"Smart grid."

I just love saying those words. And as it turns out, so does everyone else these days.

Venture capitalists, startup IT hardware and software firms, political leaders, Fortune 500s, the telecommunications industry, regulators, and an increasing number of utilities all have smart grid on their minds.

As predicted, 2009 has become a banner year for smart grid.

In June, the U.S. Department of Energy formally issued its requirements for (those wishing to apply for) the whopping $3.9 billion available in stimulus funds intended for smart grid projects. Because the bulk of these awards will be in the form of 50/50 matching grants, the resulting direct investment in smart grid projects over the next three-year period from the stimulus package alone will be approximately $7 to $8 billion, and might very well exceed $10 billion – a major shot in the arm for an emerging industry during an economic downturn.

The past six months have seen an influx of new smart grid entrants with names you might have heard of: Google, Microsoft, Oracle and Cisco. And in this time we have also witnessed the continued deployment of millions of smart meters and communication networks across the U.S., Europe, Australia, Brazil and many other nations.

While it's easy to get caught up in the excitement – and hype – of a growing industry, GTM Research intends to provide a steady hand at the wheel as we continue to explain and examine: (1) what a smart grid is; (2) which technologies and services various players offer; and (3) how and when the different market segments/applications are likely to gain market acceptance. Our newly released (and free) report The Smart Grid in 2010: Market Segments, Applications, and Industry Players does exactly that by examining the drivers, challenges, market segments, applications and largest deployments to date, as well as the leading players in this industry.

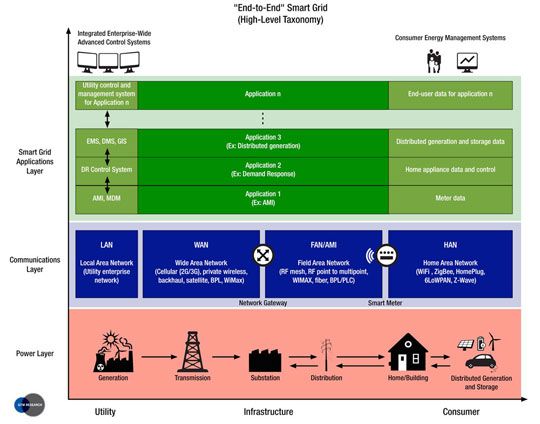

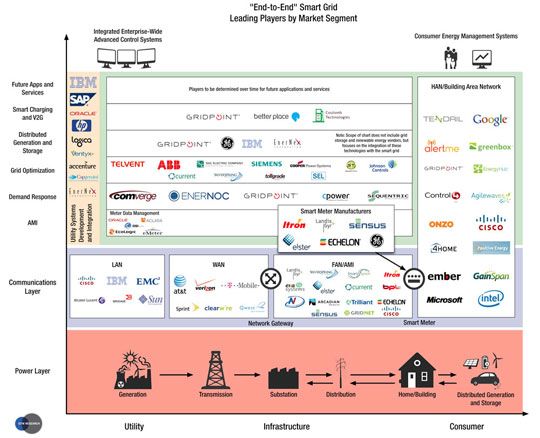

Included in this report are three market taxonomy diagrams (a high-level taxonomy, a detailed taxonomy and a vendor taxonomy by market segment) that aim to bring next-generation power networks into clearer focus.

As it currently stands, the term "smart grid" often creates as much confusion as it does celebration; however, it needn't be this way. In our experience, smart grid is best explained as the convergence of three industries – power, communications and IT. This definition makes it much more readily understood. For that reason, we present the "End-to-End" Smart Grid (High-Level) Taxonomy.

Click on the above image to a see a higher-resolution version of this taxonomy.

The smart grid is comprised of three layers from an architectural perspective: the physical power layer (transmission and distribution), the communications layer (data transport and control), and the applications layer (applications and services). The missing link, historically, has been an end-to-end communications infrastructure (the blue layer), and specifically the network connecting the existing wide area networks (WAN) to the end users, which we label the field area network or "FAN/AMI" network.

What is rapidly changing, as we approach 2010, is that FAN/AMI networks are now being deployed (for the first time) at wartime speed, as a result of wide-scale advanced metering infrastructure (AMI) deployments that replace legacy mechanical meters with advanced digital meters – or "smart meters."

This high-level diagram further illustrates: the addition of distributed generation and storage options at the power layer; the possibility of home area networks (HAN) which enable smart appliances, and ultimately smart homes and buildings; as well as the countless applications (the green layer) such as AMI and demand response, that can run back and forth from the utility to the end-user, once the communications layer is fully established. (These technologies/applications are detailed in our report.)

While admittedly the term "smart grid" has a certain appeal – and has likely proved useful in helping many a startup raise financing as well as helping utilities appear to be "on the case" in addressing concerns such as outage management and GHG emission – the downside is that the term is too broad, and does not provide insight into what various smart grid players actually do and/or how they may compare to one another.

The GTM Research vendor taxonomy by market segment is a useful tool in helping to visually position various smart grid players in order to gain more clarity as to where these specific companies compete and how they fit into the larger picture. While, at the time of this writing, it is still en vogue for companies to market themselves as "end-to-end" smart grid companies, increasingly these solutions and markets will be viewed as modular, and as such, companies will start to brand themselves accordingly. As heavier competition continues to move into each of these sectors being perceived as a smart grid "jack of all trades" (and "master of none") might not exactly be a winning formula.

Click on the above image to a see a higher-resolution version of this taxonomy.

In future perspectives, we will cover topics including: how we see the competition shaping up in various market segments; which sub-markets are maturing first, and which segments will continue to attract venture capital in 2010 and beyond. For now, you've got 145 pages of free research to enjoy.

Companies profiled in this report include:

ABB • Aclara Software • Cisco • Comverge • Control4 • Current Group • Echelon • Ecologic Analytics • Eka Systems • Elster • Ember • eMeter • EnerNoc • GainSpain • General Electric • Google • Greenbox • GridNet • GridPoint • IBM • Itron • Landis+Gyr • Microsoft • Onzo • Oracle • OSIsoft • SEL • Sensus • Silver Spring Networks • SmartSynch • Tendril • Trilliant • Ventyx