BuildingIQ, the startup that fine-tunes building air conditioning to save energy and meet grid demands, has raised $9 million from venture investors backed by some big companies in the building energy space -- Siemens and Schneider Electric, to be exact. Now the question for the San Mateo, Calif.-funded startup is, how might investment lead to partnerships in the building energy efficiency field?

Tuesday’s funding round adds to the roughly $6 million that BuildingIQ has previously raised from private investors, as well as research funding from the Australian government, where the company got its start in 2009. Investors in the new round include Aster Capital, a firm backed by Schneider Electric, Alstom and Solvay, and the venture capital unit of Siemens Financial Services, as well as venture firm Paladin Capital Group.

Aster Capital's Todd Dauphinais, Paladin Capital's Ken Pentimonti and Siemens Venture Capital's Gerd Goette have also joined BuildingIQ’s board of directors, which already includes former DOE renewable energy financing director and Good Energies managing partner Greg Kats and Exto Partners director Will Deane, as well as CEO Michael Zimmerman.

As for the focus of the new investment, Zimmerman said in a phone interview that it was primarily aimed at two goals: building up the company’s currently “thin on the ground” sales and marketing efforts, and integrating the technology with more partners.

“Our view is very much that, to be successful with the industry, you have to work with the industry,” Zimmerman said. “You can’t try to own every aspect of the building, or every aspect of the customer.”

While Zimmerman didn’t specify which companies he was talking about in the green building space, we have seen at least one high-profile failure from a well-funded startup trying to provide green building materials, software and financing in one shop. That’s Serious Energy, which last year abandoned its software and financing lines to concentrate on materials.

Other “smart building” technology startups, such First Fuel, Retroficiency, Viridity Energy, SCIenergy and SkyFoundry, to name a few, have taken different approaches to the broad problem of building energy efficiency, each with their own mix of partners. But building operators and owners have been slow to adapt the latest technologies -- perhaps because they’re so new that they haven’t had a chance to develop a track record yet.

In that light, strategic investors like Siemens and Schneider could be seen as a vote of confidence from some key players -- as well as a potential sign of interest in acquisition down the road. BuildingIQ has been working with Schneider Electric since March, and while the two haven’t announced any specific projects yet, the investment from Aster was driven by the work the French engineering giant has done with the startup, Zimmerman said.

As for Siemens, the startup has deployed in buildings using the German engineering giant’s building management system (BMS), but hasn’t yet integrated its technology in a comprehensive way -- though he noted that Tuesday’s investment was likely to lead to that kind of work in the future.

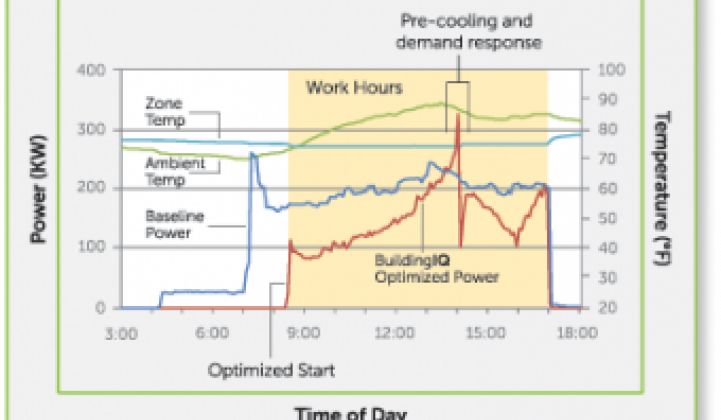

BuildingIQ’s hardware and software system for optimizing building HVAC systems can run on its own, either to serve as an individual building’s energy management system, or to tie multiple properties into a portfolio, he said. But more often, the startup’s technology is integrating with BMS platforms from the likes of Siemens, Schneider Electric, Honeywell and Johnson Controls. The startup claims to provide energy savings of up to 20 percent to 30 percent without sacrificing comfort, targeting efficiency across the board and reducing the amount of power needed for peak demand times.

From its early days testing out its technology in Australian pilot projects, BuildingIQ has been expanding to the United States, albeit slowly. In 2011 it joined up with San Francisco-based energy services company Syserco, and in June 2012 it announced a project with Las Vegas region utility NV Energy to provide energy efficiency and demand response capabilities to big commercial customers.

In November, BuildingIQ announced it was working with Johnson Controls to deliver its functionality via JCI’s new Panoptix cloud platform for building management. It’s a rare example of a building being controlled remotely, and while the two partners haven’t disclosed any projects together, Zimmerman said to expect some news on that front in the coming months.