK) will pay 55.9 percent, Trina Solar (NYSE:TSL) will pay 51.5 percent, and JinkoSolar (NYSE:JKS) will pay tariffs of 58.7 percent, WSJ reported. Companies that did not cooperate with the EC investigation will pay a tariff of 67.9%.

The investigation covered EU imports of crystalline silicon photovoltaic (PV) panels, cells, and wafers valued at $27.6 billion in 2011, which amounted to more than half the global PV market, according to Bloomberg. The Chinese companies, Bloomberg added, owned almost no global PV market share in 2004 but controlled 80 percent of the global market by 2011.

Germany’s SolarWorld, the dominant EU panel manufacturer, called for the anti-dumping investigation in the wake of price drops of 75 percent in module prices, 42 percent in cells, and 40 percent in wafers between 2009 and 2012, WSJ reported.

The competition left the once-dominant SolarWorld with “$1.2 billion in liabilities,” Reuters reported.

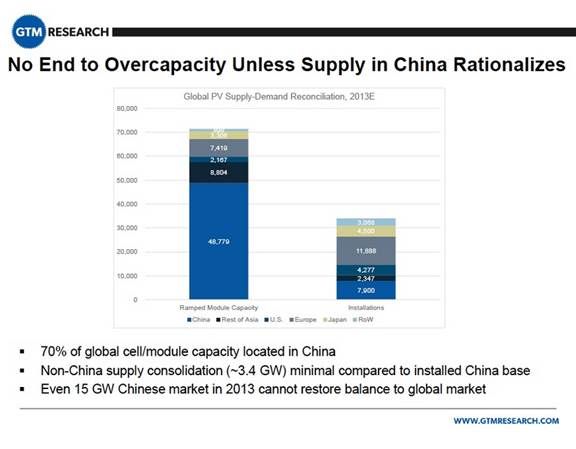

The price drops are directly related to manufacturing oversupply in China, Senior Analyst Shyam Mehta noted at the recent GTM Research Solar Summit.

U.S. authorities finalized AD and countervailing duty (CVD) tariffs in October 2012. Suntech’s rate is 35.97 percent, Trina’s is 23.75 percent, others must pay a 30.66 percent tariff, and those caught in violation will have a 254.66 percent rate imposed. SolarWorld was part of the coalition of U.S. and EU solar panel manufacturing companies that pushed for imposition of U.S. tariffs.

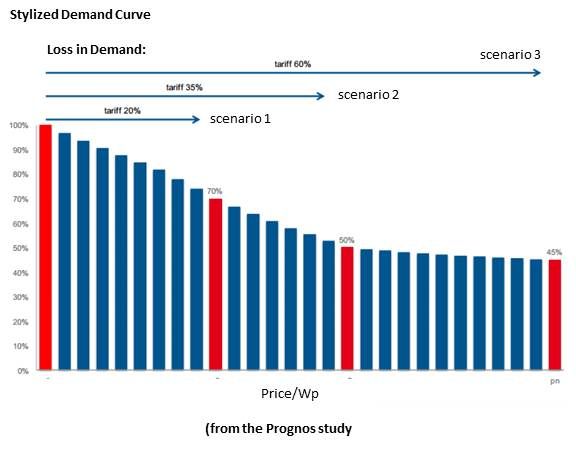

Because the low prices have driven an unprecedented expansion in solar, distributors and installers oppose the tariffs. The EU-based Association for Affordable Solar Energy (AFASE) continues to lead an effort to block the tariffs. AFASE cited a study by Prognos, a German research consultant, that found tariffs will:

- cause a drop in EU solar sector employment because of a drop in demand for solar

- cause an additional drop in EU solar sector employment because of a decrease in exports of raw materials and machinery to China

- negatively impact the EU economy because of the drop in solar sector demand

EU jobs and other economic factors may, however, “be somewhat positively affected” by a boost in domestic solar manufacturing, Prognos noted.

A tariff of 20 percent, Prognos found, would put roughly 107,600 jobs at risk in the top five EU economies (EU-5) from 2013 to 2015, including 54,700 jobs in Germany, 21,400 jobs in Italy, and 16,700 jobs in the U.K. It would cost the EU-5 €13.6 billion, including a German loss of €7 billion. With tariffs of 35 percent or 60 percent, “These numbers are significantly higher as the demand shrinks to a greater extent.”

SolarWorld has acknowledged the U.S. tariffs have not protected its domestic solar manufacturers, SunEdison (NYSE:WFR) founder/Coalition for Affordable Solar Energy (CASE) President Jigar Shah recently wrote in GTM. Instead, they have initiated an international trade war that includes:

- The SolarWorld-driven action in the EU

- A retaliatory investigation by China into alleged dumping by U.S. polysilicon suppliers into the Chinese market

- A retaliatory complaint by China to the World Trade Organization about EU subsidies to its PV project developers

- An investigation by India into dumping by U.S., Chinese and Malaysian solar cell manufacturers

“The big winners will be the producers of coal, oil and natural gas, not solar manufacturers in the U.S., China, the EU or anywhere else,” Shah wrote. “Instead of retaliation and recrimination, we need education and reconciliation. We need to work together to create an international framework for a worldwide solar industry.”

The imposition by the EC of CVD tariffs and final dispositions for both its CVD and AD tariffs are not expected until the end of the year, according to Reuters. Chinese officials remain in Brussels and discussions with EC representatives continue. But, especially in the wake of the U.S. tariff decisions, there is little optimism about a satisfactory resolution in the EU.

"It is difficult to negotiate with the Chinese," AFP quoted an unnamed EU official as saying. "They find it difficult to respect the laws of their partners, and with them, everything becomes a political issue."

China has shown, AFP added, “it is ready to play hardball when it feels its interests are being disregarded.”