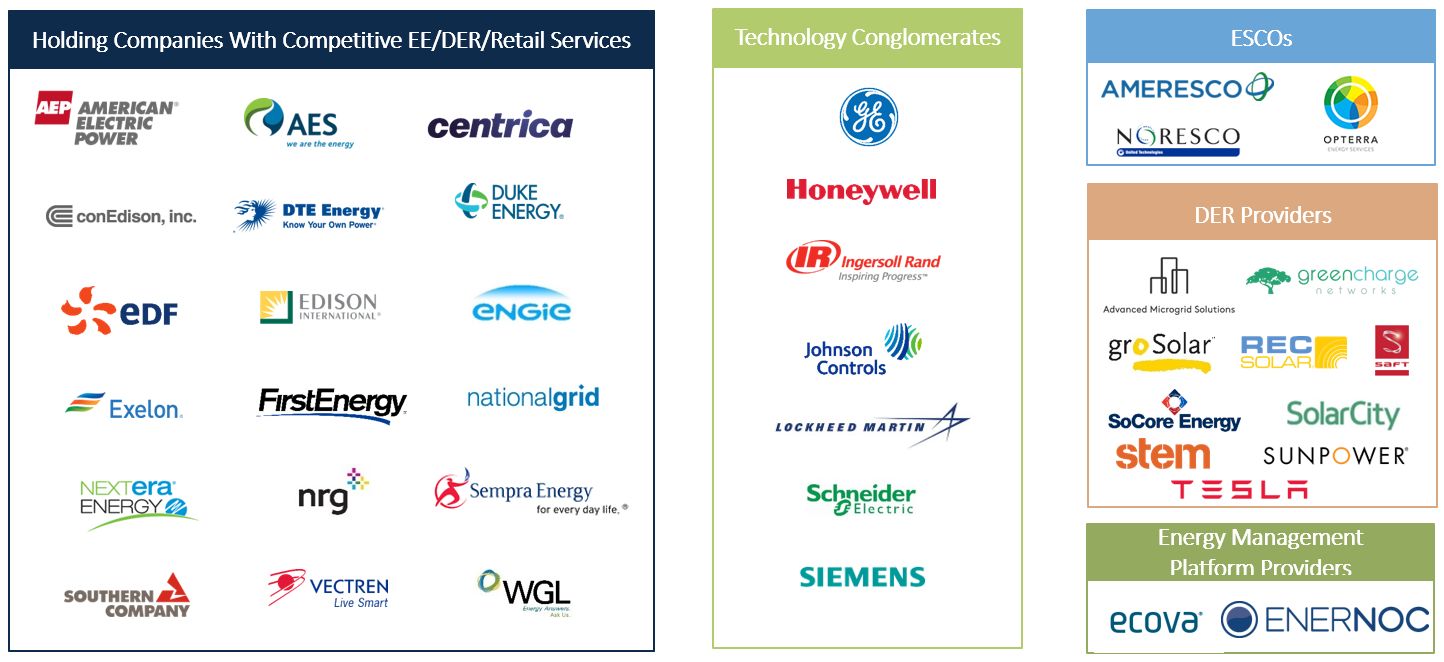

Recent headlines in the world of energy management illustrate an evolving landscape of vendors seeking to appeal to commercial and industrial (C&I) customers. Well-known names in the utility space and global conglomerates are betting on enhanced capabilities: Edison launched an energy services business, GE launched Current, Engie took a majority stake in Green Charge Networks, and Centrica bought Ener-G Cogen.

In a new report, The New C&I Energy Management Landscape: Integrating Procurement, Efficiency, Generation and Storage, GTM Research outlines changes unfolding in the energy management space, as well as discussing the reasons behind this shift and the strengths of different vendors.

The market is influenced by the declining costs of distributed energy resources, as well as changes in corporate strategy and objectives. Streamlined energy spending, reliability of service, and sustainability are all at the forefront of decision-makers’ minds. Responding to these needs, vendors are bundling energy services and technologies to deliver strategic outcomes to their clients, referred to as “energy as a service."

FIGURE: The Vendor Landscape for Integrated C&I Management

Source: The New C&I Energy Management Landscape: Integrating Procurement, Efficiency, Generation and Storage

