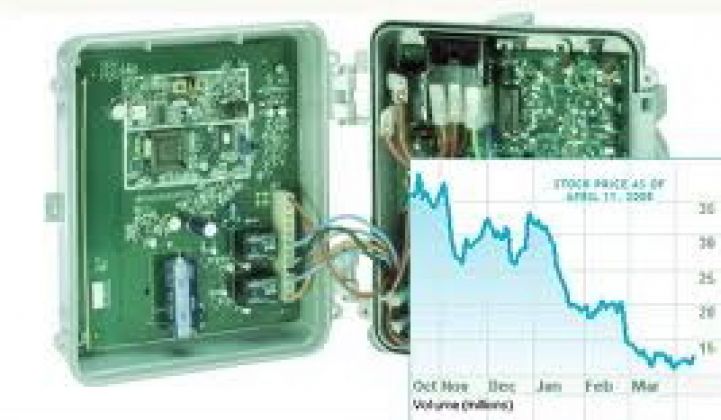

In April 2007, Comverge became one of the first publicly traded companies that could be described as a pure-play smart grid company. On Monday, Comverge ended that experiment on the public markets with a sale to H.I.G. Capital for $49 million, a fraction of the market value it commanded just 18 months ago.

What happens from here? We’ve certainly seen other key smart grid industry players go private, only to emerge stronger than ever, Landis+Gyr being a prime example. But we’ve also seen quite a few well-financed smart grid companies (GridPoint, to name one) languish for years in no-growth doldrums.

Now that Comverge has solved its immediate debt financing and cash crisis, it has a year or so to prove it can achieve a key milestone and turn cash-flow positive on an annual basis. By 2013, the Norcross, Ga.-based company wants to show a first-ever annual profit.

Analysts agree that Comverge’s 2011 fiscal year results from last week contain impressive growth in its commercial and industrial customer base, although its residential business has languished. It’s also launching new projects like the creation of a demand response market for South Africa utility Eskom.

Still, Comverge’s sale to H.I.G. highlights a key problem the company may have faced in maintaining a balance sheet strong enough to play in its chosen market. Demand response aggregators have to bid on contracts in key markets like that of mid-Atlantic grid operator PJM and others.

Comverge needed money just to participate in those auctions, and Monday’s news of an immediate $12 million in debt financing should tide over those concerns. But beyond its short-term problems, the company has struggled for years to keep up with its rivals in the demand response space — namely, big U.S. rival EnerNOC, which went public one month after Comverge.

Comverge had 4,564 megawatts under management at the end of 2011, compared to the more than 7,000 megawatts under management EnerNOC had racked up as of late last year. The two had been virtually tied on market share up until 2009 or so, when EnerNOC began pulling away.

In 2010, CEO Blake Young was hired to restructure the company and bring it up to speed. But first, he had to manage a crisis, when the company was forced to recall communications modules inside the radio-controlled home thermostats it had deployed with Texas utility TXU, over fire hazard concerns.

That ended up affecting most of the company’s utility customer base, Young said in the company’s March 16th conference call. While the company has grown residential business by 21 percent in 2010 and 14 percent in 2011, the end of a contract with NV Energy was enough to push residential megawatts under management from 1,287 to 1,134 in the fourth quarter.

In the meantime, Comverge has been growing its share of commercial and industrial customers, and added 800 megawatts overall last year. But it’s also facing tough competition from the likes of EnerNOC, Constellation Energy, Honeywell, Johnson Controls, ViridityEnergy and ConEd Solutions, to name a few big C&I demand response contenders. Still, analysts covering the company pointed to strong fourth-quarter C&I revenues of $10.2 million, double those from the same quarter a year ago, as a sign that the company was far from out of the game.

Of course, Comverge insists like the rest of its competitors that it’s outgrowing the first-wave demand response systems (e-mails, phone calls, text alerts, etc.) with its own blend of energy management technology. In Comverge’s case, it’s called the IntelliSOURCE energy management platform, and 22 utilities were using it as of the end of last year. IntelliSOURCE is meant to combine smart meters, load control devices and other “endpoints” with a back-end platform that allows utilities or customers to manage energy across a portfolio of sites, as well as for a portfolio of market programs.

Recent customers include Pennsylvania’s state government and the 80,000-member New Hampshire Electric Co-Op. The challenge here will be for Comverge to outshine all the other players — Silver Spring Networks, Aclara, Tendril Networks, Energate, Honeywell, AlertMe, Verizon, etc. — with similar plans to link up customer energy management via smart meters and broadband connections. There’s a lot of competition for a market that doesn’t really exist yet.

Comverge is also testing out IntelliSOURCE in a $27 million contract with South Africa utility Eskom to build a region-wide demand response network for itself and other demand response players to plug into. It’s already powered down a 4-megawatt cement plant in South Africa, and is expected to grow to 500 megawatts of capacity by next year, Young said last week.

Comverge is eyeing other customers interested in setting up a demand response market from scratch, so to speak. This move could put Comverge in competition with the likes of Siemens, ABB (Ventyx), Alstom (UISOL), Schneider Electric (Summit Energy) and other companies with software that helps utilities and grid operators keep power delivery and demand response capacity in balance with the latest development on electricity markets.

Comverge lacks the deep pockets of rivals like these, but it does have more than 500 utility and 2,100 commercial customers to build with. The main question is whether it can turn a profit from them. The company projects 2012 revenues of $145 million to $170 million, and a positive EBITDA of $3 million to $10 million, which should provide a “clear demonstration of improving cash-flow characteristics” of the company.

Young has said that Comverge expects to be profitable by 2013, driven by growth both in the United States and overseas, with a particular focus on China. Now that it’s becoming a privately held company, it will be a lot harder to know just what progress it will be making toward that goal. Certainly the immediate challenges for the company’s new owners should be enough to keep them occupied for the rest of 2012.