Net energy metering (NEM) in California lets businesses offset their on-site load through the same simple, straightforward tariff structure used by homeowners. A recent report from E3 called the NEM Impacts Analysis notes that commercial system interconnections might actually provide a net benefit to ratepayers, allaying utility concerns and protests regarding a supposed "cost shift" caused by NEM programs. In order to promote further growth in the commercial solar sector, new NEM options are being introduced to encourage customers to go solar.

Today, solar is truly cost-effective for many commercial customers with the right rate tariffs, load profiles and installation sites. Yet despite strong economics, thousands of farms, businesses and schools still have yet to unlock the value of onsite renewable energy generation. For example, while California’s farms and ranches generate nearly one-quarter of all on-farm clean power in the U.S., less than 8 percent of the state’s agricultural operations have invested in solar and other renewables. This demonstrates significant untapped potential, which could be stimulated by a robust NEM program that better serves commercial generators.

For California’s farms, in particular, solar can play an important role. The ongoing drought, which forces farmers to get their water from energy-intensive groundwater pumping, has caused energy costs to skyrocket. A recent UC Davis report estimated that farmers in the Sacramento/San Joaquin Delta will pay an aggregate total of nearly $500 million due to increased groundwater pumping. Solar has already helped alleviate these costs for hundreds of farms. It could play an even greater role in making California’s farms more resilient in the face of a drought.

So what is needed to encourage commercial solar growth in California? As the future of NEM in California is debated at the state’s Public Utilities Commission, let’s look at the opportunities available to encourage commercial-sector renewables growth.

Obstacles to growth

California’s slowly evolving NEM regulations have occasionally thrown up roadblocks to solar growth, with many of them landing squarely in the path of potential commercial sector customer-generators.

For example, regulations originally confined the net metering incentive to the meter connected to the solar installation. This system worked well for homes and small businesses, which generally have just one meter through which total energy usage and production can be netted.

But businesses with multiple meters were left out in the cold. Farmers and ranchers, for instance, can have dozens of meters spread across acres of property to serve irrigation pumps and storage sheds far from any centralized location. Industrial facilities often have separate meters installed for each building across a complex. Regulations required a separate set of panels to serve the load on each of these separate meters, which is clearly an overly complex and uneconomical solution.

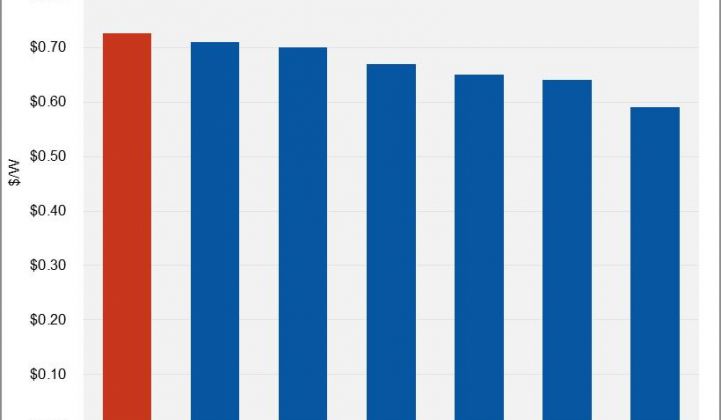

Another barrier for commercial customers has been demand charges, which do not apply to residential systems, but can make up at least 30 percent to more than 50 percent of a commercial customer’s monthly bill. Even with a renewable energy installation that offsets all on-site energy usage, it is difficult to predict a reduction in demand charges, because demand could spike when the system has no energy output -- for example, in the evenings or when the sun isn’t shining. For agricultural operations with irregular pumping patterns or machinery needs, a single instance of high electricity demand can spike demand charges for the whole month’s bill. Meanwhile, utilities continue to steadily increase demand charge rates. These charges for California’s three largest utilities have risen 30 percent in the past three years alone.

Fortunately, many solar customers have learned they can match their peak demand to the times when their solar system is producing energy. This can reduce their demand charges significantly, yielding substantial savings beyond the reduction in energy charges. Without a way to value the peak capacity of a solar project and apply that to customer demand charges, this value is often not part of a commercial solar project’s financial projection.

Net metering regulations have also historically provided a disincentive to installing larger commercial projects, even though these larger installations are known to provide greater benefits to ratepayers. E3’s report NEM Impacts Analysis states, “NEM customers as a group pay their cost of service. This aggregate result is driven by a minority of large, non-residential NEM customers who significantly overpay their cost of service.”