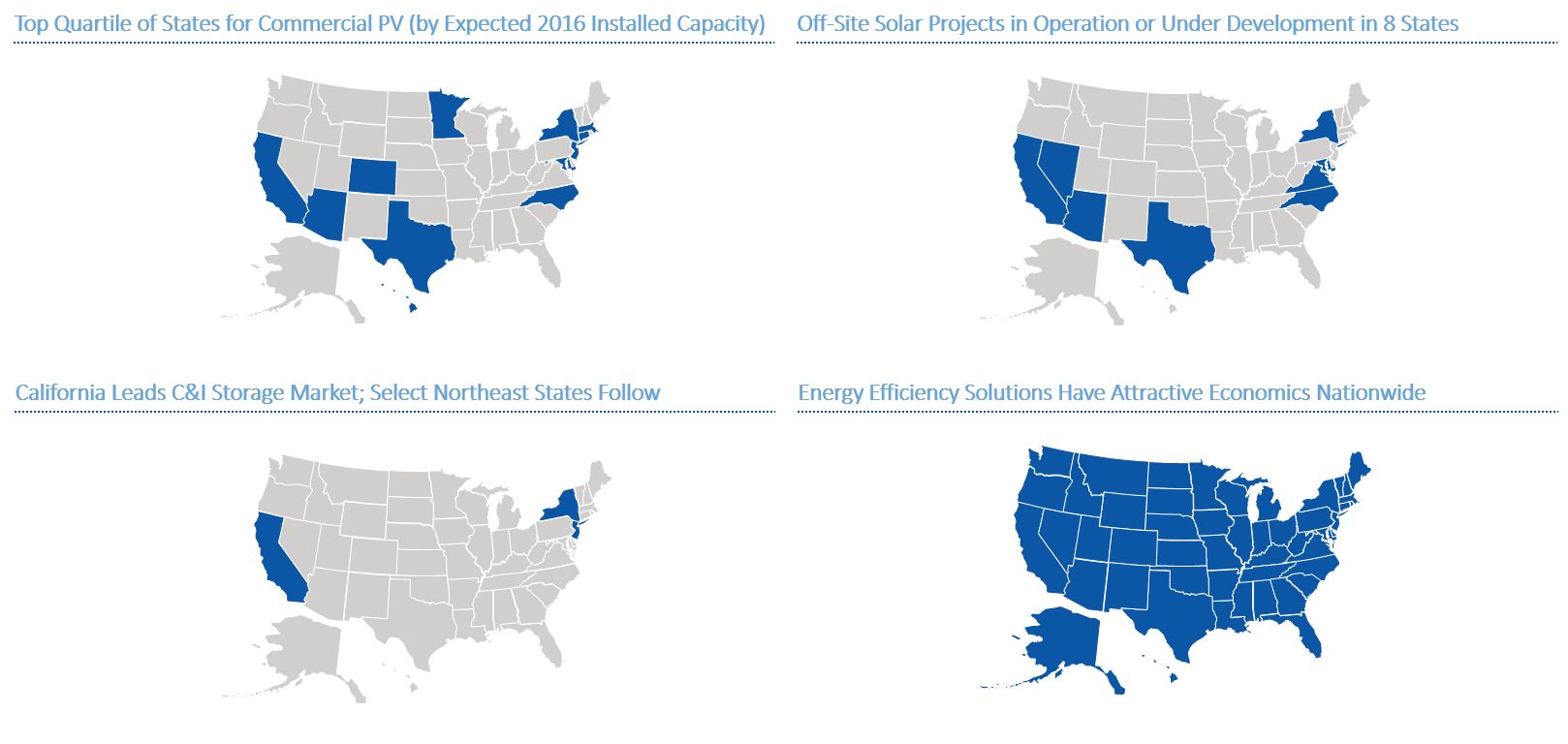

In analyzing the merits of each major market player, GTM Research notes that while utility affiliates may have longstanding relationships in the sector, technology conglomerates have the benefit of being able to execute on agreements with geographic dispersion. Location can be a factor in the U.S. market, where different services can be more or less attractive from state to state. While solar PV and energy storage are financially attractive in a minority of states, energy-efficiency solutions of different makeups can be implemented cost-effectively in every state nationwide. Still, key states stand out as more conducive to the integrated model than others; these include New York, California, Texas and Maryland.

FIGURE: Viability of Individual Energy Management Solutions Varies State by State

Source: The New C&I Energy Management Landscape

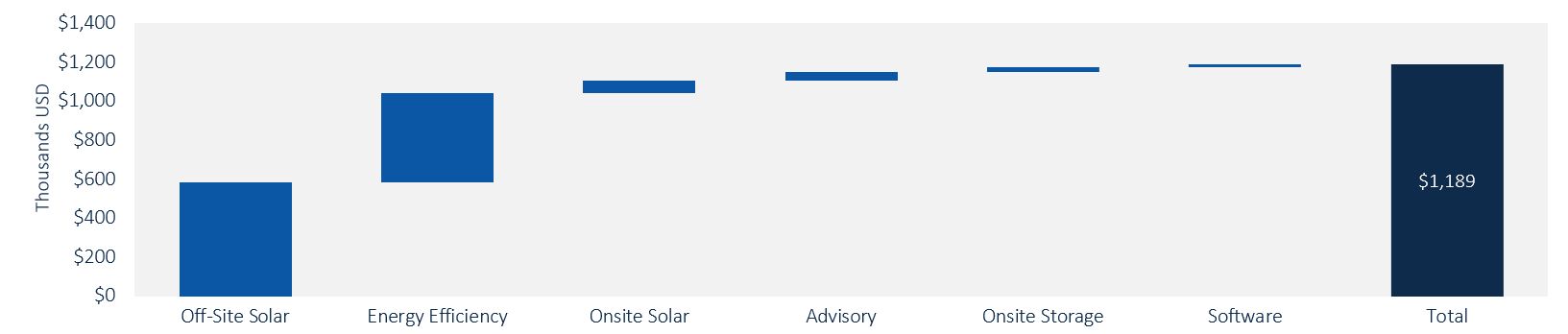

It is clear that vendors are betting on the potential of bundling services. An analysis of market size for each bundled service reveals their relative value. “Off-site solar’s ability to serve a significant portion of a customer’s energy needs makes it a large potential market. But the energy-efficiency market is worth more today due to its maturity and to the wide scope of technologies and services it covers, from lighting retrofits to control system upgrades to boiler replacements,” explained Andrew Mulherkar, grid research analyst and author of the report.

FIGURE: Approximate Contract Value for Illustrative Combination of C&I Energy Management Services

Source: The New C&I Energy Management Landscape

As an emerging market, a fully integrated solution for C&I energy management still has challenges to overcome, particularly in domains such as technology, financing and corporate norms. However, as vendors continue to move toward an advisory-based approach, customers will be able to better assess the suitability of various technologies and techniques against their energy management needs.

Learn more about the report here.