China is reconsidering its most recent Five-Year Plan’s target for natural gas because of the challenges in developing shale gas resources, according to a China energy sector source.

“There are just too many risks and no experience for developers to copy,” explained Junda Lin, a Beijing-based analyst at the China Greentech Initiative (CGTI). “The lack of investment from developers -- utilities, oil companies and other energy groups -- will push the government to reconsider its target and be more realistic, though to date, it has not changed its official target number.”

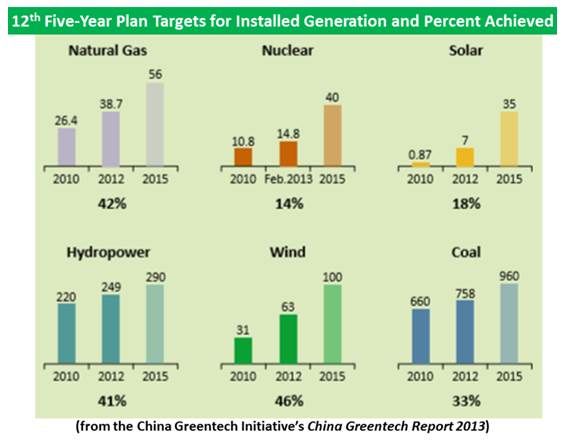

The 12th Five-Year Plan for the world’s second-biggest economy set ambitious targets for domestic natural gas, according to The 2013 China Greentech Report: China at a Crossroads. From a baseline of contributing 4 percent of China’s energy mix in 2010, the plan called for natural gas to provide 8 percent of the mix in 2015 and 10 percent in 2020.

With the government’s continuing air pollution concerns, Lin said, it has made clear that cleaner-burning natural gas could be “a game-changer in China’s energy mix.” It would come from China’s domestic conventional production, unconventional production (coal-to-gas, coal-bed methane, shale), and both liquefied and pipeline natural gas imports.

But PetroChina and Sinopec are the only Chinese companies with significant natural gas development experience and pipeline capacity, Lin explained. PetroChina’s announced target is only 1.5 billion cubic meters (bcm) of domestic shale gas production by 2015 and Sinopec’s is only 0.13 bcm. “Those two numbers will not help the government meet its 6.5 bcm shale gas target.”

Officials from those companies are unlikely to publicly debate the targets, Lin said, but CGTI's interviews and observations suggest that internally they see them as unrealistic. “China’s chance of meeting its 2015 shale gas target is zero,” said Zhang Dongxiao, Beijing University Director of Oil & Gas Research Institute, speaking recently at China’s fifth Unconventional Oil & Gas conference. And it was of significance, Lin added, that a media item on the conference reported that Zhang’s comment “aroused consensus from other officers, including Xu Kun, Senior Executive of Exploration and Drilling Department within the Consulting Center of PetroChina.”

There are four challenges to China’s domestic shale gas development, Lin said:

- Domestic fracking and horizontal drilling technologies are inadequate and access to experienced foreign advisers is limited.

- In the absence of skills that might prevent it, there are concerns about shale drilling’s use of and impacts on China’s increasingly limited water supplies.

- Without confidence in their skills, developers are leery of shale development’s high upfront capital requirements.

- There is severely limited natural gas pipeline infrastructure and more than 80 percent of it is controlled by PetroChina, discouraging other developers.

There was a similar overreach in the 11th Five-Year Plan target for the development of China’s coal-bed methane, Lin said.

In the absence of the desired coal-bed methane growth, China’s renewable energy and energy efficiency sectors -- which have invariably exceeded government targets -- boomed. Both the wind and solar industries saw their goals revised upward within the government plan timeframes and now await only the necessary grid support to assume an even larger role in China’s energy mix.

Other targets in the latest Five-Year Plan include:

- Wind: Get to 100 gigawatts of installed and grid-connected wind power capacity by 2015.

- Solar: The original target of ten gigawatts was raised three times is now at 35 gigawatts of installed and connected solar by 2015.

- Energy Efficiency: Reduce energy intensity by 16 percent below 2010 levels and cap annual energy consumption at 4 billion tons of coal equivalent by 2015.

- Air Quality: Cut carbon intensity 17 percent, sulfur dioxide emissions 8 percent, nitrogen oxides 10 percent and particulate matter 15 percent by 2015.

- Financial Mechanisms: Experiment with carbon taxes and carbon trading markets.

Shale gas represents less than 2 percent of China’s targeted 2015 total gas consumption and will not significantly impact the development of renewables in the short and middle term, Lin said. “The return on shale gas is highly risky and uncertain. Investors will not shift away from wind and solar.”