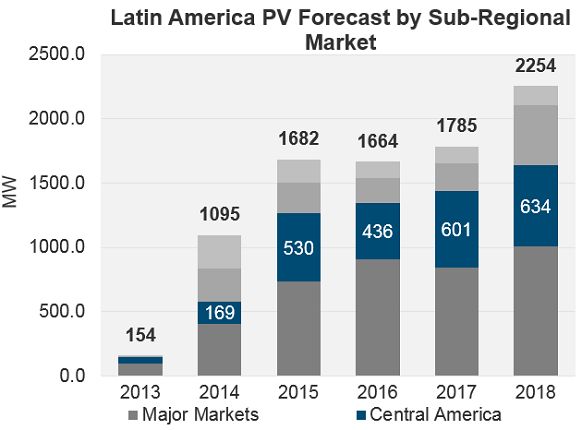

The Central American solar market will soon be making headlines. With more than 2.3 gigawatts expected to be installed over the next five years, we expect Central America to account for more than one-third of all PV demand in the Latin America region. This is all the more impressive considering its growth from such a small base: less than 100 megawatts of installations were completed in 2013.

Source: Latin America PV Playbook (3Q14)

Drawing on GTM Research’s extensive new research focus on Latin America, this article will lay out how we expect the Central American PV market to unfold in coming years and what that means for solar companies and policymakers.

The recipe for growth

There is a unique set of drivers contributing to market growth in Central America.

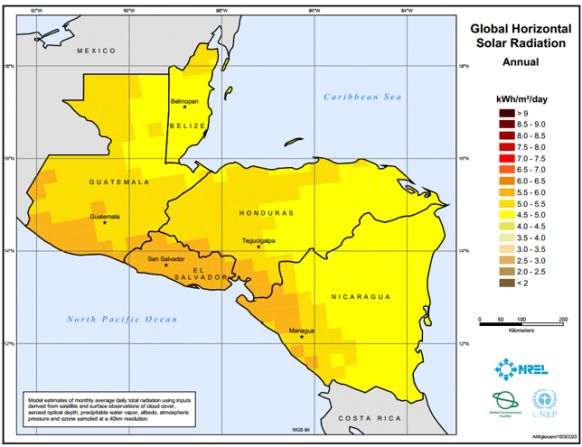

First, insolation levels in Central America are some of the highest in the region. By extension, this makes them some of the highest in the world, and significantly higher than many countries with established PV markets. For context, the average global horizontal solar radiation is between 4.5 kWh/m2/day and 6 kWh/m2/day. That’s about double what we see in Germany, the country with the most cumulative installations of solar to date.

Source: MapSearch, National Renewable Energy Laboratory

Second, the economics of the Central American electricity market favor new supply. Population in this sub-region is growing, and much of the existing population still needs access to electricity (see here and here, or cull newer data here). Rising demand and limited investment in new generation have put upward pressure on the cost of generation, which has been exacerbated by a regional reliance on diesel generation. In many places, cheap hydropower and biomass would average in to help lower costs, but these resources are susceptible to drought, and their seasonal generation profile has created challenges.

The third driver is what I’ll call cost-and-value competitiveness. Falling technology costs, increased installer experience and access to cheaper capital (especially from development banks) have all put solar in a competitive position against the status-quo cost of generation.

A few recent events underscore this point. When Delsur, the El Salvador utility, put out a call for 60 megawatts of solar and 40 megawatts of wind, it wound up signing 94 megawatts of just solar under twenty-year PPAs that were between $100 and $125 per megawatt-hour -- and that’s against cheap wind.

It’s not just El Salvador, either. Guatemala recently fired up the 5-megawatt Sibo plant, Panama just finished construction on the 2.4-megawatt Sarigua plant, and Upower recently signed 100 megawatts' worth of PPAs with the Honduran utility. The way in which those high costs of generation are distributed among consumers mean that Central American countries have some of the highest retail tariffs in the world, spurring distributed PV generation.

