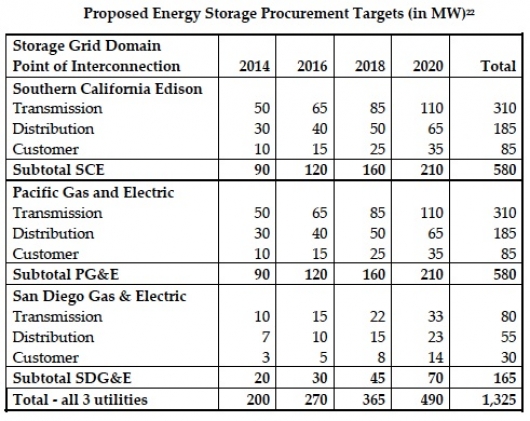

California is a fertile proving ground for tomorrow’s energy storage success stories. Big mandate requiring the state’s big three investor-owned utilities to procure a record-setting 1.3 gigawatts of grid-connected energy storage by the end of the decade? Check. A lucrative incentive program that's helped push megawatts' worth of behind-the-meter storage systems into the field? Check. A large and growing share of utility-scale and distributed solar, pushing system supply-demand curves into unusual duck-like shapes? Check.

A regulatory framework that clearly lays out how all this storage will be valued? Not quite there yet. While California has taken the lead in energy-storage policy on many fronts, its still a bit behind on some of the thornier, more complicated issues that arise when grid batteries move out of pilot projects, and into the commercial sphere.

Critical issues, such as how batteries can serve more than one revenue-generating function -- so-called “dual-use” capabilities -- haven’t yet been sorted out, for example. Nor have issues about how behind-the-meter batteries that balance building demand charges can also be called into play for grid services like demand response, although pilot projects are underway, and several key programs are set to launch later this year.

Complicating things even further, no single regulator has control over the entire process. The California Public Utilities Commission (CPUC) is in charge of the 1.3-gigawatt mandate and other utility regulations. But the California Independent Systems Operator (CAISO) handles bulk power transmission and generation, and runs the all-important energy and grid services markets that will become part of that eventual value stream.

CAISO is working on several proposals that could set firm guidelines for how storage can play into grid markets, both at utility-scale and as a distributed resource. But it's still unclear how those grid opportunities align with the CPUC's long list of utility and customer-centric benefits it wants to fulfill with its storage mandate.

“These are some of the interesting questions that are being debated right now, and it’s coming up here in California before almost anywhere else in the country or in the world,” said Ted Ko, policy director for behind-the-meter battery startup Stem. “Whose jurisdiction is this under? Where is it the utility responsibility versus the ISO?”

There’s also the critical utility-third party divide to consider. Utilities want to own as much storage as they can, since they get a guaranteed rate of return on capital expenditures. That’s a good business for turnkey storage providers and integrators, like the big grid companies and battery manufacturers.

But third-party storage developers are also bringing megawatts' worth of storage to market. Some are doing it through utility contracts, like Southern California Edison’s procurements with AES Energy Storage and Advanced Microgrid Solutions. Others are doing distributed, behind-the-meter energy storage on their own, and want to fit it into future grid plans -- think of Tesla’s new battery business, and its partners like SolarCity and EnerNOC. Some, like behind-the-meter battery startup Stem, are doing both.

Meanwhile, today’s energy-storage growth is predicated on some existing incentives that won’t last forever. The state’s 1.3-gigawatt mandate has already drawn far more storage proposals in its first round than it could handle through the rest of the decade, for example. And most of the behind-the-meter batteries and thermal energy storage systems being deployed by companies like Tesla, SolarCity, Stem, Green Charge Networks, Sunverge and others are backed by Self-Generation Incentive Program grants, which provide up to half of the cost of installation -- and are set to expire in 2019.

Where to start on untangling this complex web? We’ve come up with a short list of the key issues that are now being considered by California regulators, and how they’re playing out in the halls of power.

Defining the fuzzy line between utility and third-party storage opportunities

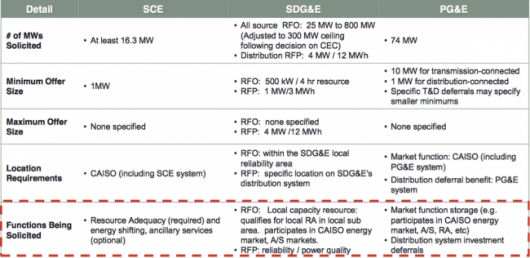

Back in July, the CPUC held a workshop to figure out an issue a bit past its due date: how to assign cost and benefit values to the hundreds of megawatts' worth of storage projects already procured to meet the first round of the state’s 1.3-gigawatt mandate.

