The energy storage industry is all about incremental improvements, so it’s rare to see a product come to market that does something radically different.

That happened last week when the stealthy Swiss/Southern Californian startup Energy Vault went public with an unusually creative grid storage concept. It devised a six-armed crane that stacks concrete blocks with cheap and abundant grid power, and drops them down to retrieve electricity when needed.

The company pitches this as a durable, trustworthy solution for the thorny problem of storing electricity for long periods of time.

The lithium-ion batteries that account for almost all of new grid storage deployments make economic sense for 4-hour duration, even 6-hour, but they get too expensive for super-long durations. Meanwhile, longer-term storage is getting more valuable as cheap but intermittent wind and solar power continue their rise on the grid.

That mismatch has inspired a cohort of lithium-ion challengers taking aim at the dominant technology’s safety concerns, degradation and duration limitations. So far, this wing of the industry has numerous bankruptcies to show for its labor, with a few survivors that could prove durable.

Energy Vault dispensed with the lengthy lab research required to commercialize new battery tech and drew inspiration instead from the granddaddy of grid storage, pumped hydro.

The shifting of water between higher and lower reservoirs still delivers the vast majority of global grid storage capacity. The problem, at least in the U.S., is that the Bureau of Reclamation and the Army Corps of Engineers have already dammed all the most auspicious sites, and modern regulations to prevent environmental devastation make new siting difficult, if not impossible.

Gravity has many uses, though. Energy Vault elevates giant bricks that eventually come down, releasing potential energy to the grid.

The concept is simple enough, although it depends on intellectual property in materials science, physics and software. The outcome, if it works as described, would be significant.

The system operates at about 90 percent efficiency, and delivers long-duration storage at half the prevailing price on the market today, said CEO and co-founder Robert Piconi.

"We are bringing something to market that, for the first time, will produce baseload power below the cost of fossil fuels, and not just for six hours a day," Piconi told GTM in an interview. "We’re in a position to accelerate the pace at which the world is going to be able to deploy renewables."

To do so, Energy Vault must succeed where several mechanical storage startups, with their own takes on seemingly simple technological solutions, have failed.

No factory required

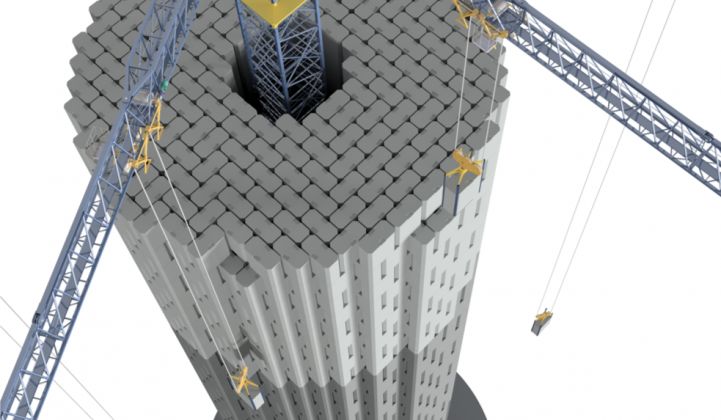

A full-scale Energy Vault plant, called an Evie, would look like a 35-story crane with six arms, surrounded by thousands of manmade concrete bricks, weighing 35 metric tons each.

That version doesn't exist yet; the company has only built a demo unit at one-seventh scale, completed in June in Switzerland. The demo is used for testing to hone the design.

Once constructed, a fully charged plant will stack the bricks around itself in a Babel-like tower; to discharge, the cranes drop the bricks down, generating power from the speedy descent. The standard configuration delivers 4 megawatts/35 megawatt-hours of storage, which translates to nearly 9 hours of duration if discharging at full capacity.

Any challenger to lithium-ion must stay ahead of its mass-production cost declines; that’s hard to do when starting up at a small scale. Energy Vault believes it has found ways around the cost centers that challenge other battery startups.

It won’t need to sink millions of dollars into a factory, for one thing.

To build an Evie, the company arranges delivery of the crane from its crane manufacturer partner. Then it assembles the bricks onsite, largely from recycled concrete material that companies typically have to pay to dispose of (Energy Vault partnered with global cement giant Cemex to develop alternative materials for markets with different resource availability).

Operation is fully automated; the control software is designed to move the bricks while accounting for inertia and wind interference, to avoid swinging the monoliths dangerously.

The durability of the materials should keep the system running for 30 to 40 years, Piconi said. The team even commissioned a seismic impact study from the experts at Cal Tech, and factored in their advice for earthquake resilience.

