When Sarah Kearney was a high school senior in upstate New York, she was a recipient of the 2003 Rochester Business Alliance’s Young Women of Distinction award.

During the process she came to know one of the judges, Arunas Chesonis, a successful telecom entrepreneur who is something of a local celebrity. A few years later, while studying finance at University of Virginia, Chesonis asked Kearney to help set up his family foundation, as his company was about to go public.

“I didn’t know what 'going public' was,” she recalls. “I didn’t really know what a foundation was. But I thought he was really cool.”

Kearney helped establish the Chesonis Family Foundation while studying in the engineering systems division at the Massachusetts Institute of Technology. As she worked on a master's degree, she realized that even though the foundation wanted to focus on addressing climate change and energy issues, there wasn't a clearly established path to follow.

“Science and engineering are often misaligned with venture-capital dollars,” said Kearney, a realization which led her to ask, “Why isn’t anyone using charitable dollars to make these investments?” Due to the large capital requirements, high risk and long time frames of many emerging energy technologies, philanthropic giving seemed a better fit than venture capital, especially since return on investment is not the first priority of charitable giving.

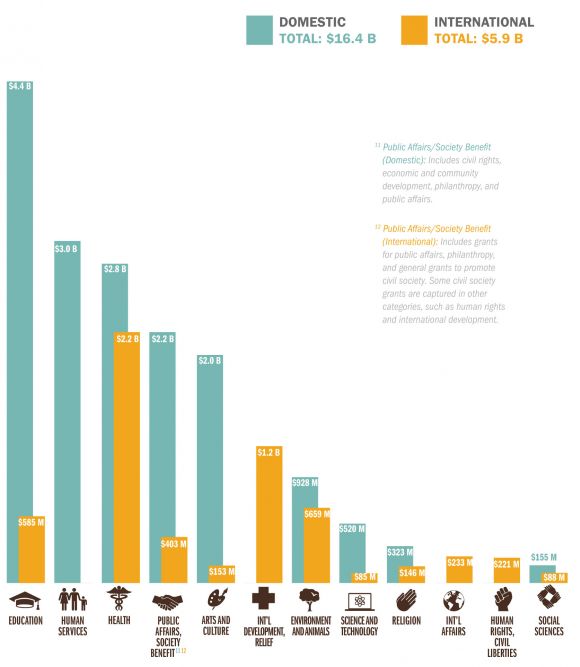

U.S. foundations have more than $700 billion in assets and give away more than $50 billion annually. Science and technology accounts for only a fraction of that, about $520 million in 2012, and rarely does that money go toward commercializing clean energy technology.

The Chesonis Family Foundation was not alone. Legal and tax issues have stymied many foundations that are interested in energy projects for impact investing, since by definition, the money that is granted to help address environmental issues must have a significant and direct benefit.

When Kearney met Priceline founder Jesse Fink in 2012, he told her that if she could get some other foundations together, he would be interested in giving money to clean energy projects through his family foundation. The idea for PRIME Coalition was born.

Philanthropy, meet clean energy

PRIME Coalition officially launched at the White House’s Clean Energy Investment Summit on Tuesday, with its first investment going to grid-scale energy storage startup Quidnet Energy.

The nonprofit organization, with Kearney as its executive director, will help foundations make direct investments to address climate change, primarily in the realm of energy, but also in agriculture, water and waste. PRIME will manage the complex pipeline process of vetting candidates and helping to lower transaction costs for foundations, as well as ensuring they’re adhering to the proper tax rules.

“We’re looking for breakthrough companies that impact resource use at a global scale.”

“The whole point of PRIME is to lower the barrier that keeps the philanthropists on the sidelines,” said Matthew Nordan, founding member of PRIME’s investment committee. “They want to be involved, but they can’t distinguish a great candidate from a good one from a bad one.”

PRIME will help charitable foundations navigate transactions such as program-related investments (PRIs), which can be used to fund businesses that have a mission which aligns with the charity organization. “For the right kinds of opportunities,” said Nordan, “PRIs are a superior kind of grant.”

PRIME Coalition’s initial support comes from the Betsy and Jesse Fink Foundation, Blue Haven Initiative, the Chesonis Family Foundation, Echoing Green, Glass Charitable Trust, the Pritzker Innovation Fund, the Stiefel Family Foundation and the Will and Jada Smith Family Foundation.

“This group decodes and detangles the challenge that many foundations might be struggling with,” Drew Fitzgerald, a strategic advisor to the Will and Jada Smith Family Foundation, said of PRIME’s ability to help foundations get into energy investment.

For Nordan, who co-founded Lux Research and then later worked at Venrock, being on PRIME’s investment committee offered a chance to work with the type of projects that he wasn’t able to get funded as a venture capitalist.

“I got more jaded, not less,” he said of working as a venture capitalist. When compared to the risk and potential payback of other projects in IT or healthcare, energy projects almost never made it through. “And the things that really could change the world definitely didn’t make it through,” he added.

PRIME is not alone in trying to move the needle on marrying philanthropic efforts and clean energy. According to the White House, the University California Board of Regents will allocate at least $1 billion of its endowment toward vehicles that help de-risk early-stage technologies that can impact climate change. Another example is the Schmidt Family Foundation committing funds toward filling market gaps to finance solutions that mitigate climate change.

In addition to hosting the Clean Energy Investment Summit, the federal government has also looked to span the "valley of death" between the lab and commercialization for energy projects with ARPA-E, the U.S. Department of Energy’s research unit, which funds high-impact technologies that are too nascent for private-sector investment.

