British energy group Centrica is continuing its buying spree and the build-out of a new type of distributed energy services business.

Its most recent acquisition is combined heat and power provider ENER-G Cogen International -- a subsidy of ENER-G Holdings.

Last fall, Centrica launched its distributed power business to help large commercial and industrial customers manage and optimize their energy use. It also launched a dedicated connected homes division. Centrica owns British Gas and U.S.-based energy retailer Direct Energy.

ENER-G Cogen has operations in five countries, including the U.K. and U.S., but will have a much larger reach as part of Centrica. For Centrica, bringing a combined heat and power (CHP) solution in-house made sense given the level of operations and maintenance required for CHP facilities.

“We need to choose where we participate and where we partner. Cogen is a significant investment for customers,” said Jorge Pikunic, managing director of Centrica’s distributed energy and power business. He added that the uptime requirements of a CHP system, often near 100 percent, make it a good technology candidate to vertically integrate into Centrica.

ENER-G Cogen does not just install standalone CHP systems. Ryan Goodman, president of ENER-G Rudox, said the company does sell co-generation technology outright, but it also works on energy services contracts that are more complex.

The company recently completed a project with a nursing home in New Jersey that involved installing two cogen systems and integrating the cogen with an existing onsite solar PV system, as well as with the emergency backup system. The firm also completed a lighting retrofit and boiler upgrade for the project.

“We want to be one-stop shopping for our customers,” said Pikunic, noting that Centrica already has 28 million customer accounts in North America and Europe.