Residential financing has exploded because the FICO score is a standard way to evaluate the risk that someone will stop paying their solar bill in the future. But because there is no commercial equivalent to the FICO score, every project must be individually evaluated for credit concerns, adding costs and time to the financing process. As NEM does not fairly compensate a system owner for backfeeding onto the grid, the projects are only evaluated on the basis of the host’s ability to pay their solar electric bill, and thus they require this credit evaluation process. If electricity tariffs accurately reflected the value of solar electricity produced by a system, there would be no need for this credit evaluation, because a system financier could be sure that they are still receiving value from producing the energy, even in a situation where the onsite customer no longer uses the solar energy.

Meter aggregation progress

In 2012, the California Legislature passed SB 594 (Wolk), which addresses some of the problems faced by multiple-metered properties using NEM. The Net Energy Metering Aggregation (NEMA) option created by this bill allows property owners to aggregate the electricity load of multiple meters on a single or multiple parcels of land, and then credit the bills with kilowatt-hour production from a single net-metered installation.

NEMA thereby reduces the costs of installation and interconnection by removing financial and technical barriers for customers with multiple meters. This new option has been particularly attractive to farmers, whom it allows to optimally site the renewable energy system, instead of having to co-locate it with the meter that takes the most load. NEMA also incentivizes the installation of larger systems, as it increases the amount of load that can be offset to include all electricity consumption within a facility or farm, not just the consumption on a single meter.

The NEMA legislation was passed with strong support from a large group of agricultural and solar advocates. But even putting this common-sense measure in place was not an easy task, requiring a significant investment of time and resources against stiff utility opposition and a protracted regulatory process.

Even now, a full twenty months after the passage of SB 594, NEMA is only available in PG&E territory. Southern California Edison and San Diego Gas & Electric are expected to roll it out by the end of July 2014.

NEMA was a step forward, but it hasn’t eliminated several of the hurdles to widespread commercial growth. Solar projects for commercial customers are still great investments for specific customer types, particularly those whose rate tariff, load profile, and installation site make solar a cost-effective way to reduce electricity bills and achieve desirable payback periods and investment returns. However, there are several policy mechanisms that will need further evaluation if commercial solar is to become fully capable of reaching beyond a few customer types and market segments.

Achieving commercial sector growth: How to get there

Last fall, the legislature passed AB 327, which tasks the CPUC with developing a successor tariff to NEM that accounts for the total costs and benefits of net metering. This successor tariff or contract, dubbed "NEM 2.0," will go into effect on July 1, 2017, or when 5% of aggregate peak load in each of the major utility service areas is produced by renewables.

This is an opportunity to address the obstacles to commercial NEM growth we have already discussed, in order to better encourage investment from farms, businesses, schools, and other commercial facilities in building California’s renewable energy future.

The CPUC has issued guidelines that govern the development of the successor tariff, which show progress toward a system that works for commercial customer-generators in addition to residential. But in order to fully unleash the potential of this market and ensure that it keeps growing, NEM 2.0 must achieve the following outcomes:

- Expand and improve upon NEM aggregation. Multi-metered properties with higher onsite load are excellent candidates for renewable installations. But confusing and arbitrary rules and regulations should not limit the ability to install the optimal system. Further, NEMA should be adopted by all California utilities, not just the IOUs.

- Rethink demand charges and other fees. Standby fees and departing load charges should be re-evaluated to make sure they are in proportion to the actual costs of grid services. Demand charges should be similarly examined. Fees and charges should be adjusted to bring total costs in line with total benefits.

- Evaluate the benefits of larger systems. Large commercial installations, sized appropriately to load, can improve the grid and help the state attain aggressive greenhouse gas reduction and renewable energy goals. California should evaluate the benefits and impact to the grid from deployment of larger systems.

- Long-term certainty is key. A commercial solar system is a long-term investment. Better assurances of equitable terms and protection from unfair tariff changes, charge increases, and added fees are needed to provide certainty.

- Provide solar financiers with more predictability. Defining standards for commercial financing will be key to reducing the time and hassle involved with assembling commercial financing packages. One option to help mitigate the need for credit reviews is to accurately value the energy produced by a system, regardless of customer use. The current “Net Surplus Compensation” mechanism needs an upgrade, and a fair value will help finance providers approve projects that may otherwise not fulfill their credit requirements.

With incredible and accelerating growth in solar installations coming alongside an overhaul of California’s net metering regulations, we are entering a new era of renewables development in the state. There are currently plenty of commercial customers who can invest in solar today and enjoy substantial savings and great economic benefits. However, we must structure NEM 2.0 to encourage participation by all commercial sector customers and demonstrate that California is truly a leader in deploying solar technology.

***

Adam Kotin is a Policy Associate at California Climate & Agriculture Network. Ben Peters is Director of Solar Finance & Policy at REC Solar.