There are now 122 blockchain startups operating in the energy space. Since January of last year, 54 new firms have launched.

"There's a new company just about every week," said Colleen Metelitsa, a grid edge analyst at GTM Research who's been tracking activity in the space.

It's a sign that we're in some kind of bubble. But it's also a sign that blockchain is being taken seriously by energy companies. There are now over 70 demonstration projects deployed or planned around the world in the electricity industry alone, according to Metelitsa's tally.

In 2015, Deloitte's David Schatsky and Craig Muraskin wrote an extensive piece on how blockchain was moving beyond cryptocurrency and into a wide range of industries, including energy. "Thus far there is little concrete happening" in energy, they wrote.

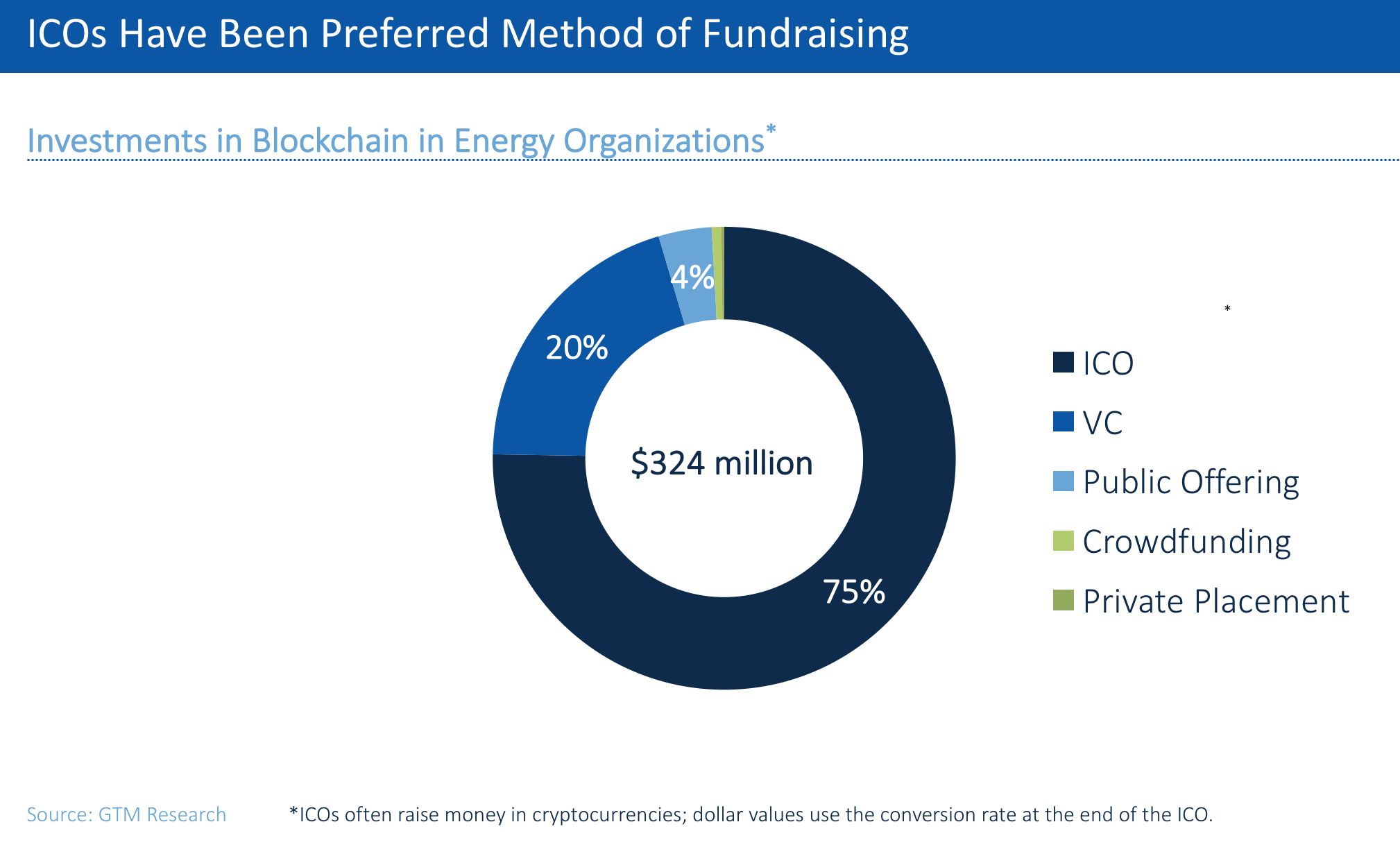

That's no longer true. Energy-focused blockchain startups raised $322 million between Q2 2017 and Q1 2018, both from venture capitalists and through initial coin offerings, according to GTM Research's accounting. Some firms are also picking up government grants.

Initial coin offerings -- a fundraising strategy "somewhere between crowdfunding, an IPO and something that doesn't exist," explained Metelitsa -- make up 75 percent of that total.

"That's going to continue, but traditional venture is going to start moving in, especially as we have increased regulation around what an ICO is," said Metelitsa. More than $900 million in venture capital was invested in 2017 alone.

