The European attempt to transition to sustainable markets is teaching the solar industry a tough lesson: PV markets don’t need fewer policies -- they need less policy risk. This post will dive into the recent policy changes occurring in European markets and how those changes will shape the future of the solar industry.

Why Europe?

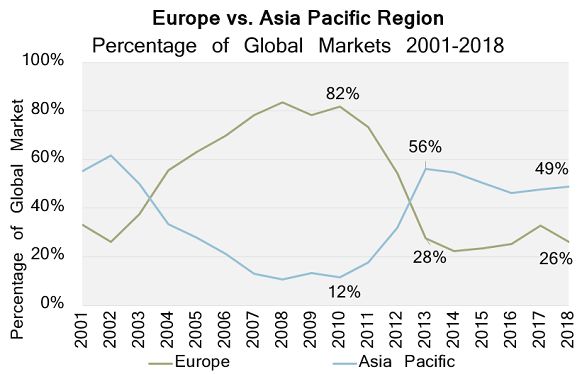

In 2013, Europe ceded its position as the regional leader for PV demand to Asia-Pacific as incentives wound down throughout Europe and increased in China, Japan and India. This major shift was a testament to the extent to which the solar market still hinges on policy risk. Markets can still virtually disappear and pop up on the other side of the world in a short span of time.

Source: GTM Research

Although the installation figures are impressive, don’t get too distracted by the Asia-Pacific region. At this point, the future of solar isn’t about “if” the industry will grow, it’s about “how” the industry will grow. And the battle lines around that question are being clearly delineated in Europe. Solar markets will eventually transition from being incentive-driven to being “sustainable.” But exactly how (and how quickly) that transition will take place is an open question. Europe is the largest regional market that is seriously grappling with this transition, with mixed results.

There are two criteria that need to be met in order for sustainable markets to form. The first is that the cost of producing solar energy needs to fall below or close to that of traditional fuel sources. The second is that the amount of policy risk in the market needs to be minimal. This second point is important, because there is no scenario in which policy does not influence markets at all. Rather, sustainable markets will be characterized by a market design that minimizes the amount of risk businesses face from shifts in policy.

Sadly, sustainable solar markets have not emerged despite the cost of solar becoming competitive against traditional alternatives. One reason is that many governments have not just removed subsidies for solar. Instead they have passed, or are proposing to pass, retroactive feed-in-tariff cuts and taxes on self-consumption. This increased risk has shattered investor confidence and weakened demand in many countries. At the same time, it has led to a tremendous amount of interest in the UK – where policy risk is significantly lower and the slow transition to sustainable markets has begun.

Which countries are falling short?

Strategies for accomplishing the transition to sustainable markets have not been consistent across national borders. Instead of making markets less dependent on policy, several countries have just swung the policy lever the other direction, passing measures that operate as outright disincentives for solar and raising projects' exposure to policy risk.

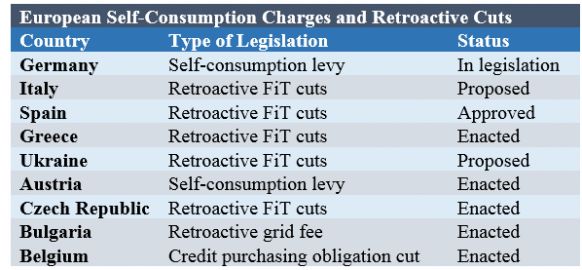

Spain, Greece, the Czech Republic, and the Ukraine have all passed some form of retroactive FIT cuts, and Italy is actively considering them as well. In some places, such as Spain, these cuts have taken the form of permitting a set rate of return over the lifetime of solar projects, usually 6 percent to 7 percent. Under that scheme, the lucrative returns in the early years of these projects translate to dramatically weakened returns from here on out, reducing the ability of developers to service their debt. The retroactive nature of these measures is particularly harmful to investor confidence, not just hurting existing projects, but significantly decreasing the chances that future project development will take place. Though efforts for merchant solar have been floated in Spain and incentive-free projects have come on-line in Italy, we expect that demand will grind to a halt until the perception of policy risk is lowered.

Another kind of policy risk has emerged in the form of self-consumption levies and grid taxes, notably in Germany, but also including Austria and Bulgaria. These levies and taxes make solar less cost-competitive compared to alternatives and perpetuate the impression that solar is still at the whim of policy shifts. In Germany, the situation is slightly more nuanced because the feed-in tariff has dropped below retail tariff levels, which should drive more self-consumption and spark a sustainable market (because consumers would make more money by offsetting retail rates than by getting a FIT contract). However, costs from a self-consumption levy and the risk premium on financing projects based on retail rates instead of a fixed contract are both headwinds against this transition.

Source: GTM Research

Which countries are meeting the challenge?

The news is not all bad. France is continuing its tendering process, and the United Kingdom is making strides toward a sustainable market with a gradual shift to a contracts-for-difference scheme. The mechanism is phasing out the Renewable Obligation Certificates for large-scale solar projects and replacing them with a system in which projects bid in at a set strike price and either are paid or pay for the difference in the market price. Though some developers are concerned about how they might secure financing against a revenue stream tied to the wholesale price of electricity, it's notable in that the government is making the transition in a consistent and predictable way without consequence to past projects and policy. Additionally, it’s worth noting that Germany already has something similar in effect for wholesale power under its market premium scheme.

The trajectory of the solar markets in the U.K. and France is heading toward sustainability. Lower policy risk, as opposed to fewer policies, and the rapidly improving economics of solar mean that these are the places in Europe where valuable lessons will be learned which could be replicated in other markets.

***

Adam James is a Solar Analyst with GTM Research covering global downstream markets, and the author of the Latin America PV Playbook. You can find him on Twitter at @adam_s_james. Scott Moszowitz is a Research Associate with GTM Research covering global demand and balance-of-system components.