In presentations, California’s three big utilities outlined what projects they’ve asked for, and what they want to do with them. The list of needs included some core utility values like distribution system investment deferrals -- using a battery to keep a stressed-out portion of the grid under its operating limits, and thus delay its replacement. Another big category is meeting long-term capacity needs, like the 250 megawatts of storage procured by Southern California Edison last year, the largest single distributed energy storage deployment underway in the state.

But the utilities are also asking for storage that can help them meet their resource adequacy goals -- the minimum amount of flexible, always-available energy that it’s required to procure to deal with imbalances in supply and demand over the coming years. What’s more, they’re looking for projects that can play into CAISO’s energy and ancillary services markets, even though the rules for doing so aren’t quite set up yet.

The utilities said in a joint statement that they’re willing to “provide use-case specificity where necessary and practicable, but generally, more optionality provides for greater competition and more innovative offers.” The basic idea is that there’s no technical reason why a utility-owned battery that backs up a power line on hot summer afternoons shouldn’t bid its capacity to the grid to help with an imbalance somewhere else on mild spring day, for example.

That’s the case that Mark Irwin, SCE advanced technology director, laid out in an interview this spring. “Because most of our distribution circuits peak during the summer, during general system peaks, when we don’t need it during those operations -- which is many hours and months a year -- we can put it into the market,” he said. “They would go get the maximum value out of it.”

Here’s the problem with this approach, however -- it would take a rate-based asset and put it into competition with an independent project. In general, the third-party vendors say they can do the job more flexibly and cost-effectively than utilities, if they’re allowed a fair share of opportunity. The California Public Utilities Commission’s 1.3-gigawatt mandate requires that utilities own no more than half of the storage they procure, but it hasn’t yet made clear how it will manage dual-use situations.

“We’re putting in proposals that include traditional demand response, backup generation, plus solar, energy storage, and other behind-the-meter resources.”

Irwin noted that the CPUC would likely ask utilities to return a share of excess revenues to “those who paid for it, who are the bundled customers,” through some kind of revenue-sharing agreement. SDG&E has also proposed a similar arrangement for a proposed pilot tariff that will encourage customers to install energy storage and turn over some control to the utility.

To date, however, almost all of the utilities’ mandated procurements have involved utility-owned storage -- a fact that hasn’t escaped independent storage developers. In a July presentation to the CPUC, the California Energy Storage Alliance cited “limitations on third-party storage for distribution solutions” as a key gap that needs to be addressed in state policy.

The CPUC’s emerging rules on distribution resource plans (DRPs) and integrated demand-side resources (IDSR) could make big changes to the way that independent storage resources are allowed to earn money for their grid-bolstering capabilities. So could new rate and tariff structures that encourage distributed energy resources (DERs) to be deployed in the right places, and charge and discharge at the right times.

But for now, the most active efforts underway on “dual-use” storage involving third-party providers are under utility contract, like Stem’s 85-megawatt contract with SCE. “Because our contract with Southern California Edison actually involves aggregation of those resources, but also Edison bidding our resources into CAISO markets, we care about this,” Ko said. “We’re installing those systems by the end of next year. We need to make sure all the settlement agreements, all the capacity agreements, work by the end of next year.”

Behind-the-meter storage complications: Dual-use versus double-dipping

It’s important to note that Stem isn’t just providing capacity to Southern California Edison. Every battery it installs comes with controls and software to make sure it’s serving its primary purpose: helping customers avoid expensive demand charges by injecting battery power when buildings are about to reach a peak in energy consumption.

Demand-charge management drives the behind-the-meter battery business case for commercial and industrial customers installing systems from Stem, Green Charge Networks, Coda Energy, Tesla and SolarCity, and a growing list of contenders. It could also provide independent parties another path to monetizing their storage capabilities outside of utility contracts.

But when those batteries begin to be used for grid-facing opportunities, several complications arise. CAISO has taken the lead on these issues with its Energy Storage Roadmap proceeding. In a May scoping document, CAISO laid out some of the key issues it’s facing with dual-use storage systems that match up customer services like demand-charge management with grid market services.

“What we need are behind-the-meter assets that can be dual-use, that can provide the full suite of services to the ISO, and that are accurately measured,” Robert Anderson, CTO of Olivine, said in an interview last month. “That last part is going to be challenging.”

Olivine, a San Ramon, Calif.-based company that serves as a “scheduling coordinator” to manage the interaction of third-party resources with CAISO programs, helped write CAISO’s energy storage roadmap, Anderson noted. It has also been intimately involved in pilot programs that allow aggregators of distributed energy assets -- like Stem’s fleet of behind-the-meter batteries -- to meet day-ahead demand response obligations and get paid as a result.

But as CAISO and utilities move to expand these programs to commercial scale, they want to make sure to avoid certain situations that would distort the market, he said. One of the biggest problems is establishing a baseline for storage-equipped buildings, to avoid the problem of “double dipping.” The basic idea is that batteries shouldn’t be paid twice for doing the same thing -- reducing peak energy consumption to limit demand charges, and also bidding that reduction into CAISO’s demand response or energy markets, for example.

