The latest report from the Energy Department offers a vision of the future without a federal commitment to reduce emissions.

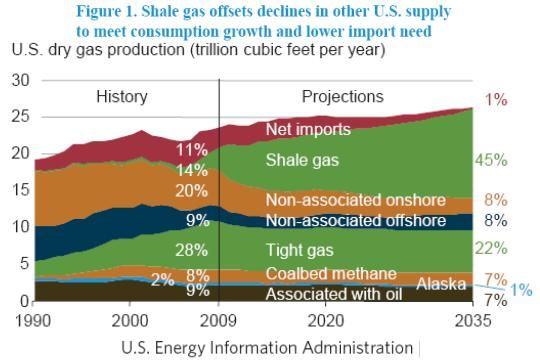

The most impressive of the numbers compiled in the U.S. Department of Energy (DOE) 2010 Annual Energy Update, from the Energy Information Administration (EIA), has to be the estimate of U.S. natural gas shale reserves. EIA more than doubled its estimate of unproved, technically recoverable shale gas reserves from 347 trillion cubic feet to 827 trillion cubic feet in the updated numbers it is preparing for the 2011 Annual Energy Outlook. (Video presentation here.)

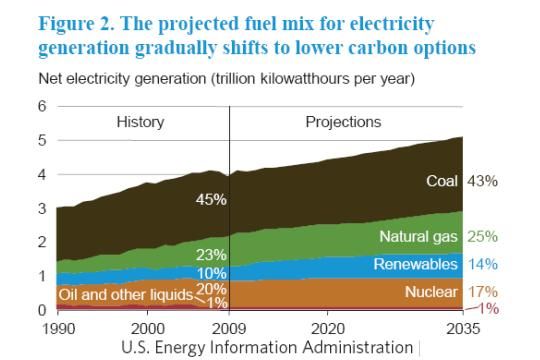

This means, according to the EIA math mavens, lower natural gas prices, twice the production for shale and an overall twenty percent increase in U.S. natural gas production through 2035 than was expected just a year ago, taking the natural gas share of electricity generation from its present 23 percent to 25 percent.

This is in contrast to the most recent report from energy sector consultants Black & Veatch (as described by Michael Kanellos in this December 6 piece) that predicts natural gas will generate 40 percent of U.S. electricity in 2035. The striking difference in the two studies comes from their different takes on the role of coal. While the Black & Veatch study sees coal plant retirements taking coal’s share of electricity generation down to 22 percent of U.S. electricity in 2035, EIA sees coal’s share of electricity generation falling only two percent, from 45 percent to 43 percent of U.S. electricity.

EIA expects the fastest-growing electricity generation source after natural gas to be renewable energy. The new numbers foresee renewables (including hydro power) generating 14 percent of U.S. electricity in 2035. The Black & Veatch report, with its much more optimistic view on the demise of coal, sees renewables (including hydro) providing 17 percent of U.S. power in 2035.

The most noticeable difference between the Black & Veatch study and the EIA study -- and it goes a long way toward explaining their diverging takes on how much coal and renewables are in the U.S. future through 2035 -- is that the former assumes there will be a price on carbon by 2016, while the latter assumes no greenhouse gas (GhG) reduction policies.

EIA contends that the growth of renewables will be driven by federal tax credits in the short run and, as the deadline years for the many state renewables standards come around between 2020 and 2025, the need to meet the standards will boost renewable capacity.

Despite its assumption that there will be no mandate for GhG reduction, the EIA report predicts energy-related emissions, which fell three percent in 2008 and seven percent in 2009 as a result of the economic downturn, will remain below the 2005 level until 2027 and will be only five percent above 2005 emissions in 2035.

The EIA predictions assume an average annual gross domestic product (GDP) growth of 2.9 percent with an average annual population growth of 0.9 percent, labor force growth of 0.7 percent and productivity growth of 2.0 percent through 2035.

U.S. energy intensity, which is the British thermal units (Btu) of primary energy use per dollar of GDP, is projected to improve by 40 percent through 2035. This follows the two percent per year U.S. pattern of improvement since 1992. Factors driving the coming improvement will continue to be (1) a shift from manufacturing to services, (2) rising energy prices (especially coal and oil), and (3) federal and state incentives for energy efficiency.

The EIA foresees the increasing supply of natural gas and its falling price to result in the present average delivered electricity price of 9.8 cents per kilowatt-hour falling to 8.9 cents in 2016 and then rising only to 9.2 cents per kilowatt-hour in 2035. The 2035 projected price is down from last year’s 10.3 cents per kilowatt-hour projection, due to the revision in shale gas supply and the resultant lower natural gas price.

The portion of energy the U.S. imports, according to the new EIA study, will drop from 24 percent to 18 percent in 2035. Federal mandates that will increase the use of domestic biofuels and the October 2010 Environmental Protection Agency (EPA) approval of an increase from ten percent to fifteen percent of the portion of ethanol that can be blended into vehicle liquid fuels are expected to drive that drop in imports, as are increasing vehicle efficiency requirements and rising energy prices.

The EIA projects that as the global economy recovers and demand for oil outstrips supply, the price will rise steadily to a nominal $200-per-barrel level in 2035, the equivalent of $125 per barrel in 2009 dollars. This translates to average 2035 prices for vehicle gasoline of $3.69 per gallon (from $2.35 per gallon in 2009) and for diesel fuel of $3.89 per gallon (from $2.44 per gallon).