Our just published report, PV Technologies, Production and Costs, 2009 Forecast predicts an installed capacity of 3+ gigawatts by the end of 2012. This may seem quite aggressive for a technology offering that remains largely unproven. While it's a valid concern, we're sticking with our numbers for now, and here's a brief summary of the logic driving our estimates:

1. Far from taking CIGS manufacturers at their word, our estimates are derated versions of company-announced figures, sometimes by as much as 80 percent – meaning that to a large extent, our supply estimates already incorporate the possibility of delays and technology/throughput issues. Our final capacity/production estimates, therefore, while seeming extremely aggressive, are actually the result of a conservative modeling methodology.

2. We've been talking to CIGS manufacturers to gauge their progress, and the signs are encouraging at present – there is evidence that some (Miasolé, Showa Shell) may be approaching the other end of the tunnel with respect to yield and throughput issues. Remember, 2012 is more than three years away – and let me remind you that First Solar's total installed capacity at the beginning of FY2006 stood at a mere 25 megawatts. No, I didn't miss a zero. People then were similarly (and understandably) skeptical when informed of their ambitions, but few doubt their 1+ gigawatt capacity estimate now. It's a good example of the dangers of assuming the past serves as precedent for the future.

3. There are around 15 companies in the space that are on a roughly similar timeline when it comes to their ramp-up plans. Our logic – even if the technology risk is high individually, the overall probability that a mere few succeed (which is pretty much what we're assuming in our forecasts) is pretty reasonable. And that doesn't count other "wild card" producers with disruptive but unproven technologies that we have not even considered for forecasting purposes (I'm not naming names here for fear that people in black suits will whisk me away).

Let's flesh this last point out a little more. It comes down to something what's termed the binomial probability distribution. Reasonably simple math dictates that with n independent events where the probability of a "success" in any given event is p, the probability of k successes is given by

Where

Here, n is the total number of CIGS companies that are trying to get to multi-hundred MW capacity over the next few years, p is the probability that any one will succeed in view of the technology risk, and k is the number of companies that we are wondering will succeed.

So let’s run some numbers. If we define “scale” as around 750 megawatts, we need 3,000/750 or 4 companies to succeed to make our predictions reasonable. What’s the probability as determined by the binomial distribution? Well, it’s 1 minus the probability that 3 or less succeed. With n = 16, k = 4, and p at say, 25 percent, this comes to 60 percent. With p = 30 percent, it’s 76 percent, and with k = 2 and p = 25 percent, it’s 81 percent. Not bad, eh?

Of course, this is far from a mathematical proof of a CIGS ramp (as if any such thing could exist), and the fact remains that at this stage, we’ve yet to see results. Is there downside risk to our forecasts? It’s possible, and only time will tell. It’s crucial, therefore, to keep a close eye on how the CIGS landscape evolves in 2009. For our part, we’re going to keep monitoring the situation. To the extent we see CIGS players facing the same old problems as before (as could be the case with Heliovolt as we recently learned), you can be sure that we’ll be refining and updating our forecasts.

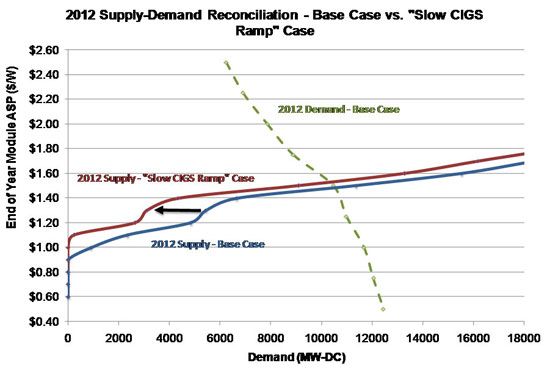

Some final food for thought. If CIGS does fail to ramp materially and occupy a meaningful share of the global PV market, what would the ramifications be for the market at large? To assess this scenario – which we refer to as the “Slow CIGS Ramp” case – we conducted a sensitivity analysis by slashing our CIGS production estimates in a company-agnostic fashion by a further 75 percent, over and above the existing derates.

What effect does this have on the bottom line? As it turns out, not very much (see the chart below). What you see when you reconcile the “CIGS-less” stacks with the demand curves is that there’s almost no change in equilibrium demand or clearing prices, because of the shape of the demand curve and the flatness of the supply stacks near the point of intersection. The producers that come into play in this scenario are those on the margin -- namely, the standard multicrystalline producers who are at large scale, and to the failure of CIGS to ramp would be a boon for them.

With the recession and the credit crunch underway, the transition to a demand-constrained world, and the looming threat of a new challenger to the throne, 2009 promises to be a very interesting year for the PV industry, regardless of the specific outcomes. If you are still hungry, watch this space – there’s more where this came from.