Economic demand response could have saved the Texas energy market $85 million during a single summer day in 2012.

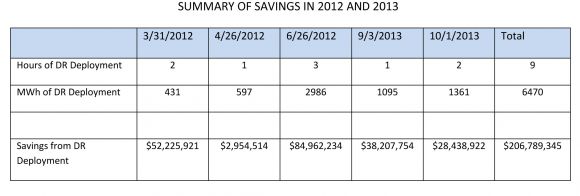

Across five days in 2012 and 2013, Texas could have saved more than $200 million, according to a study from the South-Central Partnership for Energy Efficiency as a Resource (SPEER), an energy-efficiency advocacy group.

As the market cap in ERCOT, Texas’ electric grid operator, rises to $9,000 per megawatt-hour this year, the research highlights the considerable savings that could come from changes if demand response were allowed to fully participate in ERCOT.

The study looked at the average locational prices on five specific days when prices were higher than normal. Even though the days were above-average, Doug Lewin, SPEER’s executive director, noted that they were not extreme. Those years were not particularly hot, especially compared to 2011, so the grid was not even stretched to its limit.

The study authors looked at available supply curves for the chosen days. They then modeled what those supply curves would have looked like with 500 megawatts of demand response being bid in at $300 per megawatt-hour, then another 500 megawatts at $500 per megawatt-hour, and a final 500 megawatts at $1,000 per megawatt-hour.

On June 26, 2012, that modeled scenario would have yielded nearly 3,000 megawatt-hours of demand response deployment, for a savings of nearly $85 million. March 31, 2012 would have seen a savings of more than $52 million.

Source: SPEER

The figures only represent the net savings, and do not account for the cost of retail electric providers or others implementing economic demand-response programs, so the real savings would be less. But the numbers highlight that even when prices rise a bit, there are considerable savings that could be realized if more businesses and homes participated in demand response.

But for now, demand response does not play on an equal footing in the ERCOT energy market, so the savings are hypothetical. As in previous years, a revolution is highly unlikely to occur. “All the signs point to no dramatic change,” SPEER CEO Bob King said of the prospect of a re-envisioned Texas demand response market. Unlike other regions that operate under FERC jurisdiction, such as PJM, ERCOT is not waiting until the Supreme Court rules on whether FERC indeed has jurisdiction over economic demand response.

Instead, Texas can do as it wishes, but that’s not much, given low natural gas prices and a lack of political will to invest in demand response. SPEER would like to see the $50 million cap on the demand response market, called emergency response service (ERS), lifted, as well as a move to a day-ahead market for demand response. Higher payments for demand response would clearly be beneficial as well.

The relatively low prices for participating in demand response in Texas means that many potential players aren’t taking part. Especially for smaller loads -- the payments usually aren’t high enough to justify the investment in the platforms for measurement and verification that are required for the settlement process, which can take months. “It’s nobody’s job to make sure residential demand response gets done,” said King.

On the commercial and industrial side, most of the demand response load is larger, industrial load. One company, Joule Assets, claims it will be able to unlock smaller commercial loads, less than 100 kilowatts of peak consumption, with a lower price point than has been offered before by other demand-response aggregators.

“The key is that we’re reducing the cost of service,” said Mike Gordon, CEO of Joule Assets. Joule has begun offering financing solutions to contractors in Texas for energy-efficiency upgrades, many of which involve HVAC controls that can then be used to curtail load.

Cost is only one factor, however. Gordon acknowledged that other regions with capacity markets, unlike ERCOT’s energy-only market, are easier to focus on. “We tend to get engaged where we see a real opportunity in the near term,” he said.

A capacity market in Texas is off the table at this time, and while there is ongoing talk of a day-ahead real-time market, that too seems to be going nowhere fast. ERCOT has identified many of the barriers to demand response operating in the day-ahead market, but there is no specific roadmap for addressing them in the near term.

Additionally, two bills that would have encouraged a more comprehensive plan to unlock demand response across all customer classes didn’t get anywhere before the Texas legislature adjourned this week.

In the meantime, SPEER is working with more progressive energy retailers to educate them on ways they can participate in demand response for better customer experiences and to hedge their positions in the energy market.

But for now, it’s a drop in the bucket. “We could make the Texas electric market much more economically efficient and competitive by including a resource that’s barely utilized,” Lewin said of demand response. “Even in mild years, there could still be a big impact.”