Utilities are also thinking about making direct investments in blockchain companies as they experiment with use cases for transactive energy, customer billing, data collection and distributed resource management. Centrica, RWE, Innogy and Tepco have made investments in blockchain startups within the last year. Many others are working with consortia like the Energy Web Foundation.

Metelitsa presented her findings at GTM's blockchain forum in New York City last week. GTM Squared members get on-demand access to her presentation and all the other panel discussions from the day.

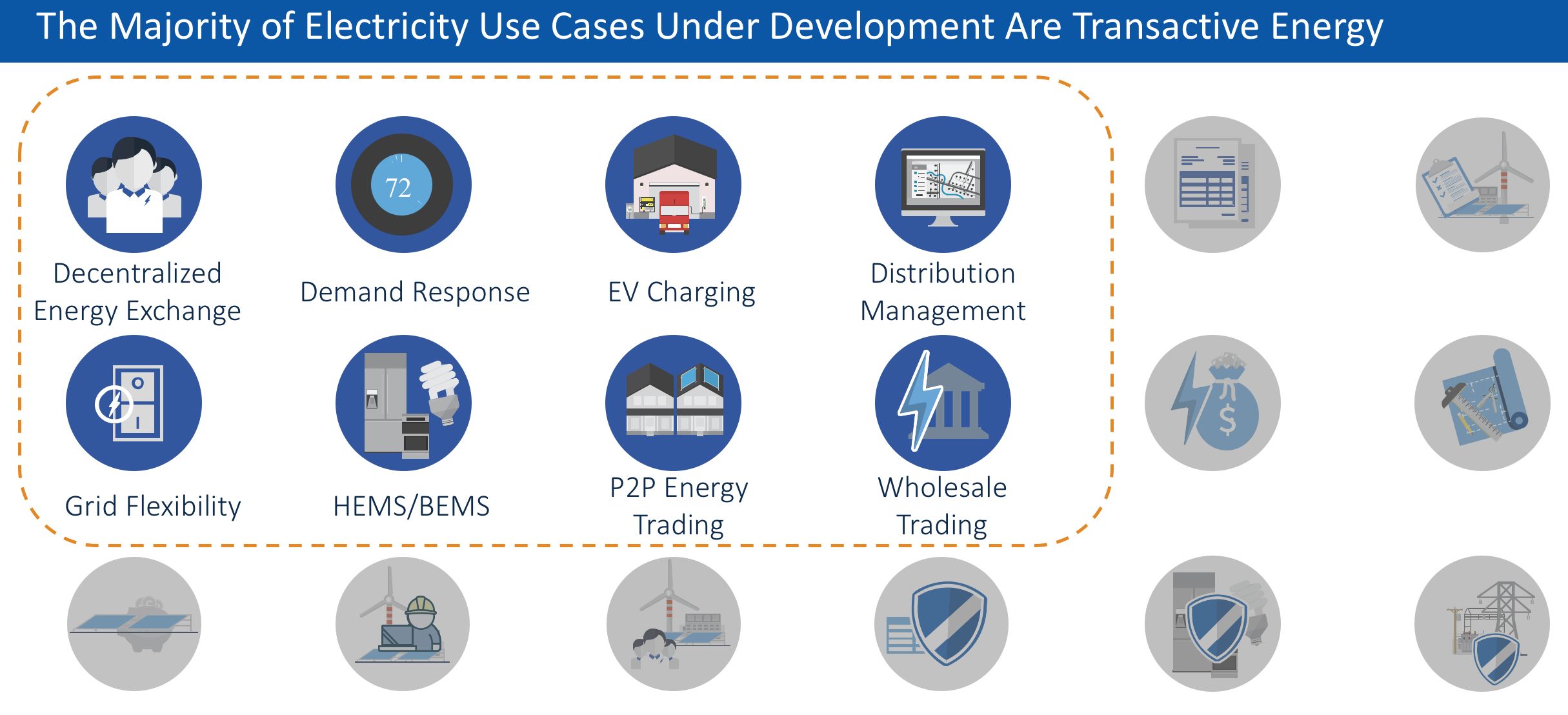

There are hundreds of uses cases for blockchain in energy. Metelitsa broke it down into a few core categories: transactive energy; accounting and billing; asset tokenization; and security.

Most of the money raised so far (57 percent) is headed toward the transactive energy space, where companies are using blockchain to verify and execute peer-to-peer transactions more rapidly. "It's demand response, EV charging, turning on and off distributed resources for grid services," she said.

Most of the companies tracked by GTM -- 94 out of 122 -- are working on an application layer for blockchain. But some of them are delving deeper, "developing a platform on top of core infrastructure that will enable middleware," said Metelitsa.

Other companies are trying to do everything, like building an entirely new blockchain platform that can support third-party applications.

"The real question is how these players are going to work together in the future, because I think it's unlikely that we're going to see one blockchain to rule them all. We're going to see multiple platforms that are going to need to interoperate and to work together," said Metelitsa.

Looking for more on the vendor landscape and use cases? Read GTM's new report on blockchain in energy.

Still trying to understand how blockchain works and why it's important? Listen to our explainer episode of The Interchange below.