AltaRock Energy, backed by Google (NASDAQ:GOOG), Kleiner Perkins, Khosla Ventures and Vulcan Capital, has made some breakthroughs in Enhanced Geothermal Systems (EGS) development in the last few months.

First, a carefully controlled, high pressure, cold water hydroshearing process late last year at the Newberry Geothermal Project in Bend, Oregon, cracked hot rock at 500 meters while producing only microseismic events. This suggested the EGS process, which was put on hold in 2010 because of concern that deep probing at California and Swiss projects was causing earthquakes, is manageable.

Early this year, AltaRock advanced control of the process further. It injected recycled plastic into fractured rock at the Newberry site, sealing off separated reservoirs, and continued fracking them individually.

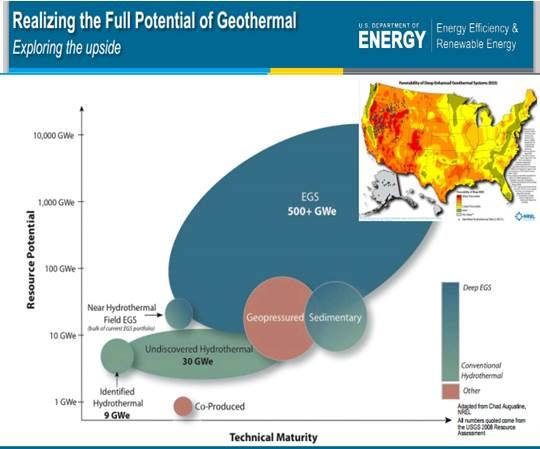

EGS, if proven safe, would turn the earth’s deep heat into productive geothermal power even in the absence of the kind of water reservoir adjacent to the heat source that makes a conventional hydrothermal well viable.

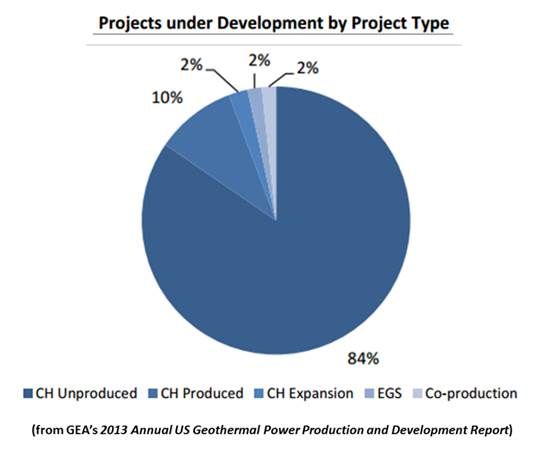

Of the 3,385.6 megawatts of the 2012 U.S. geothermal installed capacity, which was about 0.33 percent of installed U.S. generation and 3.5 percent of U.S. renewable energy generation, none was from EGS, according to the just released 2013 Annual U.S. Geothermal Power Production and Development Report from the Geothermal Energy Association (GEA). But EGS technology could cut geothermal costs and eliminate significant development risks, the report said, by allowing developers “to create multiple stimulated geothermal areas from a single well.”

“From the developments at Newberry, it looks very promising that you can do fracturing in different zones and control it,” NREL Geothermal Program Manager Tom Williams said during a State of the Geothermal Industry briefing at which the new report was unveiled.

“It is in the R&D stage,” Williams added, “but when it is proved, it will open up geothermal to the whole U.S. because enhanced geothermal systems can be created anywhere and the total potential is enough to power the electric grid many times over.”

“The general consensus,” Southern Methodist University (SMU) Physicist David Blackwell replied to a question about the safety of the AltaRock’s hydroshearing, “following a recent National Academy of Sciences report on hydrofracturing is earthquakes have not been associated with the process but with wells injected over long periods of time without any recovery of the fluid.”

“With EGS,” Blackwell said, “water is injected but water is extracted in a balance and there is no net change in the subsurface pressure, which mitigates against earthquakes.” A 2010 SMU study found EGS could U.S. expand geothermal potential to some three million megawatts.

“We are watching EGS intensely,” said President Doug Glaspey of U.S. Geothermal Inc. (NYSEAMEX:HTM), an industry leader in the development of conventional hydrothermal wells. “I still live in a world where there are two EGSs, enhanced geothermal systems and engineered geothermal systems.”

U.S. Geothermal’s Raft River project in in southern Idaho is “an enhanced system,” Glaspey explained. With it, an uneconomic well can be stimulated by fracturing and “become commercial.”

Glaspey’s company is working with the University of Utah at Raft River. Test thermal and hydraulic stimulation of a target well is imminent. If successful, it could show how EGS can be used to move “non- or sub-commercial wells to the levels of commercial production,” according to the Department of Energy (DOE) Office of Geothermal Technologies, which oversees the Department’s $37.5 million investment in EGS at AltaRock and other sites.

AltaRock is doing “engineered systems,” Glaspey said. It is “creating fractures” through which cold fluid can be delivered to hot rock. “There are identified hot spots and we know where they are so if we get a system that works we can certainly go after them and start producing electricity in many areas of the U.S. that have never seen production before.”

There are other DOE-led EGS efforts at the Ormat Technologies Inc (NYSE:ORA) Brady project and the Calpine Corp (NYSE:CPN) Geysers project.

The Newberry project “still needs to run injection tests and test the heat exchange areas in addition to drilling a production well in the stimulated zones,” the GEA report said. If those things prove out, AltaRock could then build a demonstration project and, eventually, a utility-scale power plant.