California’s 1.3-gigawatt energy storage mandate is bringing a lot of would-be grid battery project developers out of the woodwork. But there won’t be nearly enough room for everyone who wants a piece of this market.

The latest proof of this comes from Pacific Gas & Electric, the Northern California utility that’s seeking about 74 megawatts of storage projects to meet its 2014 procurement target under state law AB 2514. Last week, PG&E quietly let slip that it had winnowed down an initial queue of more than 5,000 megawatts' worth of applications to come up with a short list of finalists.

Energy consultancy Enovation Partners published this news last week, and PG&E spokesperson Paul Moreno confirmed the details with us this week. The utility isn’t disclosing any information about the proposals remaining on its short list, and expects to make its final choices known in a December filing, he said.

California’s energy storage mandate calls for the state’s big three investor-owned utilities to procure 1.3 gigawatts of energy storage over the coming decade, with a first round of 200 megawatts to be awarded by the end of this year. But the rush of proposals is already overwhelming this target, according to state grid operator California ISO, which reported that more than 2,000 megawatts' worth of storage projects had applied for grid interconnection as of last year.

Of course, there’s little reason to assume that the majority of these applicants are competitive. CAISO’s interconnection queue document (PDF) contains 18 densely packed pages of projects that have since withdrawn their applications, compared to three pages of completed projects and four pages of currently active projects. Stephen Wiley, Enovation Partners founder, noted that there are very low barriers to entry for applicants in the first round of PG&E’s RFO, which indicates that the utility’s short list is likely much shorter than where it started out.

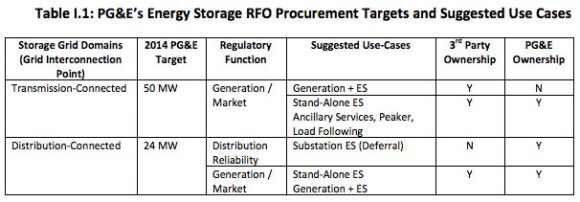

PG&E’s request for offer (RFO) calls for 50 megawatts of transmission grid-connected storage projects, and another 24 megawatts for the distribution grid. Targeted use cases include ancillary services and substation deferral.

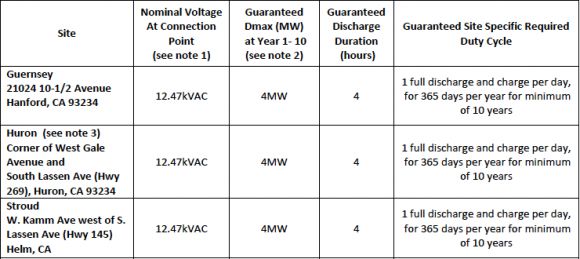

The only storage project that PG&E isn’t considering owning itself is a transmission-connected project that would play the role of a generation asset. But it does want to own and operate battery systems for three of its solar PV sites, two in Fresno County and one in Kings County. Note that the "guaranteed site-specific required duty cycle" is one full discharge and charge per day for a minimum of 10 years.

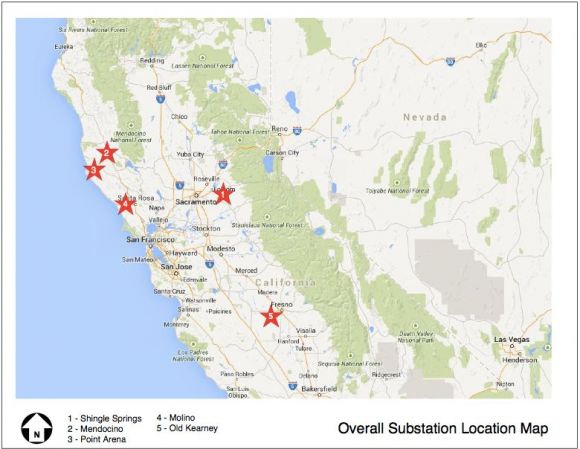

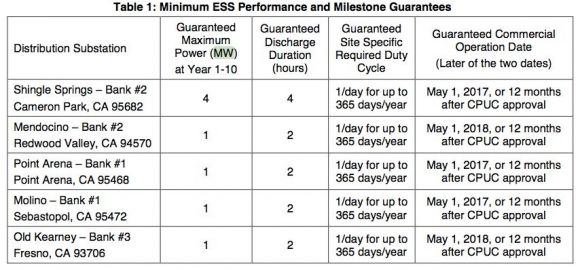

PG&E also wants to own distribution-connected batteries at five specific substations that need support during times of peak power demand.

Those systems will have to provide power for least two hours per day, every day of the year, to meet the terms of the RFO.

California’s other big utilities, San Diego Gas & Electric and Southern California Edison, are also in the midst of filling out their state storage mandates, although they’re further along than PG&E. That’s because both have already been asked to procure large-scale storage to meet the terms of a long-term procurement proceeding (LTPP) to back up portions of their service territory facing the loss of once-through cooled gas-fired power plants, as well as the closure of the San Onofre Nuclear Generation Station.

Southern California Edison has already awarded about 250 megawatts of storage contracts under its LTPP procurement, and has also put out an RFO for an additional 16.3 megawatts. And SDG&E has put out an RFO that calls for a minimum of 25 megawatts of storage, but could expand far beyond that to 800 megawatts.

Under the storage mandate rules set out by the California Public Utilities Commission, utilities have to ensure that the storage projects they select are cost-effective compared to other grid alternatives. But just how cost-effectiveness is to be calculated hasn’t been specified yet. This first round of procurements is expected to provide some hard numbers that will guide this process.

_721_420_80_s_c1.jpg)