“What if yesterday from 1 p.m. to 4 p.m., I provided the same amount of energy anyway, because it reduces my demand charge on the retail bill? What happens there is that the wholesale market, and everyone inadvertently directed by wholesale rates -- which is everybody -- is paying the resource owner to be a free rider,” Anderson said. “That’s the main rationale behind providing baselines.”

Without some way to measure and verify what happens in each use of the battery, “people can game the system -- and baselines are intended in general to find out what the normal use would have been if there wasn’t a dispatch,” he said. “That’s why I identify accurate measurement as a big hurdle to get over.”

But for companies already deploying batteries to help manage building energy, this lack of clarity on how baselines will be calculated makes it difficult to price out how much these emerging grid markets will be worth. That’s a challenge to companies like EnerNOC, the demand response provider that’s teamed up with Tesla to deploy batteries at a few test sites in California.

“We’re putting in proposals that include traditional demand response, backup generation, plus solar, energy storage, and other behind the meter resources,” Jeff McAulay, EnerNOC's senior manager of strategic partnerships, noted in a July interview. “We want to use all the tools available to us, to provide the most cost-effective combination.”

There’s certainly pressure to find ways for behind-the-meter storage to play a role, given how much of it is being deployed with the benefit of the Self-Generation Incentive Program. Here's a GTM Research tally of current storage applications under the program as of July 2015.

Spencer Hanes, Duke Energy’s director of transmission and portfolio optimization, noted that, “for better or for worse, there are a lot of storage projects that are getting approved, and RFPs in California that are behind the meter and look more like demand-reduction projects, rather than the larger grid-scale projects.”

Expect this issue to come to the fore this year, when California launches its first Demand Response Auction Mechanism, or DRAM. This new program will allow non-utility participants to bid their demand flexibility into an open market, under utility oversight at first, but potentially through direct control by CAISO in years to come.

Figuring out market values amid changing market rules

Amid all this talk about the market values to come from different storage applications, there’s some real uncertainty about how quickly each will come into being -- and whether or not they’ll end up being worth their while.

California’s ancillary services markets aren’t designed to support applications like frequency regulation, which has driven most of the large-scale energy storage deployments in the Northeast, or in the mid-Atlantic region of grid operator PJM. Even Texas grid operator ERCOT is moving more quickly to incorporate energy storage into its fast-responding markets, Hanes noted.

“One of the things we’re watching is movements in different markets, and how they’re looking to develop rules to efficiently allow energy storage to be a grid-scale resource,” he said. On that measure, “California has the mandate -- but in terms of markets, it’s really ERCOT and PJM.”

Indeed, even as California’s utilities and third parties seek permission to play CAISO markets -- and CAISO sets up the rules for letting them do so -- they’ve also been seeking to find a way to fit energy storage into another side of the equation. That’s resource adequacy -- the amount of grid capacity that utilities have to procure to make sure CAISO has the flexibility it needs to meet fast-changing shifts in the balance between supply and demand.

Right now, California’s big utilities want to use energy storage to meet their resource-adequacy requirements. But there’s a big barrier for cost-effective storage systems on this front -- the rule that resources must be deliverable at their maximum output for four hours per day, up to three days in a row.

A four-hour discharge cycle presents a punishing schedule for lithium-ion batteries, which are by far the most commercially mature battery technology on the market today. Hitting the four-hour mark will essentially require doubling the amount of lithium-ion batteries available for the task, or moving to storage technologies like flow batteries that are better suited to four-hour discharge.

But if lithium-ion batteries are cheaper and better proven in the market, why shouldn’t there be a two-hour RA category as well to let them do what they do best? Utilities and energy-storage providers made that argument last year, but CAISO decided not to take that step in its most recent RA decision.

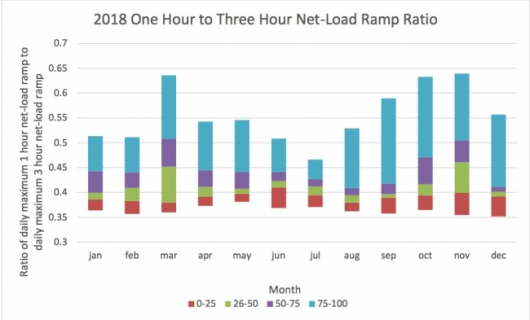

Still, CAISO is working on ways to allow shorter-duration RA products, largely to meet the ramping requirements it’s facing with the growth of solar power. CAISO calls this kind of service “flexible capacity,” and it is working out the rules for it in its Flexible Resource Adequacy Criteria and Must-Offer Obligation Phase 2, or FRACMOO-2, proceeding -- another catchy acronym that carries a lot of significance for energy storage’s future.