In some countries such as Guatemala, the residential tariffs are highly subsidized. But that’s just made solar all the more competitive in the commercial and industrial segments.

In addition to cost, utilities and governments are also starting to recognize the value of solar. For example, while hydropower usually offers the lowest-cost generation in reverse auction, that doesn’t factor in hydrological risk. Biomass, too, has a seasonal generation cycle. And since it depends on crop yield, rainfall can also effect its generation profile.

During times when those resources aren’t available, reliance on expensive diesel generation can result in skyrocketing costs. Solar offers a unique and complementary value to the whole generation ecosystem that is broader than just cost of generation.

In the distributed generation market, there are also large swaths of the population in some countries with no access to electricity. In these places, there is a serious social impetus to look into distributed resources like solar instead of building out entirely new transmission and distribution grids. The environmental value cannot be ignored, either. Costa Rica has made a firm commitment to adopting climate-friendly policies.

Fourth, the policy and regulatory environment is improving in Central America. Net metering policies are in place in Costa Rica, Nicaragua, Honduras and Panama. Grid interconnection laws of some type are in place in Guatemala and Honduras -- and multiple utilities are making tender offerings for solar in the coming years.

Implications for market strategy and policymaking

One notable feature of Central America is its relative homogeneity. With six countries situated in close proximity to one another, even small companies have the ability to launch a regional operation and own a slice of the growing market without becoming spread too thin. I’ve talked with multiple installers active in the residential and commercial markets in Costa Rica or El Salvador that are beginning to bid for projects in Honduras, Guatemala and Nicaragua. This strategic point has not escaped the larger companies. Martifer and ReneSola have both opened local offices, and we expect more to follow.

Various market segments will also fare differently over coming years. Utility-scale projects will feature prominently for the next five years or so, before giving way to a mostly distributed generation market. This is a function of a variety of factors, including how much supply is needed (and when), the limits on the grid to connect lots of large projects, and the comparative cost-effectiveness of meeting rural demand with distributed resources instead of transmission and distribution infrastructure.

This has implications for market strategy. Developers that are interested only in large-scale projects have a limited time horizon for entering the market and will likely be shorter-term players (excluding any ongoing operations and maintenance services). However, it will not take as long to make an impact in the region: transaction costs and business strategy can be more concentrated on single projects.

On the other hand, companies that are looking for longer-term returns and a continually growing market should focus on the distributed generation space. It will take more time to develop channels, and transaction costs are spread across a larger customer base. However, the total available market is huge, and there is plenty of room for new players.

However, there are a number of key issues that policymakers need to address. Financing is still basically nonexistent in most Central American countries. That means no matter how high electricity costs are, the total available market is limited to those who have the upfront equity to fund an entire solar system.

The governments in these countries can take steps to build this financing infrastructure through stable and transparent policy commitments around renewable energy and electricity rates, encouraging creative collateral arrangements (leveraging existing social tax funds), offering loans, making credit reports more accessible or providing legal recourse for installers and customers.

In addition, governments can make the market more attractive through clear interconnection rules for PV systems, smarter permitting processes that balance the consumer's need for safety with lower transaction costs for installers, tax breaks (particularly the value-added-tax on electricity in net-metered systems), and solar-specific reverse auctions.

Perceived risk about legal recourse, changing policies, criminal activity and corruption are all still real concerns in the region. These issues are much larger than solar, of course, but have cascading impacts that cast doubt over new investments in the country.

However, Central America is still one of the most exciting sub-regional markets in the world today. Companies, policymakers and advocates alike should keep a close eye on how the market unfolds.

***

Adam James is a Solar Analyst with GTM Research covering global downstream markets, and the author of the Latin America PV Playbook. You can find him on Twitter at @adam_s_james, or join him at Solarplaza’s upcoming conference PV Trade Mission: Central America November 10-14 in Panama City, Panama.