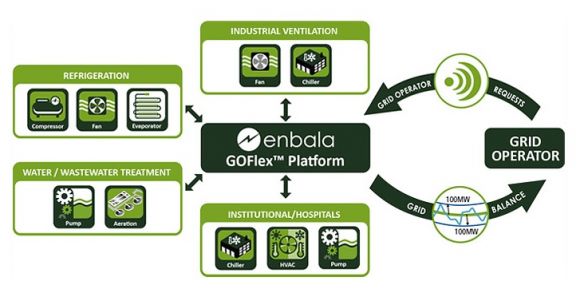

Over the past six years, Enbala Networks has put its software to use connecting, aggregating and managing megawatts' worth of energy-using systems, such as industrial pumps, refrigerators, and other loads that can be curtailed or ramped up to meet grid needs. That makes it a top contender in the world of distributed energy resource management software (DERMS) providers -- aiming to manage the complex interplay of distributed energy endpoints with the needs of utilities and grid operators.

On Monday, the Vancouver, Canada-based startup announced $11 million in new equity financing from GE Energy Ventures and Edison International subsidiary Edison Energy. The new round brings Enbala’s total financing to date to $27 million, and brings two new strategic investors on board for the startup’s next moves into broader commercial applications, CEO Bud Vos said.

So far, Enbala has been aggregating responsive energy loads on behalf of its customers in frequency regulation markets run by mid-Atlantic grid operator PJM and Ontario's Independent Electricity System Operator. It has also used its software platform, managed by employees at its network operations center, to help control customer loads to firm wind power for Canadian utility NB Power, as one of several partners in the PowerShift Atlantic project.

“What these projects did was allow the company to really prove out its technology,” Vos said. Now “we’re ready to go into the big leagues, in terms of commercialization of our technology.” That means “starting to go after many energy service providers and utilities. We wanted a strategic partner to come along with us and actually do that. We’re lucky -- we got two.”

Bundling, aggregating grid value in the energy services proposition

The first target market, energy services companies (ESCOs), is where Edison Energy comes in. Edison International owns regulated utility Southern California Edison, but its unregulated business provides energy services to commercial and industrial customers across the country. It’s competing with other utility subsidiaries like Con Edison Solutions or FPL Energy Services, as well as non-utility ESCOs like Schneider Electric, Honeywell, Siemens, Johnson Controls and others.

These ESCOs offer core energy efficiency and building system optimization, but a platform like Enbala’s can bring in what Vos called “co-optimization. We’re optimizing at the customer site, and at the same time we’re optimizing at the aggregate -- and we’re taking that aggregate and bidding it into the market.”

“That involves forecasting and a lot of very complicated software,” he said, “to leverage the asset at the customer side, without the customer knowing it, while layering it into these aggregated signals” that come from the grid operator. These can range from the frequency regulation signals sent by grid operators every four seconds to call on resources to keep grid frequency within stable bounds, to the locational marginal price, set every 15 minutes, that determines how much grid energy costs for wholesale power users.

Lots of companies are using batteries to do frequency regulation in PJM and other grid territories, and Enbala is also tapping batteries as a grid-responsive resource, Vos said. In addition, it's working with on-site generation resources, mainly solar PV, which generates power on a schedule set by the sun and cloud cover, not according to the needs of the building it’s installed on or the grid it’s connected to.

But Enbala’s software goes further, into “anything that has a motor,” he said. “I’m not just talking about variable frequency drive-based motors. Even a binary, turn-on, turn-off motor, our technology can come in and find that asset to leverage flexibility. That opens us up to pumps, blowers, fans and motors in HVAC systems and industrial process systems.”

“Couple it with a battery, couple it with the solar panel, and you’ve got a highly optimizable customer site,” Vos said. But no one single site is worth as much as a lot of sites controlled in aggregate, he added. First of all, many grid services require minimum amounts of energy or power to play into revenue-generating markets or programs.

Second of all, “the more diversity, the bigger the network gets, the more resilient the network gets,” he said. “Let’s say a building has an issue; they have to take a chiller offline. We’re going to be a lot less sensitive to that, because we’ve got lots of buildings on-line.”

GTM Research’s recent report, Distributed Energy Resource Management Systems 2014: Technologies, Deployments and Opportunities, identifies this class of software as a demand response, or DR-driven, DERMS platform. Other companies providing this kind of capability include startups such as Viridity Energy, Blue Pillar, Powerit Solutions, Innovari, Demansys and Tangent Energy. Big demand response providers are also targeting this field, as evidenced by EnerNOC’s partnership with SunPower to bring its energy management software to solar-equipped commercial and industrial customers.

Putting the power of distributed energy resources into utilities’ hands

Enbala’s second target market consists of regulated utilities seeking better information about, and possibly control over, these types of energy-optimized, grid-reactive customers. “The value proposition is slightly different” on this front, Vos said. “It’s less about making money and market opportunities. It’s really about deferral of infrastructure, and getting smarter about the resources they have.”

Utilities in states like California, New York and Hawaii are under regulatory pressure to develop DERMS platforms like these. These states have a growing number of customers installing solar PV, on-site generation, energy storage and energy management systems, which can be both problematic and helpful for the utilities serving them.

DERMS technology could help these utilities better manage their day-to-day operations in relation to these customer-sited energy assets, and help them better value and integrate them into their future grid investment and optimization plans. GTM Research calls these types of software platforms mixed-asset DERMS, and names Enbala as one of several startups, including Spirae, Power Analytics and Smarter Grid Solutions, aiming at this capability.

The big players in this market, however, are the same grid giants that are now providing most of the world’s utilities with distribution grid management software, such as Siemens, Alstom, Toshiba, ABB and General Electric. Interestingly, GE hasn’t moved as quickly as some of its competitors in this domain into its own DERMS platform, as GTM Research analyst Omar Saadeh noted in his DERMS report:

“Grid incumbents such as Alstom and Siemens are offering quasi-customizable products that promote an increased internal memory and processing capacity to accommodate the potential of thousands, if not millions, of new data points. Others like GE have yet to release a DERMS offering, citing the newness of the market and lack of client interest.”

Enbala isn’t taking on the power flow analytics and other exceedingly complex math problems involved with modeling the effects of distributed energy resources on the grid, as some of the startups in this field are doing, Vos noted. “But if you go visit our partners at GE Digital Energy, they are doing that work,” he said. “They can feed those signals into our system, and we can go control those assets. […] The GE relationship gives us a great partner to enter the regulated utility and the utility control room.”