Europe’s appetite for demand response is growing, not just to provide grid stability and energy balancing on its solar and wind power-influenced grids on a day-to-day basis, but for years to come. That’s opening up more money-making opportunities for European companies willing to turn over factory lines, HVAC systems, and other energy loads to serve those needs -- and the technology providers and aggregators that can bundle them up at grid scale.

Take European steel-making giant ArcelorMittal and Belgian startup REstore. This summer, the two announced they’ve promised up to 150 megawatts of demand response to help Belgian transmission system operator Elia manage its peak grid needs -- not now, but from Nov. 1 through March 31 for the next few winters.

REstore has built up a portfolio of about 1 gigawatt of customer-side energy resources in the Benelux area, the U.K. and France. But all of that, as with the rest of the demand response capacity in Europe, is currently being bid into primary, secondary and tertiary grid services markets. Those are the equivalent of frequency regulation or ancillary services markets in the U.S., which operate on a minute-by-minute basis, and pay only for the megawatts delivered as a result.

With ArcelorMittal, by contrast, REstore is bidding into a newly created strategic reserve, and will be paid in advance for resources that will be called on to help meet a projected 2-gigawatt generation shortfall this coming winter. In other words, it’s a capacity program -- a scheme that allows generation or demand-side resources to be paid in advance for the promise of being available to meet future grid needs.

In the United States, capacity markets and programs have been the main avenue for developing demand response resources. Air conditioning, and the high summertime peaks it creates, has driven this U.S. approach. But Europe's problems are driven by its successes in wind and solar power. These intermittent resources get first priority over coal and natural gas-fired generators, and as they've grown to make up double-digit percentages of the electricity supply, they've forced fossil fuel plants offline, to the point where they can't make enough money to justify keeping them running.

In other words, the gas-fired plant that isn't allowed to sell power during sunny, solar-rich days might not be around anymore on cloudy days, when solar isn't there. “That has resulted in a lack of peak capacity -- so the regulators have started to create peak capacity markets,” Pieter-Jan Mermans, REstore co-founder, told me in an August interview.

Europe uses a lot of electricity for heat, making wintertime its most common peak season. Industrial-driven peaks are also a challenge, particularly in grid-congested areas, which adds the threat of energy reliability to the considerations of big power users like ArcelorMittal, he noted.

European grid operators have enlisted demand response for shaving these new peak problems, but so far they've done so via bilateral contracts, as REstore has done previously in Belgium, and as Energy Pool has done in France. But a true capacity market, in which multiple parties compete on the price they’re willing to offer for future "negawatts," is “something totally new for any player in Europe,” Mermans said.

To be clear, such a market doesn’t exist yet, though multiple countries are moving ahead on plans to create them, driven by European Union energy-efficiency mandates. In July, the U.K.’s proposed capacity market got a thumbs-up from the European Commission, and plans to auction 50.8 gigawatts of capacity in December for delivery in the 2018/2019 winter season are in motion. In France, proposed rules have been submitted to government regulators, with the target of launching auctions next year for delivery in 2016/2017 (PDF).

That should expand the market for demand-side resources, as long as they’re capable of meeting those future grid needs. The aggregation of loads that REstore has put together with ArcelorMittal can respond with 90 percent or better reliability, equivalent to a natural-gas-fired power plant, Mermans said -- a measure of how likely it is that that resource will be ready to go, years from now, when those peaks arrive.

In the Benelux region, a capacity market is expected to open about 750 megawatts to competition from a host of demand response participants, compared to the 450 to 500 megawatts now open to demand-side resources in the ancillary services market operated by Elia, he said. The U.K. and France could offer much larger opportunities as they start to implement their own capacity markets, he noted.

That could have a transformative effect on how Europe’s demand response landscape unfolds. Competitors in the European demand response field include Energy Pool in France, Entelios (bought by EnerNOC) in Germany, and a whole host of players in the U.K., including EnerNOC, Honeywell, Stor Generation, Kiwi Power and REstore. Virtual power plant projects, like the one that Siemens has created with German utility RWE or that ABB/Ventyx is building with E.ON in Sweden, could also be seen as contenders.

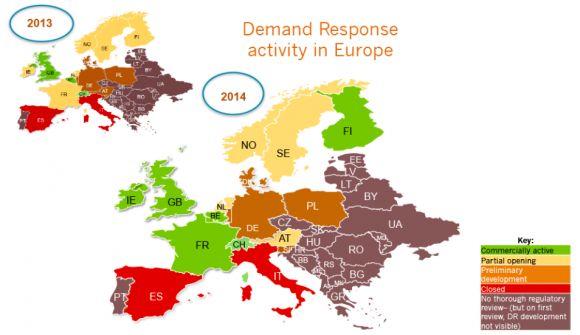

The Smart Energy Demand Coalition, a demand response industry group, has been tracking the emergence of “commercially active” markets across Europe (PDF), with some important progress made over the past year.

It will be interesting to see how it tracks the spread of capacity markets across the continent -- and how that growth corresponds with increasing opportunities for smart, grid-connected demand response and energy efficiency to help smooth Europe’s transition to a renewable energy future.