For players in the energy and utilities sector, the terms “big data” and “data analytics” can mean very different things, depending on the problems they’re being used to try to solve.

We’ve covered some of the key goals of U.S. utilities’ big data efforts, largely centered on converting the billions of data points coming from the millions of smart meters deployed around the country and turning them into actionable intelligence on the operating conditions of the grid itself.

Europe’s big data for utilities picture is a bit different. European utilities can either be massive, vertically integrated service providers for entire nations, or contenders in radically deregulated and competitive energy markets, depending on the country you’re talking about. Some EU members, such as Italy and the Scandinavian countries, have largely completed their smart meter rollouts. Others, including France, Germany, the U.K., are just getting started.

Some European countries, such as France, have massive amounts of baseload power to help mitigate the impacts of increasing amounts of intermittent wind and solar power. But some countries, such as Germany, are experiencing a renewable energy revolution that is upending traditional ways of managing the grid and threatening long-held utility business models.

EDF, France’s national utility, sits in an enviable position in comparison to many of its European counterparts, with a massive nuclear fleet to provide stable baseload power, and a domestic market insulated from retail competition. But it’s also a player in deregulated markets like the U.K., and while France is far behind wind and solar power-rich countries like Germany and Denmark, it still has to face looming European mandates for clean power, energy efficiency and smart metering.

That means a growing role for data analytics, according to Claire Waast-Richard, CIO of EDF R&D and head of its information technology research program. In a Thursday talk at the California France Forum for Energy Efficiency Technologies (CaFFEET) in Palo Alto, Waast-Richard laid out some of EDF’s research into big data, and defined other areas of key importance for the utility in the coming years -- most notably, the need to align energy consumption with the changing nature of energy generation.

EDF is already putting big data technology to use, she said. Some examples include weather forecasting for risk assessment and modeling the impacts of energy operations on the environment. But as EDF begins its plan to roll out 35 million smart meters across France, it will need to start incorporating that flood of data into its way of doing business, she said.

“You have embedded algorithms for smarter operation of the grid,” said Waast-Richard. “You have to embed some algorithms into substations. You can also use data from the smart meter to better estimate the state of the grid, but you can also use that data to better assess the material lifetime duration” of power lines, transformers and other distribution grid equipment.

“Or you can basically -- and this is the main important part -- try to manage the energy consumption,” she said. “Doing that is called demand response, and the idea is really to push the people, or to find the best condition, in which the consumer will consume less, or [will consume] on a different timescale. This is [an area] where data will help.”

Europe hasn’t developed a demand response market like those that exist in the United States. But it’s quickly starting to leapfrog the U.S. model of day-ahead, emergency dispatch of power-down signals to shave peak loads and tackle the more challenging problem of real-time demand management -- largely to deal with the ups and downs of wind and solar power generation.

That’s an important part of managing grid assets in a world where new customer loads such as plug-in electric vehicles, as well as the increasing share of power being generated by customers themselves, are altering supply-demand balances. When everyone is charging their “electric vehicle at 7 p.m., this makes a situation which is very difficult, because it increases these peaks -- and we don’t like having too much peak,” she said.

Waast-Richard noted that there are “different ways" to shift consumption. "You can have incentives, or you can have electricity price strategy. This is a place where data will probably make a difference,” she said. EDF is only starting on this process, though it is looking at opportunities to “buy software within the next few years” to help it on that journey, she added.

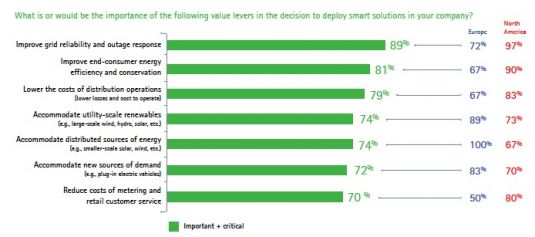

To be sure, U.S. utilities are starting to tackle challenges like these as well. But most of their data analytics focus to date has been on improving grid reliability and outage response, as well as lowering the cost of distribution operations, according to an Accenture survey of utility executives around the world.

European utilities, by contrast, have put a much greater emphasis on integrating utility-scale wind and solar power, integrating on-site power generation, and managing new sources of demand such as plug-in electric vehicles.

(Source: Accenture’s Digitally Enabled Grid program, 2013 executive survey)

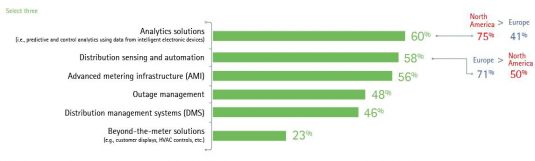

At the same time, European utilities have put much less emphasis than U.S. utilities on data analytics as a top investment category over the next five years, Accenture’s survey found.

Instead, European utilities appear to be more focused on deploying the distribution grid sensors and control systems, including smart meters, that will serve as the data collection engines for analytics to come, said Jack Azagury, global managing director of Accenture’s smart grid services business, in an interview earlier this month.

(Source: Accenture’s Digitally Enabled Grid program, 2013 executive survey)

With the addition of grid sensors comes a responsibility to find profitable uses for the data they collect. But there remains an entire world of data outside the utility enterprise that can be tapped for insight and value as well, Waast-Richard noted.

For example, “smart city” projects proliferating across Europe will offer the kind of energy data that utilities are experts in, she said. They’re also collecting data on water usage, waste collection and disposal, carbon emissions, traffic and public transit usage patterns, and a whole host of other measures of how cities operate.