When times are tough, people make sure to shop around for the best deal to cover essentials. That turns out to hold true not just for food and clothing, but also for electricity.

Between 2008 and 2011, the electric load served by competitive retail suppliers has grown 40 percent, according to a new study from Compete Coalition, a group of more than 600 stakeholders who support competition in electric markets.

The new information shows far higher rates of switching than many states have seen in a decade, or ever. There are 18 states that offer some form of competition. Texas is still the most competitive state, but others that barely registered in terms of churn rates before 2008 are now seeing rates as high as 75 percent for C&I customers and more than 40 percent for residential.

There are still many states, however, that only have limited competition, including California, Montana and Oregon. The report notes that California has moved slowly towards competition for C&I customers and Arizona is also moving forward with competitive supply choices for large customers.

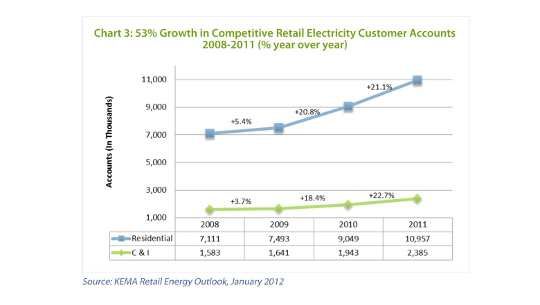

Choice for C&I customers is more widespread, but the small business and residential markets are where a lot of interesting change is happening. The residential accounts served by competitive suppliers increased from about 7 million to nearly 11 million in the past three years, an increase of more than 54 percent.

Although the increase is significant, it is still a relatively small amount of load compared to the C&I sector. But shopping around for electricity creates an awareness of price and options for the average consumer.

In the study, author Phil O’Connor, former Illinois Commerce Commission chairman, argues that without competition, customers large and small are hurt by higher prices that do not reflect what is happening in the wholesale market, which has seen lower prices in many regions in recent years.

For example, only 10 percent of Michigan’s C&I customers can shop in the open market, where they pay on average 2 cents per kilowatt-hour less than the businesses that buy through the incumbent utilities. And although prices will eventually go up, proponents of competition say that they will not rise as fast.

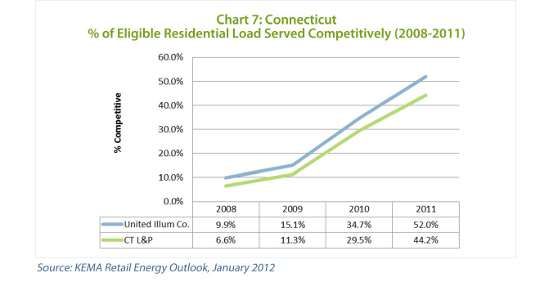

For each state, even if there is some choice, the difference in how it is delivered can make all the difference. While Michigan has a long waiting list of businesses to get into the 10 percent of those that can choose, Connecticut has a more open system where all customers can shop around.

Although Connecticut has been deregulated since the late '90s, it wasn’t until 2009 that residential choice took off, going from about 10 percent to about 50 percent in 2011. To help people make a decision, Connecticut has a website, CTEnergyInfo, to compare different offers.

Having a clearinghouse for information is critical for the residential markets. Texas also has a website, which makes it easy to see the various options -- including pricing -- all in one place.

New Jersey is another state where residential electric choice hung around zero until 2010 and is now over 10 percent for the major utilities. The study notes that changes to the access in market-reflective pricing were key in New Jersey.

Municipal aggregation is another factor in many states, including Ohio, Illinois and Pennsylvania. In those states, as governments enter the competitive electric market on behalf of their customers, large numbers of residential customers are brought into the competitive markets where they can choose their retailer.

In some states, like Maryland and Illinois, the competition was just getting started in 2011. Illinois, for example saw residential switching go from near zero in Commonwealth Edison territory at the start of 2011 to about 6.5 percent.

The key to competition is regulation. The 18 states that have active choice in electricity markets have stable regulation. The report found that market-based default service “has had the most substantial impact on the growth of retail electric choice.” Changes to supply procurement protocols to better reflect what’s happening in the wholesale markets have been key.

And for the most active states, such as Texas, education is key -- especially in the residential sector. The growth of data, especially initiatives like the Green Button program, open up the opportunity for people to better understand their usage and make decisions on how to shop based on their electricity needs.

Education and data also clear the way for differentiated offerings, which are just starting to come to market. While customers can choose on price, contract terms and generation options (coal vs. renewables, for example), the ability to pick based on time-of-use pricing or additional energy services, like rooftop solar, is just starting to come to a few markets.

With clear and novel regulation, things could get really interesting in coming years.