Deregulation in the electricity markets is often talked about in terms of choice and bringing the variation of the wholesale markets more in line with what the average person is paying. States with competitive retail markets are largely seen as some of the most exciting areas to be doing business in the utility space. But are they really?

A few months ago, Greentech Media looked at the offerings in the most active state, Texas, and found that the options are just barely starting to see some real differences on the residential side besides generation and contract options, despite the fact that nearly 60 percent of consumers exercise their right to choose. For the other states, well, it’s an even bleaker picture according to recent data from the U.S. Energy Information Administration.

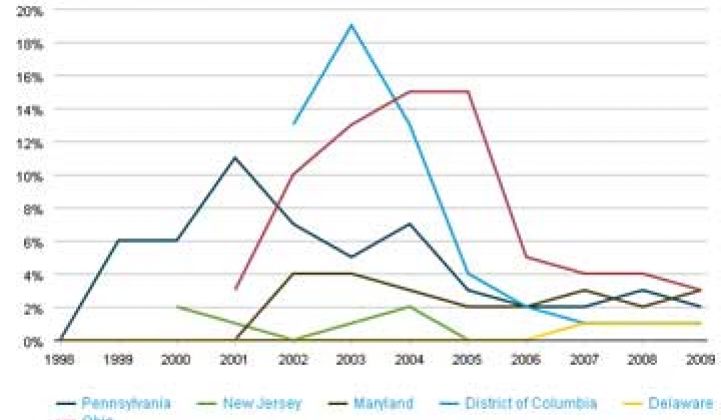

Fifteen states and the District of Columbia have active retail choice programs for residential electricity customers, but you’d never know it looking at some graphs published last month by the EIA. The rate of switching is paltry, at best, in all states except Texas. In six states, the rate of participation was too low for the EIA to even put on a chart.

Despite the fact that some states have been deregulated for the better part of a decade, the growth rates are often sloth-like in pace. There are a variety of reasons for the slow roll of these programs, ranging from lack of consumer awareness to regulatory missteps. However, there is also a thin silver lining with more states joining the fray and competition finally picking up in other regions, such as the Northeast.

“Customers are in fact switching,” said Greg Guthridge, managing director for Retail and Business Services for Utilities at Accenture. “Where market conditions are favorable, retail electric providers (REPs) are entering -- both traditionally large C&I focused firms, as well as smaller, less well-known, more nimble, ‘simple solution’ players.”

The key there is favorable market conditions. For starters, although the EIA study shows some participation in the Pennsylvania market, the state is only truly deregulated starting this year for the majority of consumers. “We haven’t been at this very long,” said Michael Valocchi, Energy & Utilities Industry lead for IBM's Global Business Services unit. He noted that the addition of more customer analytics -- in part because of smart meters, and just giving the markets more time to mature -- will fix some of the problems.

One of the major impediments to active markets is a regulatory, not an age, issue. When wholesale prices increased in the middle of the last decade, many regulators set the default cost for residents so low that it impeded competition. “There was no way for a competitive supplier to supply against that price,” said Paul Thomas, CEO of Green Mountain Energy Company, a retailer owned by NRG Energy that is active in various states. “A utility can lose money for that time but build it into their rate case.”

Another problem is awareness. I recently heard a smart grid and utility analyst proclaim that he wished he could shop around for his electricity. He can; he lives in New York. However, as someone that has swam into the deep end, this reporter can say it’s a fairly painful process, at least in New York. Unlike Texas, which has a Power to Choose website, which is a clearinghouse for picking your REP, New York lists choices, but then you have to go to individual companies’ websites for more information. With many REPs, you have to pick up the phone for exact quotes.

There are two sides to the customer awareness coin. One is the fact that in most states, like New York or Maryland, you are automatically assigned a retailer when you move to town, usually the incumbent in the area. In Texas, you have to choose a provider. By forcing people in new homes to shop around, it opens up the market. “There’s a lot of information there,” Terry Hadley, Spokesperson for Texas’ PUC, said of the Power to Choose website. ”There should be that ability to learn as much as you can for the first-time customer.”

The flip side is education campaigns. Most public utility commissions, like every other public agency, are strapped for cash. While a single utility might have a media campaign about energy efficiency, few REP newcomers can afford the costs of a full-blown media campaign -- and incumbents don’t want to tout the fact that consumers can shop around.

Again, Texas is the example of how to do it right. The state’s PUC had an aggressive campaign just after deregulation to let customers know they now had a choice. “What you see in Texas is a tremendous amount of competition and a very informed consumer,” noted Thomas.

Consumers being left in the dark is just part of the problem. The EIA noted that in some states, such as Ohio, early growth was due to the fact that local governments could sign up their residents as a group, but as rates increased, governments changed their minds.

For all of those reasons, many experts, including Guthridge, say that Texas is the “real” deregulated market to watch. “The Texas model is getting attention in terms of job creation,” said Thomas, “and demonstrable benefit to customers.” But Pennsylvania is the next one to keep an eye on. Guthridge noted that switching has reached 37 percent in PPL’s territory in this year alone.

And yet, even in a market with the right regulation, there is a limitation in who might want to switch. In the case of Green Mountain, it only sells clean energy. For people who either are not interested in the source of their electricity or who have relatively low bills to begin with, shopping around just isn’t worth it. “Pocketbook impact matters -- customers act when they understand they have choice and when a financial benefit exists,” said Guthridge. Most deregulated states, however, have generally higher rates overall than regulated states, meaning that there are potentially more customers who will want to shop around.

Beyond pricing, Accenture notes that there are barriers to market for many small retailers. In markets where residential retail is attractive, “We are starting to see some companies buy whole companies to buy their business model,” said Guthridge. M&A activity is likely only to increase as utilities evaluate ways to stay competitive as the overall business model changes in coming decades.

And some markets are looking more attractive. Besides Pennsylvania, Thomas said Green Mountain Energy was very interested in Illinois to get access to the Chicago area. “We expect aggressive expansion,” he said, even in areas where customers wouldn’t traditionally be thought likely to shop with “green” values in mind. New York is another area where competition is gaining ground.

In coming years, offerings will also go far beyond type of generation, length of contract and price per kWh. In Texas, there are already some early dynamic pricing plans and more will be coming. Eventually, retailers may partner with other services, such as telecom, or sell solar panels -- as Origin Energy does successfully in Australia. Even though some of the competitive U.S. states are relatively dormant, the ones that tweak their regulation in coming years could welcome a wave of innovation. “There’s a wave of technological change coming,” said Thomas.