Last month, we reported on the criticisms coming from California solar groups and utilities regarding the draft version of the California Public Utilities Commission’s Public Tool -- a software platform that will be used to analyze different proposals for how the state should change, or retain, different aspects of its current solar net metering regime.

Last week, the CPUC released its final version of the Public Tool (PDF), one that CPUC staff members said has undergone some significant changes and improvements in response to the initial critiques. Now different parties can start to run their proposals through the platform’s analysis, in preparation for a July 2 deadline to submit them to the commission, and begin to debate their relative merits.

The CPUC has also released an exhaustive list of answers (PDF) to the questions and concerns raised by those who reviewed the draft version of the software, which is required under state law AB 327 in order to manage an incredibly complex task. That’s to measure the long-term effects of a wide variety of alternative proposals for how the state should compensate the owners of rooftop solar and other distributed energy systems, balancing policies that support the continued growth of the state’s distributed energy markets against the financial impacts on utilities and their customers.

“It’s basically [about] how you create a market that works, that’s cost-effective and sustainable,” Sara Kamins, CPUC program supervisor, said in a Tuesday interview. “It’s important, and statutorily required, to sustain a distributed generation market. It’s also important to balance that with considering the costs to ratepayers and to the grid.”

Under AB 327, the CPUC has to create a successor “NEM 2.0” tariff, to kick in once the state’s big three investor-owned utilities -- Pacific Gas & Electric, Southern California Edison, and San Diego Gas & Electric -- reach a threshold of 5 percent of nameplate generation capacity under net metering, or in mid-2017, whichever comes first.

Solar groups have largely pressed for retaining today’s net metering regime. But an October proposal from PG&E (PDF) has suggested replacing it with a feed-in tariff (FIT) structure, which it says would better compensate customers without solar for the grid costs borne by all ratepayers. The California Solar Energy Industries Association has charged that this FIT proposal could reduce the economic reward for customer-sited rooftop solar systems, compared to current net metering rules.

This conflict means that, as with so many of California’s renewable energy policies, there’s plenty of room for disagreement on whether the final version of the Public Tool will yield projections that are fair and balanced.

That’s why Kamins walked through a point-by-point analysis of many of the criticisms of the draft tool, and how the final version has been changed to address them -- or, in fact, was able all along to manage them.

Solar and utility challenges get some fixes, some clarifications

Let’s start with a key criticism, voiced in CPUC comments from both solar industry groups The Alliance for Solar Choice and Solar Energy Industries Association (PDF) and from PG&E (PDF). This critique was focused on how the draft version of the tool modeled the growth of the state’s solar market through the rest of the decade.

According to both groups, the draft version of the tool predicted that solar installations will drop to below 2014 levels in 2017 and beyond, an outcome that seems to fly in the face of consistent projections of falling solar system and installation costs. Those outcomes emerged even when policy changes that might possibly cause them, such as the sunset of federal Investment Tax Credit for solar power and changes to California’s tiered rate structures, aren’t put into the model.

“PG&E’s comments were specifically focused on the adoption model” that yielded these results, CPUC analyst Shannon O’Rourke said during Tuesday’s interview. “Their criticism is that the adoption model significantly under-forecasted adoption.”

“The good news for PG&E is that in the final draft of the tool that was issued on Thursday, we were able to address their issues, as well as issues from the solar parties,” she said. “Now, if you were to run the tool with the same scenarios you ran it with previously, you would see increased adoption.”

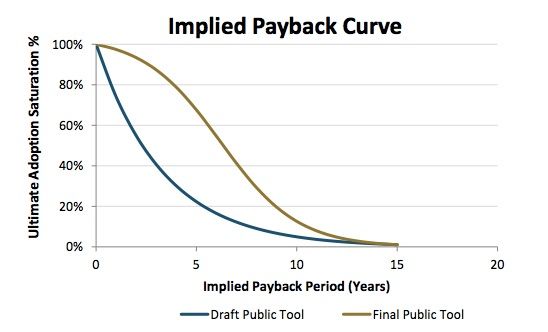

The fix that yields this outcome has to do with replacing the exponential function used in the draft tool with a log function used in the final version of the tool, she said. For those unfamiliar with these terms, here’s a graph from the CPUC’s June 4 ruling that illustrates how the new version increases “the number of forecasted adoptions for a given economic proposition, especially for customers with good economic propositions.”

Another change to the final version of the tool will allow proposals to input details on the locational value of solar, O’Rourke said. That’s important, because according to comments filed by solar advocacy group Vote Solar (PDF), the draft version of the tool assumed a single, average energy price across the state.

But actual energy costs vary widely, based on the locational marginal price (LMP) system that sets prices at different points on the grid. According to TASC's and SEIA's comments, "the 50 highest value Locational Marginal Price nodes have more than 10 times the capacity of installed solar as the 50 lowest value Locational Marginal Price nodes" across the state -- an important factor in calculating the value of solar by location that would be lost without some way to include it in the analysis.

CPUC has responded by including “an adjustment to allow users to input a value for locational values,” O’Rourke said. “It’s not as granular as assigning locational marginal prices, but if parties can come up with a proxy value, they can put that down.”

These are two instances of how Energy and Environment Economics (E3), the consultancy contracted by CPUC, made active changes to the tool, she said. But in other cases, criticisms from groups that tested the draft tool were based on misunderstandings about how the tool worked, she said.

One example is the critique that the draft version of the tool assumed very high levelized costs of energy (LCOE) for solar PV in years to come -- in fact, higher costs than prices available today in California from some vendors, according to PG&E’s comments.

But O’Rourke pointed out that “we built a lot of flexibility into the tool, so that stakeholders could largely use their own inputs.” In other words, those default LCOE figures, while based on publicly vetted research, also come with options for proposals to adjust them to prices they believe are more accurate. “We have clarified that the tool always allowed users to evaluate and input their own solar costs,” she said.

Not all future variables can be easily built into the Public Tool, however. One example is how to manage the outcome of the CPUC’s distributed resources plan (DRP) proceeding, another mandate of AB 327.

This proceeding is requiring the state’s big three investor-owned utilities to develop grid investment plans to incorporate the effect of distributed energy resources. It’s another highly complex policy challenge, and utilities are set to file their proposals for how to accomplish it next month.

“We definitely need to consider the benefits of DG [distributed generation], and there’s a reason why AB 327 included the distribution resources plan and net metering in the same bill,” Kamins said. But with DRP draft plans coming in July, and a net metering decision required by year’s end, “it’s tricky to balance” how to include DRP plans in progress, she said.