Just finished reading the recently released Congressional Budget Office (CBO) report examining the financial costs of biofuels and their efficacy as a carbon mitigation tool. The report, entitled "Using Biofuel Tax Credits to Achieve Energy and Environmental Policy Goals," presents a number of striking conclusions that have resulted in a frenzied dance of political posturing and maneuvering from the corn ethanol industry.

Before jumping into the conclusions of the report, some context is needed. The corn ethanol industry is supported with myriad subsidies that have resulted in domestic production increasing from one billion gallons in 2001 to more than 12 billion gallons of ethanol produced this year (see True Cost of Corn Ethanol). The most commonly known subsidy is the $0.45/gal Volumetric Ethanol Excise Tax Credit (aka the "Blenders' Credit") that is provided for each gallon of ethanol that is combined with gasoline and sold. The U.S. also has "Renewable Fuels Standards" that require escalating amounts of corn ethanol (and other biofuels like cellulosic ethanol, biodiesel, and "advanced biofuels") to be blended into the nation's fuel supply through 2022. The third most important subsidy is indirect; the U.S. slaps a $0.54/gal import tariff on Brazilian sugarcane ethanol to essentially insulate U.S. ethanol producers from international competition.

The blenders' credit and import tariff expire at the end of 2010, and Big Ethanol lobbyist groups like the Renewable Fuels Association (RFA) and Growth Energy have been furiously trying to convince Congress to pass extensions to these subsidies. In an almost unprecedented development, Congress has balked at writing the corn ethanol industry a blank check and has asked the CBO for a comprehensive analysis of the corn ethanol industry's economic and environmental impact.

According to the CBO report, the U.S. taxpayer will spend $7.6B subsidizing the corn ethanol industry in 2010 with a cumulative taxpayer cost of more than $41B since 1980. In 2010, the U.S. will use more than 30% of its corn crop to produce 12 billion gallons of ethanol. Given that a gallon of ethanol has two-thirds the energy of a gallon of gasoline, 12 billion gallons of ethanol equates to 8 billion gallons of gasoline -- or 5.7% of the domestic U.S. gasoline market (assuming 140 billion gallons of consumption in 2010).

Although the report has a long list of conclusions, these are the ones that I found most interesting:

- "Although the [blenders'] credit is provided to blenders, most of it ultimately flows to producers of ethanol and to the farmers who grow the corn -- in the form of higher prices received for their products."

- "In fiscal year 2009, the biofuel tax credits reduced federal excise tax collections by about $6 billion below what they would have been if the credits had not been in effect."

- "Because the production of ethanol draws so much energy from coal and natural gas, it can be thought of as a method for converting natural gas or coal to a liquid fuel that can be used for transportation."

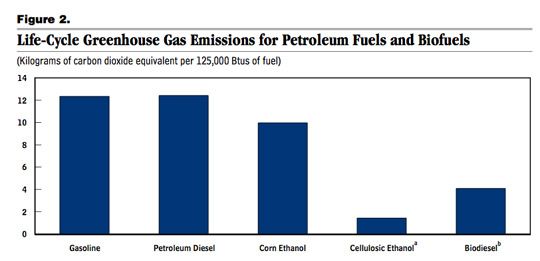

- The costs to taxpayers of reducing greenhouse gas emissions through the biofuel tax credits vary by fuel: about $750 per metric ton of CO2e (that is, per metric ton of greenhouse gases measured in terms of an equivalent amount of carbon dioxide) for ethanol. This $750/MTC02e does not reflect any emissions of carbon dioxide that occur when the production of biofuels causes forests or grasslands to be converted to farmland for growing the fuels' feedstocks (i.e., indirect land-use changes).

At $750/MTC02e, corn ethanol has to be the most expensive carbon mitigation strategy ever considered. To put it into context, the Canadian company Carbon Offsetters charges between $20 to $40 to offset a metric ton of carbon dioxide.

Although these conclusions are not surprising to anyone following this debate, they fly in the face of what the propaganda arms of Growth Energy, the Renewable Fuels Association, and the other members of the Agricultural Industrial Complex Mafia espouse. For example, in response to an article I wrote in June (see Will the BP Tragedy Spur Faster Adoption of Biofuels?) proposing that corn ethanol should lose all its subsidies and federal policy should be shifted towards drop-in fuels that could actually displace significant volumes of petroleum without utilizing scarce cropland and freshwater, a spokeswoman for Growth Energy wrote, "the ethanol tax credit (which goes to the refiner, not the producer) pays for itself in federal tax revenue. Corn ethanol contributes over $92 billion to our Gross Domestic Product every year... It is 59% cleaner than gas refined from oil." Hmmm, I wonder whose numbers are more reliable: Congressional Budget Office or Growth Energy?

The Senate Energy Committee chairman Jeff Bingaman, traditionally an ally to the corn ethanol industry, was quoted by the Associated Press as saying, "This report by the nonpartisan Congressional Budget Office provides further evidence that our nation's biofuels tax incentives might not be appropriately calibrated... According to the Congressional Research Service, the VEETC will cost the American taxpayer $7.6 billion this year alone. That high price tag makes the VEETC by far our Tax Code's largest subsidy for renewable energy."

This is where things get interesting.

The corn ethanol industry had been asking for a five-year extension of the blenders' credit, at an estimated cost of $30B. Yet, in light of the fallout from the CBO report, Growth Energy has taken a 180-degree reversal and called for a gradual phase-out of the blender's credit. Instead, Growth Energy proposes that the tax credit be transformed into a subsidy that installs 200,000 E85 pumps, loan guarantees for the construction of dedicated ethanol pipelines, and the requirement that all automobiles sold in the United States be flex-fuel vehicles (FFVs).

For proponents of corn ethanol, the investment in such infrastructure is a necessity. The U.S. is quickly moving up against its "blend wall." Ethanol is only approved in blends up to 10% in unmodified gasoline engines. According to the Renewable Fuels Association, corn ethanol production capacity is currently 13 billion gallons with another 1.4 billion gallons under construction; if/when all the production capacity comes online, it will exceed 10% of the 140 billion gallon gasoline market.

The EPA is conducting a series of tests to determine whether higher blends are safe in unmodified engines and is expected to make its decision whether to increase the blend wall shortly.

Growth Energy's "Fueling Freedom" claims that it is creating a "level playing field," "an open market for automotive fuel," and a "genuinely free market."

It takes a great deal of chutzpah for an organization whose constituents have been the recipients of $41B in corporate welfare -- often at the expense of other alternative fuels -- to claim that its policies are creating a "genuine free market." My guess is what they mean by "free market" is that among biofuel options, people will have a choice between ethanol and ... ethanol.

As discussed in previous blogs and chronicled in our recently published Third and Fourth Generation Biofuels: Technologies, Markets, and Economics Through 2015, there are myriad advanced feedstocks and technologies that produce "drop-in" fuel with similar molecular characteristics as petroleum.

With drop-in fuels, you do not need to invest in biofuel-specific pipelines or modify engines. There are several hundred companies pursuing algae, pyrolysis, gasification, upgrading, metabolic manipulation, solar-to-fuel, and a plethora of other bio-chemical and thermo-chemical methods. Many of these processes do not require food-based feedstocks, cropland, or freshwater. Most, if not all, of these technologies are currently more expensive than petroleum, though with added investment and scale, costs are expected to decline substantially.

Which brings us to a crossroads. As the recent Gulf oil debacle reminds us, society must wean itself off oil -- and quickly. And while corn ethanol has paved the way for advanced biofuels industry, it is time that we become more realistic about the limitations of ethanol and pursue a national biofuels policy based on principle, not principal.