Jim Rogers, CEO of Duke Energy, wants to own every piece of the smart grid, all the way down to the energy portals in customers' homes and the solar panels on their roofs.

After all, the utility is developing the technology to make all those systems perform at optimal levels – and Duke Energy has access to more capital than a family trying to save for sending their kids to college, after all, Rogers said Wednesday at the GreenBeat conference in San Mateo, Calif.

So instead of relying on customers to buy their own home energy systems, "I'm going to own the batteries, I'm going to invest in the homes," he said. "I'm going to redefine the boundaries of the business."

That's one of the ways that Duke, which plans to spend $1 billion over five years on smart grid projects, is bucking predominant trends among utilities in the United States.

Sure, Duke is joining with most utilities in deploying smart meters to its customers, with an eye toward linking them with in-home energy management systems. But Duke's approach has focused more strongly on utility control, and ownership, than most (see Utilities Mull Price Points, Policies for Home Energy Management).

While some utilities are awaiting the arrival of home energy systems on the consumer market, Rogers says he doesn't want to wait for that market to emerge.

After all, when it comes to being able to access capital for investing in energy efficiency in customers' homes and businesses, "I can beat Walmart in a heartbeat. I can beat Home Depot. I have a lower cost of capital," he said. "Why not own every piece of it?"

The key advantage to utility-owned systems, he said, is that the utility can coordinate them all to maximize payback in terms of energy efficiency.

"We're prepared to invest in other devices, sensing devices in the homes, all the way to writing the software, because we have a chance to optimize it against the mother grid," he said.

That's the idea behind the "virtual power plant" pilot project Duke has underway in its headquarters city of Charlotte, N.C. The project links solar panels, batteries for energy storage, smart meters and in-home demand response systems, all managed by software developed by Cincinnati-based startup Integral Analytics (see Integral Analytics: Orchestrating Duke's 'Virtual Power Plant').

While the solar panels and batteries involved now sit at Duke's McAlpine Creek substation, Rogers said the same concept could well apply to solar panels and batteries at customers' homes – if the utility can control them.

Similar projects, which can also go by the name of "microgrids," are being tested around the country, and could offer utilities a host of benefits, ranging from the ability to turn down customer power loads at peak demand times to making local distribution grids more efficient (see Microgrids: $2.1B Market by 2015).

To jumpstart that process with customers, Duke is "thinking about a [home energy] portal we give them, just to set them up," Rogers said. Just which company's portal Duke might be looking at, he didn't say.

North Carolina startup Sequentric Energy Systems has such a system, and Greentech Media has learned that it is being tested in Duke's Charlotte virtual power plant project, though neither company has confirmed that fact (see Sequentric Working on Duke Pilot Project).

On the other hand, Duke is also working closely with Cisco Systems on developing an overall architecture for its smart grid deployment, and Cisco is working on a home energy management system as well (see Duke Energy Enlists Cisco in Smart Grid Efforts).

Not to say that Duke wants to tell its customers what home energy gear they can buy, Rogers said. Any portal it gives to customers should be able to interoperate with others that emerge, he said.

"We can't envision the products that are coming. But we want people to be able to plug in," he said.

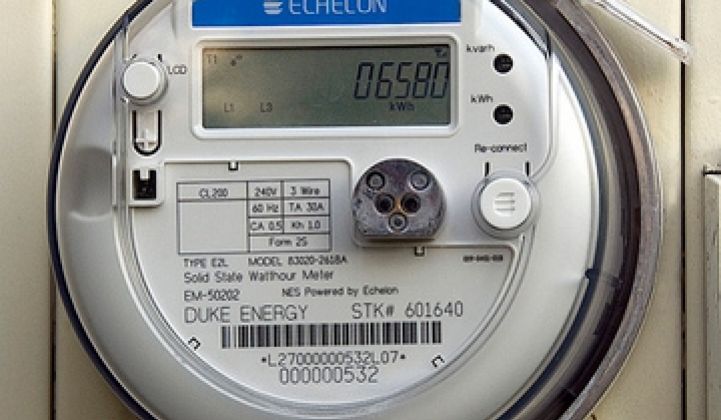

Duke has also taken a different tack from most U.S. utilities in choosing Echelon Corp. to supply its smart meters. San Jose, Calif.-based Echelon, which has an initial $15.8 million deal with Duke that could expand to as much as $150 million for Duke's planned 1.5 million smart meter deployment, uses powerline carrier technology to communicate over the same wires that carry electricity (see Echelon Expands Smart Meter Contract With Duke Energy).

Most other North American utilities have chosen smart meters that use wireless-based technologies (see RF Mesh, ZigBee Top North American Utilities' Smart Meter Wish Lists).

Duke isn't eschewing the wireless route. It has worked with Echelon, as well as smart grid communications startup Ambient, on designing a smart meter system that can be adapted to multiple communications modes.

The bottom line is the goal of bringing "universal access to energy efficiency to all customers – large and small, low income and high income," Rogers said. "The only way that can happen is with a smart grid."

Rogers also touched on Duke's partnerships with Chinese companies Huaneng Group to develop cleaner coal-fired power plants and ENN Solar Energy to build solar power projects in the U.S. (see Duke Energy, China's Huaneng Group Collaborate on Coal Carbon Capture and Chinese Company to Build Solar Power Plants in U.S. With Duke).

Duke is one of several U.S. utilities exploring relationships with Chinese companies, as the Wall Street Journal reported Wednesday, and Rogers said he sees more to come for Duke. After all, the utility is looking for ways to finance its five-year, $25 billion capital improvement plans, and Wall Street has become a tough place to raise funds, he said.

Chinese partnerships could also give Duke some extra clout when seeking to develop more projects overseas, such as in Brazil, where the utility already owns about 4,000 megawatts of generation capacity, he said.

"Let's take a U.S. company, and a Chinese company, and let's conquer the world," he said.

China is moving more quickly to find ways to capture and store carbon from coal-fired power plants, he said. While the U.S. could take 10 years or more to bring such projects to scale, in China, "If it's doable, they'll do it in five to seven years," he said.

And if carbon capture and storage from coal plants isn't doable, Duke wants to know, he added.

In that case, "I'll build nuclear plants, instead of coal plants," said Rogers, who has long pointed to nuclear power as a low-carbon alternative to coal (see Reuters).

Among the more experimental projects Duke is contemplating with Chinese partner ENN is a system to capture carbon dioxide from coal plants using algae, and then turn that algae into biofuel, Rogers said.

ENN has been testing the system at different power plants, and Duke is "exploring" the idea as well, he said.

Similar pilot projects are being proposed by utility Arizona Public Service Co. and the Department of Energy's Idaho National Laboratory (see APS Gets $70.5M to Feed Captured Carbon to Algae).

Of course, Duke – as a recipient of $200 million in Department of Energy smart grid stimulus grants – might face some backlash if its partnerships are seen as directing U.S. taxpayer dollars toward Chinese companies. A stimulus-backed 600-megawatt wind farm planned to be built in Texas using wind turbines made in China has already raised the ire of Sen. Charles Schumer (D-N.Y.), who has asked the Obama administration to block federal funding for the project.

A study Duke has undertaken is expected to show that its Chinese partnerships will yield jobs and economic growth for both countries, David Mohler, the utility's chief technology officer, said Tuesday at the Dow Jones Alternative Energy Conference near San Francisco (see Is China a Friend or Foe to the U.S.?).

Photo of an Echelon smart meter via Duke Energy.