The Supreme Court upheld FERC Order 745 in January 2016, certifying the legality of demand response and instigating opportunity -- and growing pains -- for participating resources.

As demand response continues to evolve within the domain of distributed energy resources (DERs), integration into system planning and operation is growing in complexity. For DERs to become more active and operate as a source of capacity, energy and ancillary services resources, as well as market design, must adapt and prompt proper signaling and appropriate remuneration.

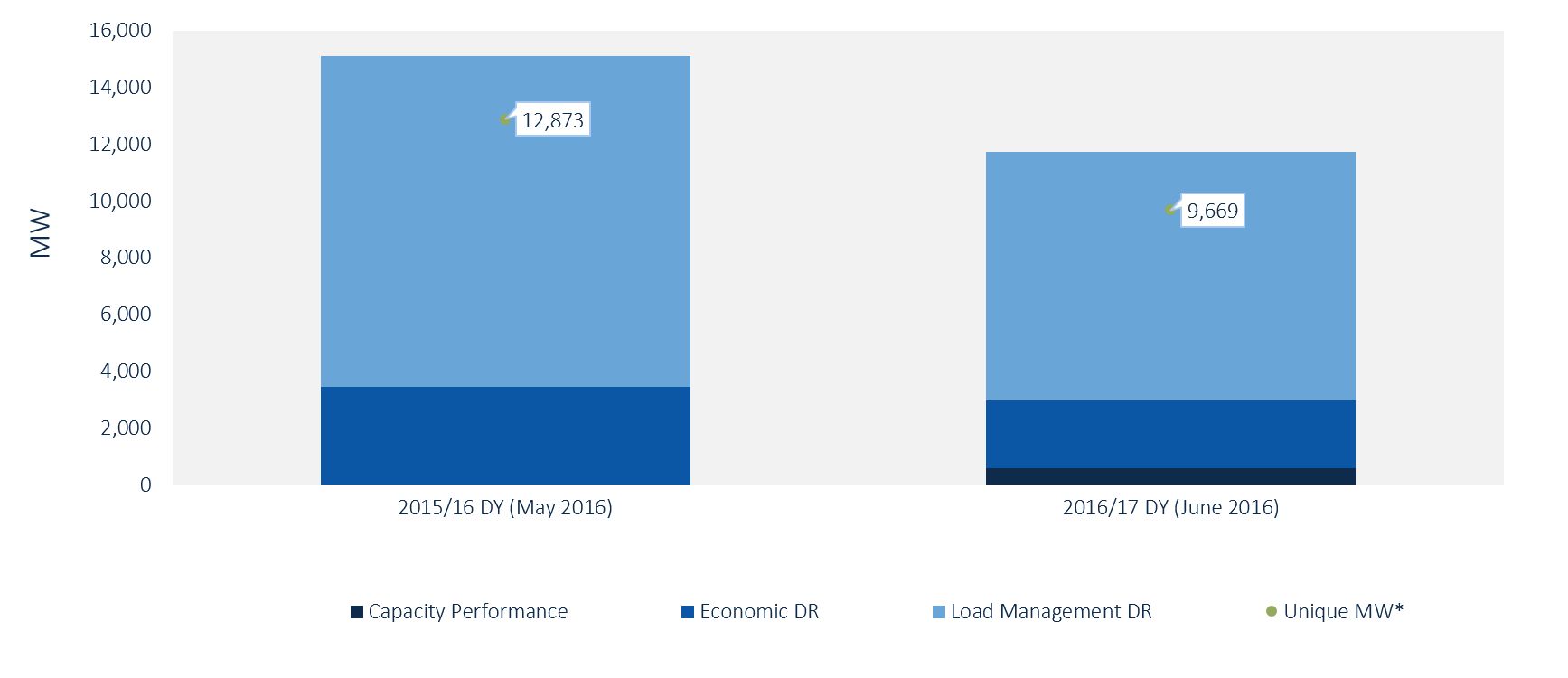

Evidence of evolving market structures can already be seen in the PJM Interconnection territory, which hosts the bulk of the available wholesale demand response (DR) in the U.S. With a new delivery year underway as of June 1, new market rules have gone into effect, available DR capacity has contracted by nearly 25 percent, and the mix of participating resources has been slightly modified. PJM ended delivery year 2015/16 with nearly 12.9 gigawatts of demand response available for dispatch at all times and started the new delivery year 2016/17 with barely 9.7 gigawatts of DR capacity.