CAISO is projecting an increasing need for one-hour ramping resources, as distinct from three-hour resources, as this chart of projected ramping needs for 2018 indicates. That's a direct result of the so-called "duck curve" effect, as increasing amounts of solar power reduce daytime load, then fade away in the late afternoon and early evening, creating steep ramp-ups in demand.

The next step in making this flexible capacity even more flexible could be to allow it to come from storage systems that are also doing something else with their time. One problem for that approach is that “RA is 24/7 -- CAISO is saying you have to be available for RA, you can’t use it for anything else,” Ko said.

“We’re saying that’s not necessarily true,” he noted. “You could have a battery where half is for RA, and half is for a customer. Or in a fleet, at any point in time, half the fleet could be used for customers, and half for RA.”

Even so, Stem’s contract with SCE includes a four-hour requirement “because they wanted to have that option to have it qualify for RA,” he said. Until

Balancing what’s best for storage, what’s best for the grid, and customers

This kind of situation leads to an unclear, yet predictable, increase in the cost of energy storage, SCE noted in a July presentation before the CPUC. “The lack of certainty in market rules and regulations increases operational costs, which is subsumed into energy storage capacity prices,” it stated.

Of course, SCE and its fellow investor-owned utilities haven’t publicized what they’re paying for their energy storage procurements to date. That makes it hard to know just how much more expensive they are than they would be if regulatory issues like these and others could be resolved.

To be fair, there’s no clear set of guidelines on how third-party storage providers could take advantage of the same smoothed-out regulatory process, either. The CPUC hasn’t yet defined how it’s going to measure the cost-effectiveness of competing proposals for the 1.3-gigawatt mandate, for example, although it has launched a “Consistent Evaluation Protocol” (CEP) to set guidelines for how that’s going to be done.

“These are some of the interesting questions that are being debated right now, and it’s coming up here in California before almost anywhere else in the country or in the world.”

That’s not going to be an easy task, however. The CEP will start to provide publicly available data to build cost-benefit measurements for utilities’ next round of mandated energy storage projects. But the data it’s using will come from the “most recent avoided-cost calculator used in a Commission proceeding” -- namely, the same software developed by CPUC contractor E3 to calculate the costs and benefits of new net-metering proposals. That “Public Tool” has come under criticism from utilities and third parties for an array of shortcomings, although the CPUC has said that new versions of the tool have resolved many of those issues.

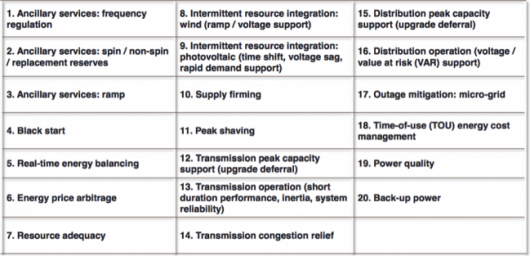

Meanwhile, there’s a bewildering range of potential values to be measured. The CPUC framework includes 20 different end uses that “might exist for an offer,” according to a July presentation. Some are strictly customer-facing benefits, like outage mitigation and time-of-use energy cost management, while others, like grid peak capacity support or intermittent resource integration, are firmly in the utility camp. And, as we’ve covered previously, some can be combined with others, while some are mutually exclusive.

In a broader sense, this framework could also measure whether any storage project is more or less cost-effective than any other alternative investment. That could be a traditional power plant or grid upgrade, or some combination of distributed energy resources and demand-side management that accomplishes the same goals.

AB 2514, the state law that established the 1.3-gigawatt mandate, specifically calls for the CPUC to create new markets and regulatory structures to support this unprecedented build-out of storage capacity. But not all regulators have the same imperative, Olivine’s Anderson noted.

“Many of the storage advocates lead with the idea that storage assets are not properly incentivized,” he said. “That certainly is an issue for California, with all these different mandates, the requirement to get all these assets into the field. The challenge for people like the ISO is, that’s not their problem, exactly.”

At the same time, there are good reasons to adapt today’s regulations to take advantage of the technology shifts happening in the marketplace -- namely, the falling costs of batteries and the rise of intermittent wind and solar power as a significant source of grid energy.

These two trends are combining in the form of battery-backed solar systems, which are now being offered by almost every major solar developer that’s active in California. But they’re also being manifested in a number of other regulatory changes afoot in California -- net-metering regulations, time-of-use rate structures, and distributed energy resource-grid integration proceedings -- which could all have significant effects on the value of energy storage.

“We need tariffs that send the appropriate price signals, but they have to be beneficial to all customers” who install technology, including energy storage, to “avoid the cost of what would be an alternate technology,” Jason Simon, director of policy strategy for microinverter maker and would-be energy storage player Enphase Energy, said at an August energy conference in Sacramento. “The regulatory process doesn’t exist today to broker that transaction.”