Eventually, the building will become an IT platform for managing energy a bit like we manage data today. But to get there, you don’t just have to make fans, chillers, lights, backup generators, smart load control circuits and the rest of a building’s hardware smart enough to act as IT assets. A platform -- software that ties these disparate devices into the multiple, overlapping technical and economic models that help humans decide how to manage their building -- is also required.

One example came recently from Blue Pillar, a startup with about $10 million in VC and software and digital controls now optimizing building energy assets for clients like Tenet Healthcare and the U.S. Air Force (PDF). Last week, Blue Pillar launched its “Digital Energy Network” -- essentially, a repackaging of its existing building control system for deployment via the cloud.

Blue Pillar is far from the first company to bring a cloud-computing-based building energy management offering to the market, of course. Over the past few years, most of the big energy services giants have rolled out cloud platforms promising everything from efficiency project management to real-time building energy optimization, with names like Schneider’s StruxureWare, Honeywell’s Attune, Siemens’ Apogee and Johnson Controls’ Panoptix. At the same time, startups like BuildingIQ, Viridity Energy, SCIenergy, SkyFoundry and others are tackling discrete parts of the building energy-IT puzzle.

Each of these contenders is taking a different approach to moving different aspects of building energy management into the cloud. Blue Pillar’s DEN platform, for its part, ties together a bunch of disparate functions across this building endpoint-to-enterprise dashboard nexus in some interesting and noteworthy ways. Here’s a quick look under the hood.

The Building as the Network

Blue Pillar calls its DEN a “turnkey system of subsystems,” a term that’s useful on multiple levels. Let’s tackle the individual building first, where Blue Pillar, founded in 2006, got its start testing generators and other emergency power systems that keep critical medical services up and running during blackouts.

That work quickly led the startup to look at using those backup generators to shave peak loads, serve demand response calls from utilities, and other functions during the time they weren’t needed for emergencies, CEO Kevin Kushman said in an interview last week. Early work with customers like Orlando Health System and Duke University Health System (PDF) saw the startup adding its digital end-point control and networking gear to multiple building circuits and end devices, from HVAC systems to medical oxygen flow control panels.

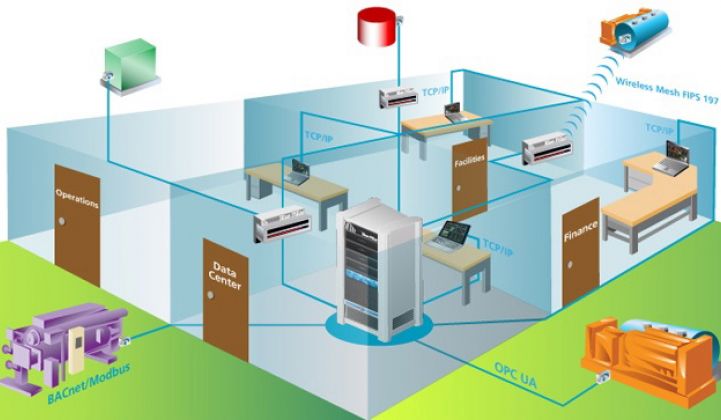

All those disparate devices -- generators, switchgear, automatic transfer switches, fuel systems, cogeneration units, chillers, etc. -- are connected to Blue Pillar’s Asset Interface Microservers (AIMs), boxes that sit within the building and coordinate the platform’s data monitoring and dashboarding functions, as well as automation capabilities.

While some customers just want to track how much energy they were using and make sure critical gear kept running, others are working on optimizing their energy use to meet efficiency goals or cut power bills, Kushman said. So far, the savings and benefits from such projects have paid off in anywhere from a couple of years to as quickly as six months, depending on the individual case, he said.

Kushman sees a potential $1-billion-per-year market for energy efficiency and management in the medical industry alone in the United States. But Blue Pillar is also expanding into other industries, including manufacturing, telecommunications and data centers, including some customers soon to be named in Europe, Kushman said. Another big customer is the U.S. Air Force, which has detailed (PDF) a project with Blue Pillar and big property management firm CBRE to meter and manage power use at MacDill Air Force Base in Florida.

The Property Portfolio as Power Grid Asset

Blue Pillar’s AIM servers don’t just manage the buildings they’re in, of course. They also connect via the internet to Blue Pillar’s cloud-based Enterprise Software -- a system that the startup has more or less rolled out with big customer Tenet Healthcare across sites in Texas, Florida and California, and is now making available to a broader customer base.

Moving to the cloud allows Blue Pillar to handle a multitude of tasks to help customers squeeze more value out of the not-insignificant cost of setting up their buildings for digital energy controls. Take, for instance, Blue Pillar’s asset library, or reference model for the hundreds of different makes and models of building gear found across a typical customer’s real estate portfolio.

Putting that library to work begins at the commissioning stage, when Blue Pillar can send out iPad-equipped engineers to audit a customer’s building and model its energy assets and loads in a matter of hours, compared to days or weeks for the more typical clipboard approach of traditional energy audits, Scott Prince, executive VP of sales and marketing, said last week.

Blue Pillar’s enterprise platform also translates and normalizes data flowing from building networking technologies such as ModBus, BacNet and LonWorks into a single interface -- a web services “handoff” between these various protocols, as Kushman described it. That’s critical for a digital control network that intends to be able to influence power use profiles across multiple building systems, as well as across properties, sometimes in multiple states, in something close to real time.

How are customers using this building-to-portfolio energy control platform? In some cases, customers are bidding into demand response programs, whether traditional day-ahead markets with Mid-Atlantic grid operator PJM, or the faster, 30-minute to 10-minute window programs available to customers in Texas, he said. Others are using Blue Pillar’s control capabilities to limit demand charges, or the penalties utilities apply to customers who exceed a maximum power use limit at any point during the month -- a hefty part of many commercial and industrial power users’ utility bills, Kushman said.

Blue Pillar works with partners such as EnerNOC on enabling demand response for its customers, as well as handing direct control over to those customers who want to work directly with their utility, Kushman said. New technologies to automate and speed up utility-to-customer communications, such as OpenADR, are also on the startup’s roadmap, he said, though he didn’t mention any specific projects using the technology.

Importantly, Blue Pillar is a "closed-loop" system, Kushman said, meaning that the same platform that's commanding building endpoints and systems to do stuff is checking out the energy use and power cost changes that result from those actions. Surprisingly few of today's traditional building management systems meter their own energy use, although commercial/industrial interval meters and new smart meters can provide whole-building power data that's of some use in closing that gap.