Chrysler will work with Zeachem to navigate the market and regulatory hurdles involved in getting more ethanol to market.

The strategic partnership does not include an equity investment in Zeachem, but it will provide the startup some heft in Washington, D.C. and various states. Zeachem aspires to make ethanol, green chemicals, and other materials through woody feedstocks like Eucalyptus or poplar trees. The process combines both thermochemical and biological processes and results in higher yields per ton of feedstock than other techniques, says CEO Jim Imbler. Zeachem can extract 135 gallons of fuel or chemicals out of a bone-dry ton of forest products.

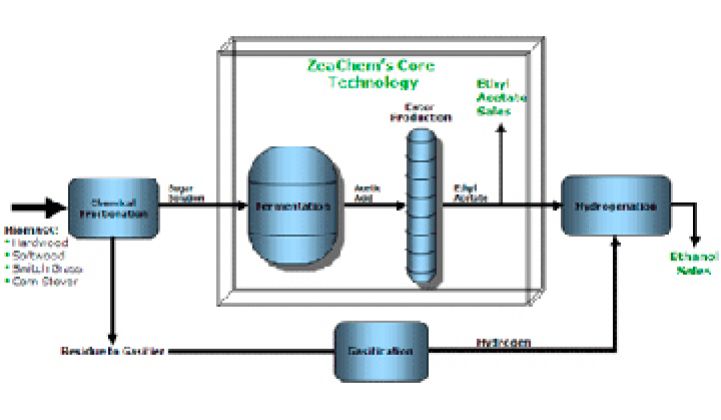

The key is acetic acid, the signature ingredient in vinegar. After separating plant matter into cellulose, hemicellulose, and lignin, Zeachem employs a microbe found in the guts of termites to convert cellulose and hemicellulose -- which can account for 61 percent of the material in wood -- into acetic acid. The acid then gets combined with other chemicals processed from the same wood.

The conversion into acetic acid does not produce any carbon dioxide. In most biochem processes, a refiner might put in three hundred carbon atoms to wind up with a saleable molecule that contains 200 carbon atoms. Almost all of the carbon in Zeachem's process ends up in a molecule that gets sold to someone else. The illustration provides an overview.

Wood, he adds, is good. Unlike in food markets like soy, prices in the timber industry remain fairly stable. Tree farmers don't switch from one crop to another year after year like traditional farmers do. The markets are also less sprawling than the ones for foodstuffs. As a result, growers seek to establish long-term relationships.

In turn, that benefits Zeachem's end-customers because Zeachem can promise long-term, fixed-price contracts on its chemicals. "That is huge for a chemical customer," Imbler said.

The company's break-even point occurs when oil is at approximately $50 a barrel. Oil has dipped in the recent craziness, but remains most of the time above $80. Oil producers will have a tough time getting below $70, Imbler added. A substantial portion of the world's oil now comes from tar and shale, which requires extra processing steps.

Zeachem currently has a pilot plant. A larger pilot plant capable of producing 250,000 gallons per year is 80 percent complete. The company has development deals with Proctor & Gamble and Valero. P&G wants packaging material and Valero is interested in ethanol. The Valero and P&G are somewhat open-ended at the moment and both giants have similar deals with other biofuel/biochem companies, but again, these are the corporate partnerships startups need to have in place to graduate to commercial production, so it's a strong preliminary step for Zeachem.

Zeachem also has supply agreements with Greenwood Resources.

The first plant will produce chemicals and fuels on a so-called C-2 platform. That is, the molecules will contain two carbons. A C-3 platform and other platforms are in the works. A number of companies want to produce butanol, used in jet fuel. Butanol contains four carbons.

We filmed a video in their labs a few years ago. Check it out: