China has the fastest train in the world, the most megacities in the world, and the biggest population.

Now China can boast a new record: It has installed the most solar PV in one year.

Preliminary figures released by Bloomberg New Energy Finance (BNEF) show that China installed 12,000 megawatts of solar in 2013 -- beating Germany's record of 8,000 megawatts in 2010.

These figures merit a major caveat, however. China is a very tough country to track and estimates differ significantly. China's Renewable Energy Industries Association puts its preliminary estimate between 9,500 megawatts and 10,660 megawatts. GTM Research has not released its figures yet; it's waiting for a final number on actual grid connections.

The range of projections varies, but they all tell the same story: China's domestic solar market is now a major force.

In comparison, the booming U.S. market just surpassed 10,000 megawatts of cumulative installations last year, with around 4,200 megawatts deployed in 2013. That's a big deal for America, as it's the first time in fifteen years that the country has put up more solar PV than Germany, the historical global leader.

However, if BNEF's estimates are accurate, the U.S. only completed around a quarter of the installations that China was able to build last year.

As developers rushed to secure a feed-in tariff set to scale back at the close of December, the market surged in the fourth quarter. BNEF speculates that the installation count could potentially rise to 14,000 megawatts.

But there's a big difference between installations and actual grid connection. The "vast majority" of Chinese projects were large-scale installations connected to the transmission network. Since China's grid has been notoriously troublesome for the wind industry, it's unclear how many solar projects are facing the same interconnection problems. That could skew the numbers once everything is counted.

"These installation figures also highlight the growing gap between installations and connections in China, with connections reaching 3.6 gigawatts as of October," said Adam James, a global demand analyst with GTM Research. "Grid connection continues to be an issue, although we see the country's shift to production-based incentives as a step in the right direction for encouraging generation and not just capacity."

In order to alleviate grid bottlenecks, the Chinese government has turned its attention to promoting rooftop solar with a $0.07 per kilowatt-hour incentive for distributed projects. Rooftop projects will also get a bonus payment of $0.03 to $0.06 for offsetting sulfur emissions from coal plants.

In recent years, China has been known mostly for its heavily subsidized fleet of zombie solar factories, rather than its solar installation market. But a shift is underway. The Chinese government recently announced that it will scale back support for nearly 400 domestic solar manufacturers, keeping 134 companies on its survival list. That could shake loose some of the surplus production capacity and help level out the market as the country's domestic demand for installations grows.

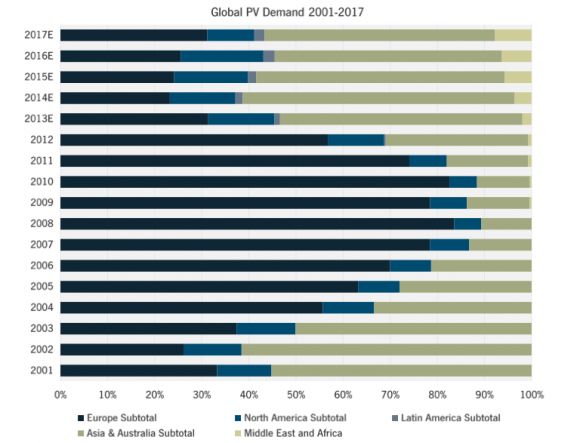

Together, China and booming Japan are putting the Asia-Pacific region far in the lead for installations. As this chart from GTM Research shows, Europe has lost the dominant position that it held for many years.

"The recent installation figures projected for China are the first tangible evidence of the profound eastward shift in global demand," said James. "This is an unprecedented figure for annual installations, even compared to the days of lucrative European incentives."