In the last 24 hours, Danish giants Novozymes and Genencor have announced technological breakthroughs that radically cut the price of their enzymes.

Why are enzymes significant?

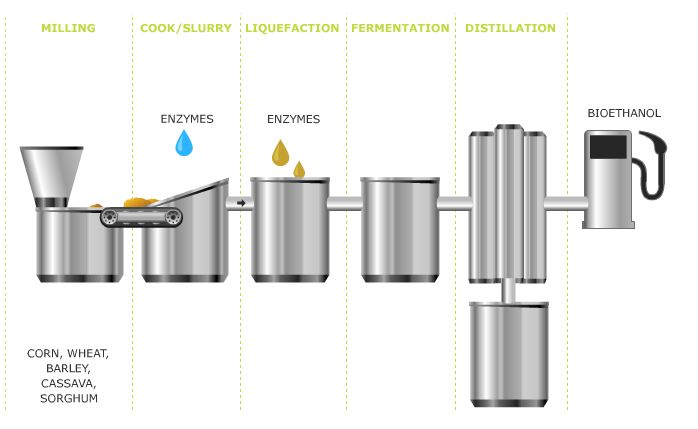

All biomass contains cellulose, hemi-cellulose, and lignin. Cellulose and hemi-cellulose can be thought of as complex carbohydrates that, when broken down into simple sugars, can be fermented into ethanol. Yet, millions of years of evolution have made cellulose resilient to enzymatic attacks in the natural world. Thus, there is a need for powerful enzymes that can unlock the simple sugars. (For information about other processes that bypass expensive enzymes, see http://www.greentechmedia.com/articles/read/a-closer-look-at-the-q-microbe/.) Up until these announcements, enzymes have represented a cost-prohibitive first order economic cost for 2nd Generation cellulosic ethanol producers pursuing bio-chemical processes.

Genencor got the ball moving yesterday at the 15th Annual National Ethanol Conference in Orlando, FL by announcing that its new enzyme is an advanced version of its Accellerase 1500 model. By using a whole-broth formulation, the enzyme provides nutrients for fermentative organisms while lowering the chemical load created during fermentation. Genencor claims that this new enzyme results in higher yields at a three-fold lower dosing, and also that it works well with all feedstock and pretreatment combinations.

Not to be outdone, Novozymes today announced its first commercial enzyme for cellulosic ethanol produced from agricultural waste via its Cellic® CTec2 enzymes. Most significantly, the company's CTec enzyme, when combined with the HTec2 enzyme, has reduced current enzyme production costs for cellulosic ethanol producers by 80% over the last two years to $0.50/gal -- a longstanding price target in the industry. At $0.50/gal, enzyme costs will represent approximately 25% of the total levelized cost structure for cellulosic ethanol production via bio-chemical processes. Yet, if total costs have now been brought down to $2.00/gal, cellulosic ethanol can now be said to be very close to cost parity with corn ethanol and gasoline at $75/bbl.

Novozyme has strategic partnerships with Greenfield Ethanol Inc., Inbicon, Lignol Energy Corp., Poet LLC, ICM and Sinopec, and its new enzyme will be compatible with feedstocks like corn cobs, stalks, sugarcane bagasse, wood chips, and wheat straw.

These Danish companies, although not fuel producers per se (despite the fact that Genencor's parent Danisco is pursing a production joint venture with DuPont), are the industry leaders in commercial enzymes and can both secure a high value corner of the market, as the supply chain for cellulosic ethanol is not a zero-sum game. They are both fierce competitors and have publicly announced that they expect enzyme costs to further decline to $0.20-$0.25/gal as economies of scale accelerate. As long as the industry does not coalesce around thermo-chemical processes (which are much less enzyme-intensive), pursuing enzymes is a far less risky proposition than securing several hundreds of millions of dollars to build the infrastructure and handle the logistics of being an builder-owner-operator.

In early February 2010, the U.S. reconfirmed its commitment to increasing the amount of advanced biofuels in the nation's fuel supply to 16 billion gallons of cellulosic ethanol by 2022 (see http://www.greentechmedia.com/articles/read/epa-issues-renewable-fuel-standards-what-it-means-for-1st-and-2nd-generatio/). If the long-term enzyme costs are $0.20/gal, this could represent a $3.2 billion market -- of which these Danish firms could own the lion's share.