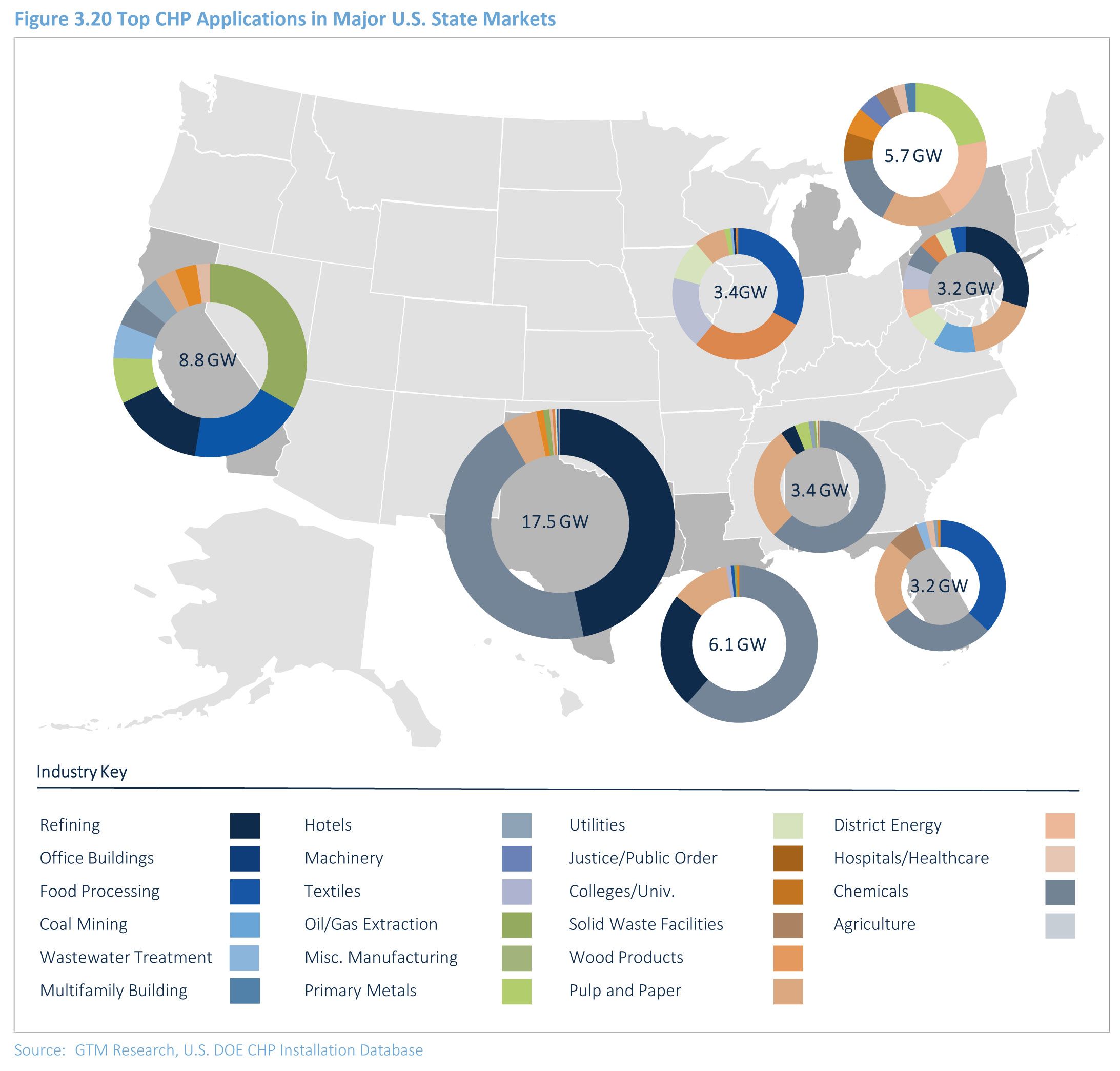

The adoption of CHP is largely driven by the spark spread, which is the margin between the retail price of electricity and the cost of natural gas needed to produce the electricity. In the U.S., Texas, California and the Northeast dominate the CHP market.

Historically, industrial applications were the most common for CHP, but in the past 10 years more than half of new CHP capacity has been for commercial applications, especially hospitality, according to a new report from GTM Research, CHP and Fuel Cells 2016-2026: Growth Opportunities, Markets and Forecast. The report estimates 11 gigawatts of new customer-sited fuel-based generation will be deployed in the U.S. over the next decade.

Historically, industrial applications were the most common for CHP, but in the past 10 years more than half of new CHP capacity has been for commercial applications, especially hospitality, according to a new report from GTM Research, CHP and Fuel Cells 2016-2026: Growth Opportunities, Markets and Forecast. The report estimates 11 gigawatts of new customer-sited fuel-based generation will be deployed in the U.S. over the next decade.

CHP is just one small piece of the puzzle. In April, Centrica acquired Danish energy trading platform Neas for $249 million and picked up energy management startup Panoramic Power for $60 million last fall. Pikunic said Centrica has already launched Panoramic Power’s circuit-level energy analytics in various countries. In the U.S., Direct Energy said the technology was helping commercial customers save 10 percent to 15 percent on energy bills.

More acquisitions are likely, but Centrica also said it will be adding more partnerships, such as the one it has with SolarCity in the U.S. “One company cannot do everything,” Pikunic said. In 2014, however, Direct Energy bought solar installer Astrum Solar for $54 million, showing a healthy appetite for acquisition and integration on many fronts.

Centrica is not alone in its quest to be the trusted energy provider for sophisticated commercial customers. Competition abounds, not just from other deregulated energy providers but also from regulated utilities investing more heavily in the deregulated space, such as what Edison International is doing with Edison Energy, and companies such as Current by GE.

Current recently made its first acquisition, buying Daintree Networks for $77 million, and just announced a partnership with building automation software provider Tridium (owned by Honeywell). European retailer Engie (formerly GDF Suez) bought U.S.-based energy services firm OpTerra, and took a major stake in battery startup Green Charge Networks in May. Also in May, French oil giant Total acquired battery maker Saft for $1 billion.

Despite different approaches to market, all of these companies see a more engaged commercial customer looking for a trusted partner to tackle increasingly complex energy issues. “We’re coming to customers to understand what they want to get out of their energy,” said Pikunic. “We know energy is a complex space. We bring that expertise.” It is an assertion heard more and more as large energy producers jockey for position in the evolving energy services market.