The efforts are not all siloed. PRIME is using ARPA-E to help build its pipeline. PRIME's pipeline is also taking companies from cleantech incubators around the country and others vetted by the Cleantech Group. Any potential company is also analyzed based on its greenhouse gas mitigation potential. “We’re looking for breakthrough companies that impact resource use at a global scale,” said Nordan.

A second life for abandoned wells

PRIME’s first proof-of-concept is Quidnet Energy, a grid-scale energy storage startup that wants to pump water into abandoned oil and gas wells. With a potential cost of energy storage in the tens -- rather than hundreds -- of dollars per kilowatt-hour, it is just the sort of high-impact technology that PRIME, and its foundation partners, want to see succeed.

Quidnet received money through PRIME in three ways: a conventional angel investment from various investors, a PRI from the Sorenson Impact Foundation, and a recoverable grant from the Will and Jada Smith Family Foundation.

Quidnet has already been issued patents for using rock formations to store energy and will use the seed round from PRIME for its first test well. “The goal is to get away from expensive battery chemistries,” said Aaron Mandell, co-founder of Quidnet and current CEO of AltaRock, a startup developing enhanced geothermal energy resources.

Quidnet uses off-the-shelf drilling equipment and has a goal of delivering grid-scale energy storage for about $25 per kilowatt-hour with about four to 10 hours of storage, and easily longer, according to Mandell. The test well will be 5 megawatts to 10 megawatts, with about 20 megawatt-hours of storage.

“The early data is very compelling,” said Nordan, who is also on Quidnet’s board. “You can’t do it anywhere, but you can do it in a heck of lot of more places than you can do pumped hydro.”

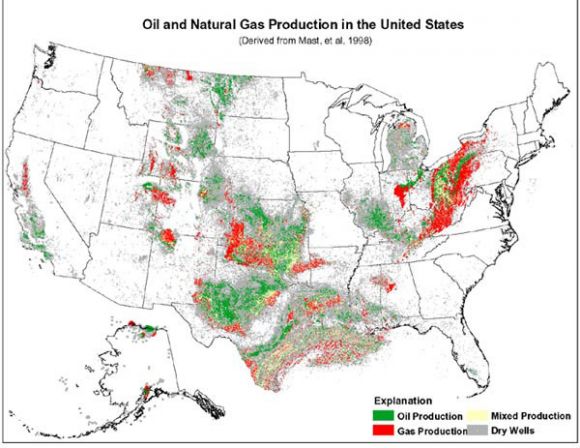

The company is first focusing on abandoned wells, which are located across many regions of the U.S. If successful, Mandell said they could drill new wells just for storage anywhere with impermeable rock. The most similar technology is compressed-air energy storage, although Quidnet’s technology could theoretically be used in even more places and done cheaper when using available wells.

Quidnet’s process involves pumping water under pressure into an abandoned well. As the rock is compressed, the energy is stored. Opening the well allows the pressurized water to be released to spin a turbine to create energy.

The test well will use about 5,000 barrels of water, but a typical commercial well would use about 50,000 barrels (a barrel is equal to about 43 gallons). Mandell said that because it’s a closed-loop system, it will not draw on precious water sources in drought-ridden regions. The process could theoretically even use frack water or seawater.

Mandell says Quidnet’s technology has a round-trip efficiency of more than 75 percent, and an average spent oil or gas well could offer hundreds of megawatt-hours' worth of storage. Because they are not removing anything from the ground, the siting only requires a lease for surface rights, similar to what's granted to a wind or solar developer.

Quidnet Energy's test site in Texas isn't much to look at, but it has piqued the interest of some of the biggest names in Hollywood and impact investing.

For the first test site in central Texas, Quidnet is not working with a local utility, but rather is simply testing the energy storage efficiency with a turbine and generator at the well site.

Even if the focus is merely leveraging abandoned wells, there are various regions such as Texas where there are significant wind resources and no shortage of spent wells. Not every well is a candidate. Ideally, a reservoir will be very impermeable and will not fracture further as water is pumped into it, which would degrade the efficiency of the energy storage. “We need the water to go in, and we need the water to come back,” said Mandell.

Hollywood comes calling

The real challenge for Quidnet so far, however, is not finding a good test well -- rather, it is securing financial backing. An unproven energy-storage solution based on oil and gas technology had been a difficult sell to venture capitalists. Yet even during his stint as an entrepreneur, Mandell did not speak the language of foundations. “I was definitely surprised these types of charitable foundations were interested in funding an energy venture,” he said. “I would have no idea where to begin with the grant world.”

Making bedfellows of energy startups such as Quidnet with foundations such as the Will and Jada Smith Family Foundation may seem like a strange pairing, but it could be just the first matchup of many between the foundations of the rich and famous and high-risk, high-impact energy startups -- if PRIME is successful.

“Quidnet can be very [emotionally appealing] when described in the right way,” said Fitzgerald. Many of the issues that are dear to the Will and Jada Smith Family Foundation and other foundations, such as health, education and poverty, are often related to energy issues. “I don’t care if it’s sewer management software,” said Fitzgerald. “If it’s going to help people, it’s sexy.”

The Will and Jada Smith Family Foundation was excited to be on the forefront of helping PRIME Coalition launch, not only so it could try to put its money to use for a technology that could help address climate change, but also to serve as an example to other foundations in terms of what is possible in this realm.

Even if PRIME can unlock just a fraction of the $700 billion in assets that U.S. foundations have available for cleantech, “that would be far more than all of the VC dollars,” said Kearney. PRIME plans do a few more seed rounds and then raise a large fund of committed capital.

“It’s like PRIME is a new movie studio and Quidnet is its first movie,” said Fitzgerald. “We’re very proud to be involved in this.”