Figure 1: Available DR Capacity in PJM

*Unique MW represents total estimated demand reduction assuming full DR compliance and economic reductions

Source: PJM, GTM Research

Market changes in PJM

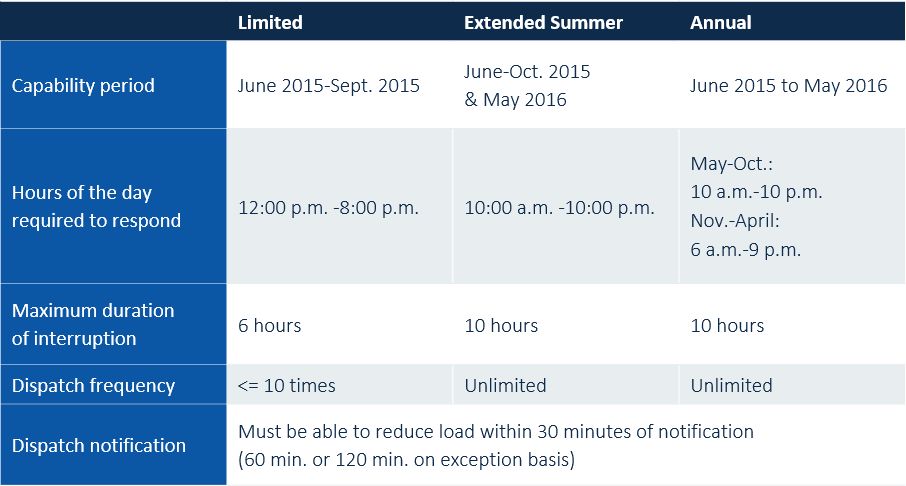

Generators performed poorly during the January 2014 polar vortex -- 22 percent of generation in the regional transmission organization (RTO) territory was unavailable to serve customers. Due to “deteriorating resource performance and the ongoing change in the resource mix,” FERC gave PJM the green light to restructure its capacity market rules to account for capacity performance. Starting in delivery year 2018/19 and 2019/20, PJM is no longer procuring Limited, Extended Summer and Annual DR and is only going for two types of Emergency Demand Response products through RPM: (i) Capacity Performance (CP) resources which must be able to sustain availability throughout the delivery year and (ii) Base Capacity resources with a seasonality component. From delivery year 2020/2021 onward, only CP resources will be procured, and this auction will be held in May 2017.

Figure 2: Changing Capacity Products in PJM

Demand Response Capacity Products Through Delivery Year 2016/2017

Demand Response Products Until Full Capacity Performance Is In Effect

Source: PJM, GTM Research

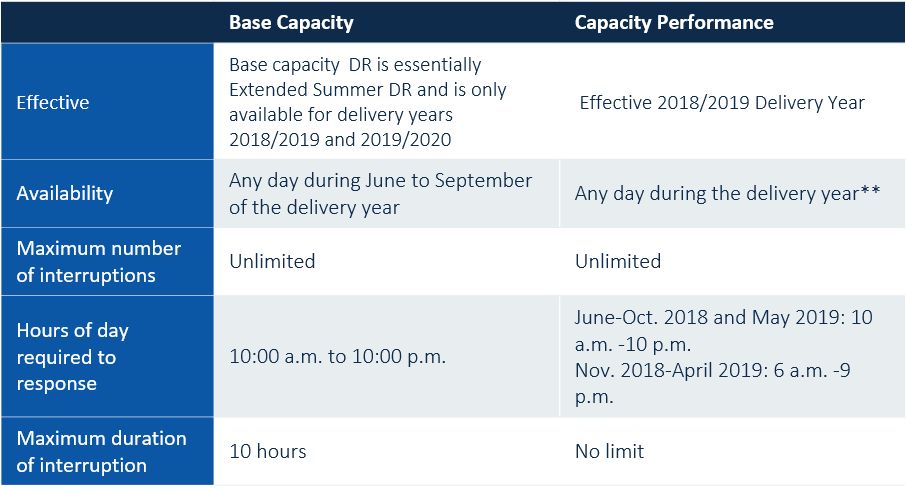

As seasonal products get phased out and CP becomes the established product, there is a lot of speculation over the benefits that CP might bring, as well as whether this was the right move at this critical time for DERs and renewables. The much-anticipated Base Residual Action (PJM's capacity auction) for 2019/20, which cleared in May, was characterized by low overall prices (hovering around $100 per megawatt-day) and shrinking levels of DR capacity. Prices along with cleared volumes spurred some discomfort for DR participants banking on PJM capacity and traditionally favorable prices for future revenues. As the largest DR market in the world, PJM represents a big chunk of revenues for national aggregators such as EnerNOC. Over the past five years, PJM has represented anywhere between 45 percent and 60 percent of EnerNOC's overall DR revenue.