"Our solution doesn’t degrade," he said. "It’s a large concrete brick that sits there."

An Energy Vault plant may look like this, once one gets constructed. (Image credit: Energy Vault)

Taken together, these factors achieve a system price in the $200 to $250 per kilowatt-hour range, with room to decline further as the company iterates its crane technology, Piconi said. That puts it roughly 50 percent below the upfront price of the conventional market today, but 80 percent below it on levelized cost, he added.

“We’re going to get the cost points that people didn’t think we would get to for the next five to 10 years,” Piconi said.

The company already has sufficient funding from two rounds to carry it through initial customer deployments, Piconi said, although he declined to name the size of that financing. Energy Vault is a portfolio company of the long-running Pasadena-based incubator Idealab, and Idealab CEO Bill Gross co-founded Energy Vault.

What’s the catch?

Industry observers by now are rightfully wary of big claims about roundtrip efficiency and breakthrough storage technology. The subsegment of mechanical storage startups has a particularly dim record of claiming simple, commonsense breakthroughs and achieving little or no deployment.

The allure of physical storage led some startups to mimic or improve upon pumped air storage. The idea is simple: pump pressurized air into some sort of vessel and release it to generate power. LightSail never got its containerized system to market, though, nor did competitor SustainX. General Compression was trying to improve on underground storage, but its web presence suggests it met with a premature end as well.

Pressurizing gas does sound harder than lifting things up and down, but a crew of startups have attempted the latter without much to show for it.

Advanced Rail Energy Storage obtained a right-of-way lease from the Bureau of Land Management in 2016 to build a 50-megawatt/12.5-megawatt-hour gravity-based storage project: a heavily loaded locomotive that drives up and down a hill. Sounds simple and durable, with a promised roundtrip efficiency of 85 percent.

Two and a half years later, the company is finishing up the remaining land use permits and plans to begin construction soon, with operation planned for 2020, VP of Operations Francesca Cava told me last week. What sounds simple on paper can still take years to permit and construct.

Energy Cache tried the gravity storage thesis back in 2012 with a ski lift that carries weights up an incline. This story mirrors Energy Vault in almost every respect: addressing the same limitations of pumped hydro with a "drop-dead simple" technology, a design that leverages equipment from existing industries, scalable, backed by Bill Gross and Idealab.

Energy Cache built a 50-kilowatt pilot, but the scale-up didn't follow. Founder Aaron Fyke spent about four years on the project, according to LinkedIn. Now he's a founder of Energy Vault.

This history should not suggest Energy Vault can't do what it says it can do. It's founders have more information at hand than their predecessors in the earlier days of the cleantech boom, and they display a keen understanding of why other storage concepts did not pan out.

That said, the story behind this company isn't as new as it may appear. This concept has been tried before, and simple, durable, scalable technology alone did not suffice.

Proof points

Energy Vault can outdo its forebears by building a full-scale plant and showing the world how it performs. That could come as soon as next year.

The launch Wednesday at the Energy Storage North America conference revealed that Energy Vault is taking orders, and that at least one customer is ready to go public: Tata Power Company, the energy-producing arm of the Indian industrial conglomerate, will install a full-size system in 2019. ("This is not something we're paying for," Piconi told me when I asked — you can't take that for granted when a long-duration startup announces a first customer.)

Energy Vault has additional agreements for demo units under contract in other regions of the world, Piconi added. The four target segments are utilities, renewable power producers, governments (in parts of the world where they play an active role in the energy system), and large enterprises.

The partnerships with Cemex and GE (for the motors) bolster confidence in the venture. Industry experts interviewed for this piece were willing to give the crane technology the benefit of the doubt as a low-risk approach. The 90 percent efficiency claim raised eyebrows, however.

"Everybody always says they’re going to make 90 percent," said Steve Brick, a former energy project developer who tracks storage for the Clean Air Task Force. "I’d have to see the real performance data. I think 90 percent is a pipe dream."

The exact business model remains to be seen, too, with the main question being how dependent it is on cheap or free renewables to charge up, and how it fares if other storage plants start tapping that same supply.

Looming over all of this is the inexorable march of mass-produced lithium-ion, which has already swamped the cost curves of challengers who thought they could undercut it.

"There's nothing on the horizon that is going to come close to our economics," Piconi said. That could be true, but the sentiment veers into the danger zone of famous last words for storage industry startups.

With knowledge, funding and a slick story in place, it's up to Energy Vault's founders to show that their commonsense technology is the real deal at last.