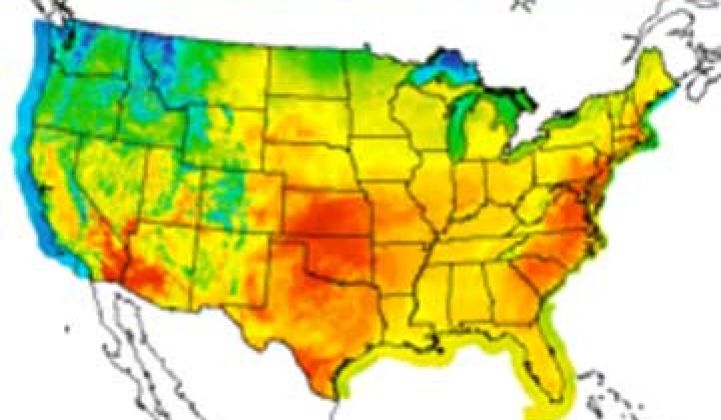

When triple-digit temperatures pushed across the U.S. last week, the nation’s electric grid was stressed but did not break down. For leading demand response providers like EnerNOC and Comverge, which both delivered about 1,250 megawatts during the heat wave, it was an affirmation of the role that demand response contributes to maintaining reliability. EnerNOC's delivery of 1,230 MW on Friday was a record for the company.

Although demand response plays an increasingly important role in different regions of the country, the hot weather showed that there is still great variability in how and to what extent the resource is dispatched.

Midwest Independent System Operator says it did not call on demand response at all last week, despite a record 103,975 megawatts used on Wednesday. PJM Interconnection did not use demand response on Thursday, when it hit a record for peak power at 158,450 MW, but it did call up about 2,300 MW on Friday (it has nearly 12,000 MW in demand response capacity total for 2011) to help with localized issues in its territory.

New York ISO tapped both its special case resource and emergency demand response program on Thursday and Friday, requesting 852 MW and 1743 MW in load drop, respectively.

In New England, the Independent System Operator called on 643 MW of demand response, which was similar to the amount called upon during the region’s all-time peak in August of 2006.

The variation is due in large part to the limited role to which demand response is relegated in the capacity markets. At PJM, for example, the operator can only call on those resources for six hours at a time, 10 times a year, according to Ray Dotter, Manager of Strategic Communications for PJM. Operators don't want to call on too much too soon, only to be left without it in the case of hot days at the end of summer.

New products, like an unlimited demand response offering in the PJM market in 2014, will expand the options for demand response companies to take part. Also, the Federal Energy Regulatory Commission ruling earlier this year, which mandates that demand response will be paid the same as generation when it is cost effective, will help drive the market.

Currently, companies that take part in the price-responsive markets are far fewer than those that bid into capacity markets. Also, price-responsive markets are voluntary, so grid operators do not rely on those the same way they do capacity. Peter Langbein, Manager of Demand Side Response Operations for PJM Interconnection, estimates that once the price structure changes, far more companies will want to participate in price-responsive (or economic) demand response. However, the rules will also change so that system operators will have more control over those resources.

All of the ISOs agree that once the new FERC rules are implemented, they expect to see far more demand response, which means that it could play a much bigger role than it does now. “We expect to have these resources be dispatchable and therefore more operational than today,” Langbein said during a webinar hosted by Restructuring Today. Demand response is also being evaluated in different markets for its ability to provide frequency regulation when there’s high penetration of renewables.

It will take more than just rule changes, as well. A wave of complaints crashed upon Baltimore Gas & Electric when customers who voluntarily signed up for utility's PeakRewards program, which turns residential AC units down or off during peak load. For demand response to enter more markets, there will have to be far more automation that can shave kilowatts without sacrificing comfort. Demand response is also just one tool enabled by the smart grid that can ease the stress during high demand days. More renewable integration, volt/VAR optimization and distribution automation can also help mitigate supply and demand.

“Demand response load management isn’t a special exception, but it’s one of the equal resources,” said Dotter. “In the future, it will give us more flexibility.”