It’s no revelation that First Solar and SunPower dominate the utility PV market in the U.S. today; one of the two companies has been involved in every one of the 11 largest operating projects in the country. But they are not nearly alone in the market. Rather, there are 55 different project developers with at least one signed utility PPA, and at least 25 more that have not yet signed any off-take agreements. This number seems to rise daily as new developers enter the market with announcements of multi-hundred-MW pipelines. In fact, it would not be inappropriate to claim that there is currently an oversupply of project developers -- more developers than there are available projects.

CONTRACTED UTILITY PV PIPELINE MARKET SHARES, TOP 6 DEVELOPERS

_540_225_80.jpg)

This is reflected in the increasing competitiveness of project bids. For example, in 2009, Tucson Electric Power issued an RFP for solar resources. The RFP generated 144 proposals from 58 different developers, of which 24 were shortlisted and only 10 contracts were ultimately signed (five of which were for PV). Most RFPs have taken this path as new developers scramble to acquire pipeline. This situation has been exacerbated by the recent spate of pipeline acquisitions (Sharp/Recurrent Energy, First Solar/NextLight, First Solar/Edison Mission). These acquisitions have sent a message to the market, right or wrong, that acquirers are willing to pay a premium for project pipelines. A number of upstart developers have taken this as a sign that the most important thing they can do is win PPAs at virtually any cost. This often results in underbidding for PPAs and, ultimately, the failure of contracted projects. Suffice it to say, however, that project development has become an increasingly crowded and difficult space in which to operate.

Developer Types

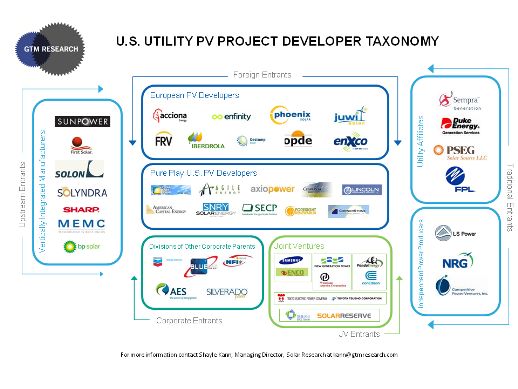

The figure below contains our taxonomy of U.S. utility project developers, contained within our newest report on the U.S. utility PV market. It displays 43 developers -- all of the established players and some of the more credible newcomers -- but is certainly missing a number of new entrants. We classify developers according to six categories:

· Vertically Integrated Manufacturers, of which First Solar and SunPower are the most established but certainly are not the only examples.

· Traditional Energy Entrants, a category that can further be divided into traditional independent power producers (IPPs), which have historically focused on other generating technologies, and utility affiliates, which are generally IPPs that share a parent company with one or more utility.

· European PV Developers, which have experience developing projects in countries such as Germany, Italy, and Spain.

· Pure-Play U.S. Developers, of which there are continually more entrants but fewer established players.

· Joint Ventures, an increasingly popular alternative to downstream integration for manufacturers.

· Divisions of Other Corporate Parents, which often utilize their parent’s balance sheet to enable project finance.

Click the figure above for a larger view.

Let’s focus on the most rapidly changing group: pure-play U.S. utility project developers. The field of pure-play utility PV developers in the U.S. is both growing and shrinking. It is growing in terms of sheer numbers; new developers are constantly emerging with plans to develop large pipelines. While many of these that developers are bidding competitively on are at the heart of the PPA underbidding problem, some do have valuable expertise and experience to bring to the table. They come from a variety of backgrounds, with founders hailing from places such as the CSP industry (Agile Energy), Independent Power Producers (also Agile Energy), wind project development (Lincoln Renewable Energy, Axio Power), and property management (Birdseye Renewable Energy).

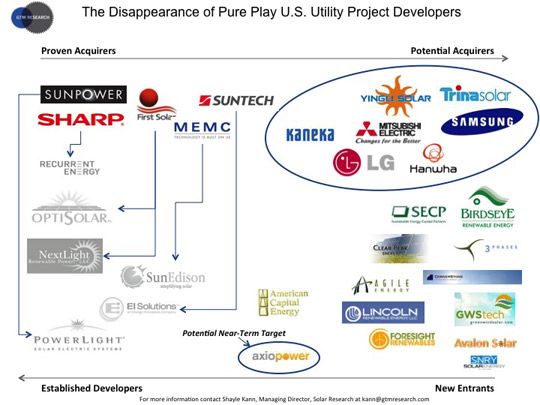

On the other hand, the field of established pure-play developers is shrinking. This is obviously a subjective characterization but can be relatively easily broken down by which developers have either completed projects or, at the least, signed PPAs with utilities. By this characterization, most of the established developers have been acquired, many over the past year alone. The figure below displays recent developer acquisitions and the remaining pure plays in the market. Until recently, the most established pure-play developers would have been Recurrent Energy, SunEdison, and Nextlight Renewable Power; however, all three were acquired in the past 14 months. Today there are fewer than ten remaining pure-play developers with any contracted or completed pipeline, of which the most established are Axio Power, American Capital Energy, Agile Energy, Clear Peak Energy, Sustainable Energy Capital Partners, and Foresight Renewables. Any of these firms could be near-term targets for the remaining upstream players that are yet to integrate downstream. The figure also identifies firms that we believe could be considering downstream acquisitions, either in order to prove out their technology or as a pure module allocation strategy play (more on downstream integration strategy in a later post).

ACQUISITIONS THIN THE FIELD OF PURE-PLAY PROJECT DEVELOPERS

Why are there so few remaining established players? In short, it’s hard for them to compete. With increasing bid, permitting, and interconnection deposits, it is becoming more and more difficult to be a pure-play developer without access to a large balance sheet. One developer recently noted that these early-stage project costs can range upwards of $10 million, and project finance is hard to attain so early in a project’s life. For a venture-backed developer with $5 million to $10 million to fund the entire company, this is difficult to swallow.

In particular, interconnection application costs can be substantial. Under the current Large Generator Interconnection Protocol (LGIP) in California, which applies to all projects over 20 MW, total interconnection securities can range from $1 million to >$15 million, depending on necessary network upgrades. For developers without a large balance sheet, this presents a significant barrier.

So what can pure-play developers do, outside of selling their pipelines? One solution being considered by a number of pure-play developers is undertaking a joint venture with a larger company. This can also be a back-door mechanism through which a supplier can integrate downstream. Instead of developing (or acquiring) an internal project development team, a supplier can essentially “rent out” its balance sheet to a developer seeking to finance a project in exchange for the supplier’s modules being used in the project.

A prime example of such a joint venture is the recently announced partnership between Wanxiang America and New Generation Power. Wanxiang, the Chicago-based arm of Chinese conglomerate Wanxiang Group Companies China, had recently announced plans to set up a module assembly facility in Illinois. New Generation Power is a relatively new project developer that previously had no announced projects. Through the joint venture, Wanxiang would be able to guarantee the sale of its modules, while New Generation Power would be far more likely to attain project financing with Wanxiang’s backing.

Beyond this, it’s a tough road for the small utility PV developer today. Look for more consolidation over the next couple of years, particularly if tax equity markets fail to open up following the expiration of the Treasury Cash Grant. The worse the macro conditions for project finance, the sooner the shakeout of pure play developers will transpire.

This is an excerpt from GTM Research's recently published comprehensive U.S. Utility PV Market report, The U.S. Utility PV Market: Demand, Players, Strategy and Project Economics Through 2015. For more on the report, go here.