The world of demand response, which involves the aggregation of megawatts of curtailable energy loads across a broad portfolio of customers, is not an easy industry to break into. It’s also a pretty crowded world, at least in the United States, with big players such as EnerNOC, Comverge, Constellation Energy and NRG’s Energy Curtailment Specialists well entrenched in established markets, and well positioned to compete in emerging ones.

At the same time, there’s a new world of demand response opening up, involving a much finer-tuned integration of fast-responding industrial and commercial loads to meet grid needs such as frequency regulation and ancillary services. Call it demand response 2.0 -- a landscape where technical and operational know-how, along with new regulations opening new markets, can yield far richer payoffs than the old-school demand response models.

This is the world being targeted by Demansys Energy, a New Milford, Conn.-based startup which has in the past few months announced some significant market wins. It started in October, when Demansys bought a controlling interest in CPvT Energy Asia, a Singapore-based demand response company that was originally part of CPower, the U.S. DR provider bought by Constellation Energy in 2010.

That move made sense -- Demansys CEO Jeff Lines is the former CPower strategic partnerships VP who put the Singapore deal together, giving his new startup an inroad to securing the deal. What it didn’t do was provide a big U.S. deal to put its promise of fast-responding, grid-integrated load management to the test.

Now it has that deal, with this week’s announcement that it has started bidding 75 megawatts of aggregated load into a New York Independent System Operator (NYISO) initiative known as the Demand Side Ancillary Service Program, or DSASP. This program, first opened to demand-side resources last year, represents the fastest and most technically challenging market run by the state grid operator.

That means that the combination of loads Demansys is controlling need to react within seconds to NYISO automated commands -- not just to turn on and off, but to ramp their energy consumption up and down in mimicry of the generators usually called upon to provide these services. A few companies are doing this today, such as Enbala Power Networks with variable-speed pumps and motors, or Sequentric with aggregated water heaters. But it’s far from a common capability.

Grid Daemon is the name of the technology Demansys has developed to do the job. It’s a combination of a utility-grade distributed SCADA system, which gives it its real-time speed and control, and a cloud-based data analysis and prediction platform, which allows it to mix and match the available responsiveness in its myriad customers’ loads to meet the most lucrative market opportunities.

“It’s technically difficult -- not all customers qualify,” Lines told me in a recent interview. But “when you do have a customer who qualifies and can hook up with us technically, then it’s of very, very great value for the system.” While he declined to cite specific customers that are participating, or how much investment or market value the 75 megawatts of aggregated load represents, he did say that “the initial capital for demand-side resources in ancillary services measures out in weeks, rather than years.”

Demansys will be proving out its capabilities with its unnamed industrial customers over the coming year, Lines said. “We’ll have to stay in it a good six months to assess what the economic impact is,” he noted. That’s because these ancillary services and frequency regulation programs are bid into moment-by-moment markets with prices that fluctuate over time.

That makes managing the ramping up and down of aggregated loads only half of the challenge, Demansys CTO and co-founder Adam Todorski noted. The other half involves knowing just what value it can derive from that aggregated capacity, and constantly matching it against the effect it has on its customers’ ongoing operations, he said.

“One of our differentiators is that we’re constantly watching what the customer process is doing,” he said. “At each site, if we have an idea of the accumulation of how much they’ve been disrupted over a period of time, we can use that to manage our forward bidding of loads.”

“To solve that problem -- it’s a lot of math, really,” he said. “Real-time control solutions that can watch how the load is responding, and understands the dynamics of the processes that can predict where they’re going to be 30 seconds from now, five minutes from now, 30 minutes from now.”

But at the end of this complex calculation could be a far larger group of customers willing to participate in grid programs, Lines noted -- and not just because the payoffs can be more lucrative. They’re also less disruptive to customer operations. Unlike traditional demand response, which may require customers to take their loads offline for hours or more, ancillary services markets can be bid in at shorter intervals. “It’s a more attractive program for customers who say, 'When I’m called, I could probably do fifteen minutes'” or so, he added.

Demansys’ role in this process is as a traditional aggregator, he said -- “We are the market participant, and we do a revenue share” to split the proceeds with the customers. While individual customers could control their own variable loads to similar effect, they’d have to invest in the SCADA systems and automated generation control (AGC) links to connect to the grid operator programs, as well as the software to know just when they’re able to bid loads into the program for optimal economic payoff.

They’d also have to worry about cybersecurity, Todorski noted -- something that Demansys manages by making its cloud-based management platform completely separated from the SCADA and AGC links that connect grid operators to individual customers. At the same time, the analytics platform is constantly taking data from grid operators and customer facilities, in order to “tell us what resources we should bid, and do some of the failover logic,” he said, such as knowing which customers can’t provide their loads at any moment in time, and finding other customer resources to fill in the gaps.

Demansys is working on expanding beyond variable loads to add energy storage systems, which to date have been the biggest source of non-generator assets bidding into fast-responding programs like these, into its portfolios, Lines said. At the same time, it’s lining up more customers in different markets, as well as working on the processes that would open up demand-side resources to new programs, he said.

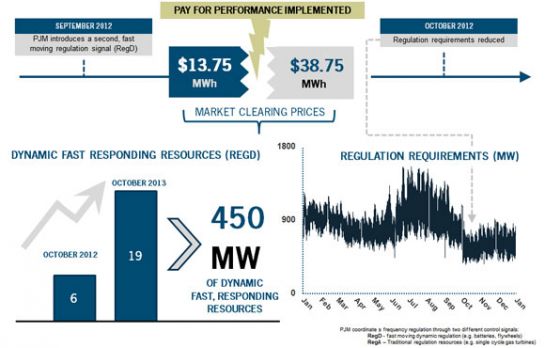

For example, Demansys took the lead on suggesting a new model for mid-Atlantic grid operator PJM to create a program that could allow energy storage to play a role in PJM’s capacity market program, known as the Reliability Pricing Model (RPM). Demand response is part of this PJM program today -- but Demansys has suggested a new model for fast-reacting assets that could expand their value, Janette Kessler Dudley, senior vice president for business development and regulatory affairs, and also a former CPower executive, told me in a November interview.

“We’re not trying to model the rules off the rules for demand response in RPM -- we’re trying to model it off the rules for generation,” she said. These are the kinds of changes to energy markets that could start to realize more value for flexible resources that can be relied on as generators are relied on today, and thus open up the economic incentives to tie them into modern grid operations.

It’s also the model that demand response is taking in Europe, where intermittent renewable energy is causing grid disruptions that need fast-responding loads to help manage. While Demansys’ Singapore project doesn't yet include fast-responding loads, the company is looking to incorporate these features in that project, and use it as a launching pad to broader Asian markets as well, Lines said.

Certainly the established demand response players, along with new entrants like Honeywell and AutoGrid, are putting automated demand response systems like OpenADR to use to help create new markets, and capture market share, in this emerging field. Consider Demansys another contender -- and watch closely for how the evolution of technological, regulatory and economic models for making this all work continue to change the definition of demand response.