Echelon’s partner-and-conquer strategy for breaking into big emerging smart grid markets took a step forward Thursday, as the Brazilian government gave its partner ELO Sistemas Eletronicos the OK to deploy an end-to-end, two-way smart meter system built on Echelon’s technology.

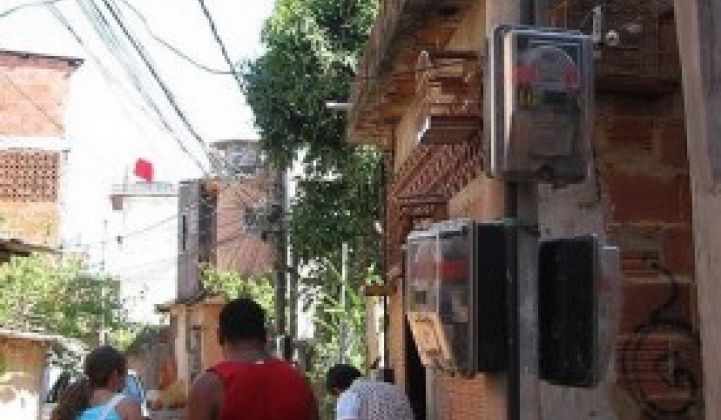

The certification from Brazil’s Inmetro agency is only a first step -- ELO and Echelon haven’t yet announced any pilot projects or deployments. But given that Brazil is under mandate to replace about 65 million electromechanical meters with smart meters by 2021, it’s doubtless an approval that many other smart meter companies are going to be chasing in the coming years.

It’s too early to tell for sure, but Thursday’s announcement does appear to give Echelon’s smart meter technology a good head start. Partner ELO is a big metering player in Brazil, serving some 40 electric power distributors in Brazil with a combined 55 million customers, as well as serving customers in other Latin American countries.

Even so, as one of the largest emerging smart grid markets in the world, Brazil is the target of multiple smart meter contenders. Landis+Gyr, the smart meter giant bought by Toshiba this spring, won approval in 2009 for a 200,000 smart meter deployment in Brazil, giving its technology entrée to the market. Likewise, U.S. smart meter networking leader Silver Spring Networks is partnering with L+G on a technology solution for Brazil, and Cisco has named Brazil as a likely target of its smart meter partnership with Itron in the coming years.

Echelon remains one of the more underappreciated smart meter players out there, perhaps because its North American smart meter projects are limited to an as-yet small-scale deployment with Duke Energy. Still, the San Jose, Calif.-based networking and building systems company has about 35 million meters deployed, mostly in Europe.

The majority of those are the 27 million smart meters that Italian utility Enel deployed in the mid-2000s using technology licensed from Echelon. Still, Echelon has since deployed millions more with utilities across Scandinavia and central and eastern Europe; the firm has captured about 80 percent of the European market, Frost & Sullivan announced in August.

Of course, many of the countries with the largest smart meter plans, such as France, Spain, Germany and the U.K., are still open for competition -- the European Commission expects EU countries to spend about 40 billion euros ($53 billion) to install about 200 million smart meters by 2020.

In Brazil, Echelon is returning to a partnership model, one that Echelon CEO Ron Sege decided to push to the forefront for the company’s smart metering business when he joined the company last year.

“Doing it this way, and choosing to sell systems and subsystems and components, is calculated to bringing our technology to more markets faster,” Sege told me in a Wednesday interview. “Our goal is to grow faster, and to get our technology adopted by and used by more utilities faster.”

In part, that’s a way to get Echelon’s foot in the door via smart meters, then add on more smart grid functions as time goes on. Echelon’s Control System (ECoS) software platform is designed to use the control nodes that link its smart meters via powerline communications as hubs for a variety of different smart grid functions: voltage sensing and regulation, distribution automation, plug-in vehicle management, and the like. The system is open to third-party developers, and Echelon named its first such partner, smart grid analytics vendor Tollgrade Communications, in September.

Just how Echelon’s partnership model will affect the revenues it’s able to achieve on a per-meter installed basis, as compared to those it sells directly, Sege wouldn’t say. One would assume the partnership model won’t be as lucrative.

Even so, such an approach makes sense in Brazil, which imposes prohibitively steep tariffs on smart meters manufactured outside its borders -- a fact that led Landis+Gyr to open a smart meter factory in Brazil to supply its 2009 project.

Another country that might require a partnership approach is China. In August, Echelon agreed to collaborate with China’s Holley Metering to develop products to meet the standards of State Grid Corp. of China and China Southern Power Grid Co., the country’s two biggest utilities.

China’s potential smart meter market is huge, but most observers expect domestic meter makers such as Wasion, Hi Sun Technology, Linyang Electronics and Holley to dominate at least the initial rollouts. But foreign competitors that can help those companies meet China’s metering standards -- particularly its plans to communicate with meters over powerlines, a technology Echelon specializes in -- could use that to get a foot in the door.