Xcel Energy is once again backing efforts to stop the city of Boulder, Colorado, from breaking away and forming its own municipal utility.

Despite Xcel’s campaign, voters approved a 2011 ballot initiative that funded an analysis of municipalization. The plan called for the city to purchase the Xcel-owned transmission and distribution infrastructure and take over supplying electricity so it could select preferred generation sources and fund smart upgrades.

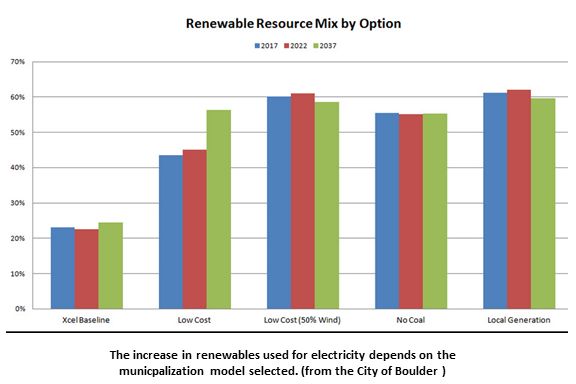

The New Era Colorado-backed 2011 ballot measure allowed city leaders to proceed with municipalization if the analysis found it feasible. A set of analyses and review by PowerServices, which conducted an independent, third-party review this year, concluded the shift would allow the city, under certain scenarios, to sustain rates and reliability while doubling renewables and cutting emissions in half.

In response to the feasibility findings, an Xcel-supported citizens' group called Voter Approval of Debt Limits (VADL) wrote a proposed measure and managed to get it on the ballot for this November’s election. New Era Colorado’s leaders believe the measure was designed to block their efforts.

“Each one of the items in the ballot measure is meant to kill the process,” explained Executive Director Steve Fenberg.

The measure has four provisions. Each is designed to give Boulder’s voters “some insurance and protection” as municipalization goes forward, according to VADL spokesperson Katy Atkinson.

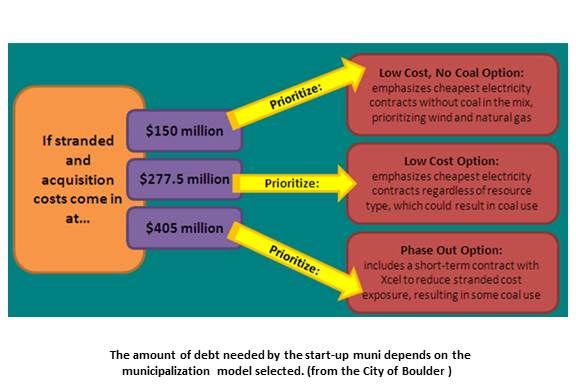

The first and most potentially impactful provision requires voter approval of “the amount of the utility's debt limit and the total cost of debt repayment the utility will incur.”

Instead of being able to float bonds to fund operations like most municipal utilities, the Boulder muni would have to first obtain voter permission to take on debt.

That voter permission must come, the initiative’s second and third provisions state, through “a general municipal election” and must include the participation of affected ratepayers outside Boulder’s city limits.

Because some of the wires Boulder would buy from Xcel would deliver power to ratepayers outside those city limits, this provision requires the (impossible) participation in city elections of non-resident voters.

A last provision restricts broker fees for handling utility bonds to “1 percent of proceeds,” which, municipalization advocates say, will make floating a bond to support operations more difficult.

The chief “roadblock,” Fenberg said, is the debt limit provision. Xcel and the City of Boulder must enter a formal negotiation process called "condemnation," similar to eminent domain proceedings, to establish the purchase price of the system. The city can only take part in the condemnation negotiation if it can guarantee its price offer. And it could not guarantee that offer if the new measure passes and voter approval of the debt is required, especially since the measure requires that non-eligible voters participate in the voting process.

Atkinson said there are ways to work out these complications. “This was not designed to torpedo municipalization, but to hold the line on rates,” she said. “This is the biggest expense Boulder has ever taken on. The feasibility study guarantees rates will not go up on day one -- but what about day two?”

Fenberg agreed there might be a way to resolve the current impasse. “But when the new municipal utility needs to issue bonds to upgrade the system or build new infrastructure in the future, it will have to go to another vote, making normal operations extremely burdensome.”

Based on the analysis of energy consultant Bob Bellemare, Xcel doubts the validity of the PowerServices evaluation and believes it can provide the renewables the city wants, spokesperson Michelle Aguayo said. “Since the 1940s, countless consultants have said a municipal utility is not feasible until this last go-round.”

Xcel, an investor-owned utility (IOU) with an obligation to its shareholders, potentially stands to lose significant revenues if the city takes control of operations. Though it did not give money to Atkinson’s group, it did advise the VADL of poll findings as to the most persuasive ballot-measure language and also provided legal services, Aguayo acknowledged.

These are among the steps recommended by the report New Public Power Takeovers: Strategic Resources for Defeating Municipalization from the Edison Electric Institute, Fenberg noted.

“Municipal entities are amenable, adaptable, and agile,” explained Rabago Energy Principal Karl Rabago. Having been an executive at Austin Energy, one of the premiere U.S. municipal utilities, as well as a Texas utility commissioner who regulated utilities, Rabago knows both IOUs and munis. “Municipal utilities are amenable to things that communities like Boulder increasingly want. They are also adaptable, because they don’t swing around an eight-state tail like Xcel. And they are agile and can make dynamic moves in this uncertain utility industry environment.”

Rabago is currently advising New Energy Economy in Santa Fe, New Mexico as it explores municipalization.