The 2019/2020 auction cleared nearly 10.4 gigawatts of DR capacity, of which only 613.7 megawatts were classified as CP. An additional 4,700 megawatts of the offered DR capacity qualified for CP consideration, but low CP prices created little incentive for curtailment service providers to meet more rigorous CP requirements. The total DR capacity cleared its lowest nominal value procured in the past five auctions. However, it is important to keep in mind that as a percentage of the total committed capacity, DR procurement only fell 3.1 percent versus its 2011/12 and 2018/19 peak of 6.4 percent.

Figure 3: PJM Demand Response Committed Megawatts by Delivery Year

Source: PJM, GTM Research

Lower prices across the region are attributed to several factors, including lower natural-gas prices, lower demand forecasts, new combined-cycle gas plants clearing capacity in the auction, and the growth of renewable capacity from wind and solar resources.

Emerging concerns of capacity performance requirements

Over the years, more renewables and DERs have slowly made headway into the PJM market, proving their reliability and cost-effectiveness. When stepping back and taking a look at the bigger picture, it is evident that market forces of a liberalized competitive power sector are at work, driving down overall prices for consumers. Although penetration levels of renewables and DERs have deepened, there is a looming concern on the part of environmentalist groups that CP is not the way forward for achieving a more sustainable power system.

More recently, the Sierra Club, Natural Resources Defense Council, the Union of Concerned Scientists, and Earthjustice filed a lawsuit challenging the FERC approval of CP in PJM. The advocacy groups argue that requirements for resources to be available year-round will disadvantage renewable sources and that PJM rushed into developing these rules without consideration of the barriers put forth for clean energy choices. This concern is reflected in the RES clearing results from the 2019/20 Base Residual Auction, where over 1,300 megawatts of wind and solar cleared with very little of that as CP, approximately 90 megawatts. However, it is important to keep in mind that about 2,600 megawatts less of coal-fired capacity cleared.

PJM has initiated a Seasonal Capacity Resources Senior Task Force (SCRSTF) to investigate how wind, solar, and various DERs with seasonal differences can participate in the capacity market once the new rules are fully implemented. The task force points to the aggregation of complementary seasonally capable resources as the solution to satisfying the annual performance obligation requirements. Nevertheless, lack of aggregation in the most recent auction proved that the current design has not stimulated aggregate resource participation in the capacity auction. During a recent meeting of the SCRSTF, two redesign approaches were suggested for further stimulation of aggregate resource participation in the next Base Residual Auction which must comply with 100 percent CP:

- Currently, resources that comprise an Aggregate Resource must be located in the same modeled Locational Deliverability Areas (LDA). This location specificity may be inhibiting aggregations, and as such, PJM is proposing a change to the rules which will allow resources not located in the same LDA to aggregate for participation in the capacity auction.

- For resources that are capable of CP seasonally and do not pair up prior to the auction, PJM is proposing to act as the aggregator and match up seasonally complementary resources during auction clearing process. This change will allow seasonally CP-capable resources to clear capacity as part of an Aggregate Resource.

In spite of the opposition, PJM is continuing as planned with full CP to be procured for the following capacity auction in May 2017 for Delivery Year 2020/2021 and aims to have fine-tuned the new CP rules by late fall 2016.

Leading innovation in market design

The PJM Interconnection is regarded as the model of wholesale market innovation; it is the most attractive market for the largest DER aggregators across the country. PJM is clearly anticipating an evolving resource mix while ensuring it has a system ready to accommodate the transition without compromising reliability.

The evolving power landscape is not favorable to legacy generation. PJM is praised for its ability to act on change impacting the power sector, and in turn, providing a hospitable environment for innovation while also compelling increased operational efficiency. Although the transition to capacity performance is a challenge, it will, if successful, allow the grid operator to harmonize rules between DERs and centralized generation. The evolution to a single year-round product further stimulates opportunity for resource aggregation to clear capacity that meets performance requirements, fulfilling comparable treatment promised through FERC Order 745.

Market design reform is evolving to accommodate a changing resource mix, and this may disrupt business models. However, existing models for DR aggregators and renewable generation independent power producers have proven robust in procuring supply to meet demand in the power system.

***

Click here to find out more about GTM Research's report series on wholesale DER aggregation and learn how wholesale markets are evolving and impacting business practices.