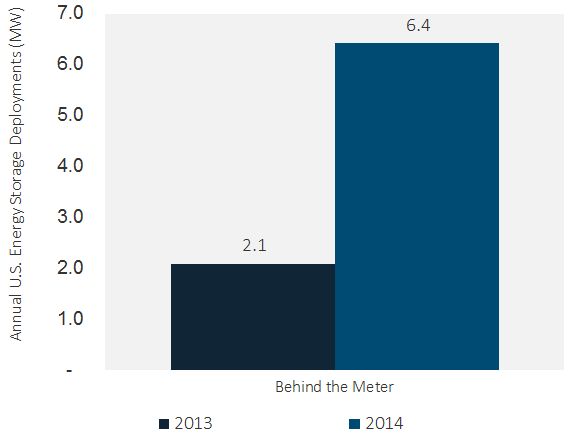

2014 was the biggest year for behind-the-meter (also known as customer-sited) energy storage deployments, according to the inaugural GTM Research and Energy Storage Association U.S. Energy Storage Monitor report. Behind-the-meter deployments increased more than three times, rising from 2.1 megawatts in 2013 to 6.4 megawatts in 2014.

FIGURE: Behind-the-Meter Energy Storage Deployments, 2013 Versus 2014

Source: GTM Research/ESA U.S. Energy Storage Monitor report

The non-residential segment accounted for most of the behind-the-meter deployments.

Non-residential customers typically pay a big portion of their electricity bills in demand charges (charges based on peak electricity consumption in a billing cycle).

Energy storage can produce bill savings through peak demand reduction. The resulting economics have started to pencil out for a sizeable portion of the non-residential electricity customer base in markets with high retail tariffs.

California has led the growth in behind-the-meter markets; 5.7 megawatts of energy storage were deployed in the state in 2014 (88 percent U.S. market share). California has one of the highest electricity tariffs in the mainland U.S., and another big driver for economic returns in the state has been the Self-Generation Incentive Program (SGIP), which can provide up to 60 percent of total project costs for eligible storage systems or a maximum of $1.46 per watt of installed capacity. The program is one of the biggest policy pushes for behind-the-meter energy storage deployments in the country.

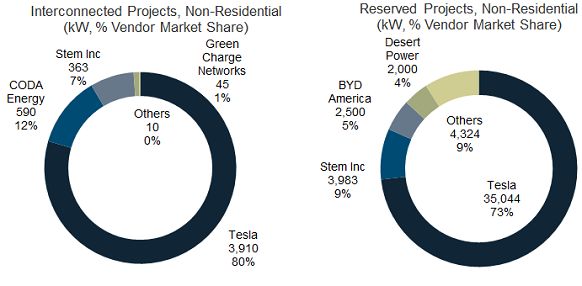

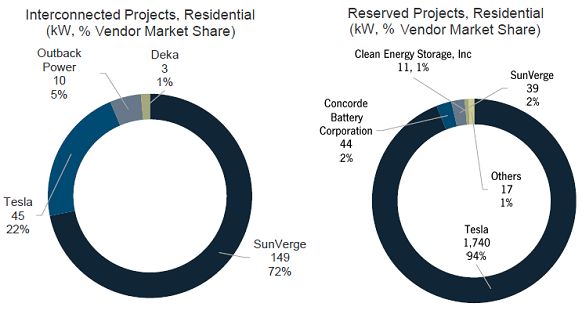

Tesla has, by far, the largest share of interconnected energy storage deployments through SGIP. In the non-residential segment, of the 4.9 megawatts and 45 projects interconnected under the SGIP regime, 3.9 megawatts and 20 projects were from Tesla; in the residential segment, Tesla has a smaller share, with 45 kilowatts out of a total 207 kilowatts.

What is more staggering is the massive pipeline of Tesla’s approved projects under SGIP -- which stands at 35 megawatts non-residential and 1.7 megawatts residential (39 megawatts non-residential and 2.1 megawatts residential if we include projects that are still pending reservation).

FIGURE: Non-Residential Projects Under SGIP

Source: GTM Research/ESA U.S. Energy Storage Monitor report

FIGURE: Residential Projects Under SGIP

Source: GTM Research/ESA U.S. Energy Storage Monitor report

Tesla is not the only company making big news in the rapidly evolving energy storage market. SunEdison announced the acquisition of Solar Grid Storage, and both Stem and Advanced Microgrid Solutions won awards for deploying energy storage to meet Southern California Edison’s Local Capacity Requirements (LCR).

Where is the U.S. behind-the-meter market headed?

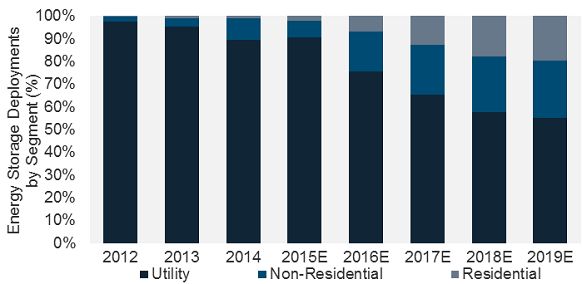

Behind-the-meter deployments accounted for 10 percent of total 2014 deployments, but we expect this segment to grow faster than front-of-the-meter storage, growing sixty-fold from 2014 to 2019, making up 45 percent of the overall 2019 market.

FIGURE: Market Share by Segment, 2012-2019E

Source: GTM Research/ESA U.S. Energy Storage Monitor report

While demand charge reduction has developed into a bread-and-butter use case for commercial customers, the behind-the-meter market is on the verge of faster growth as a result of its ability to provide different grid services for utilities and system operators.

Southern California Edison’s LCR procurement is the largest procurement of behind-the-meter storage for utility needs. Other markets are actively pursuing storage to meet their demand needs, enable renewable integration on the grid, provide distribution deferral, and fulfill resiliency needs. The Brattle Group released a study conducted for Oncor which concluded that up to 5 gigawatts of distributed storage (much of which could be behind-the-meter) can be economical on the Texas grid by providing reliability and wholesale market needs if storage costs fall to $350 per kilowatt-hour by 2020. Arizona utilities have proposed procuring energy storage, coupled with solar, as a means to facilitate more distributed energy resources on the grid.

So while Tesla has been successful in gaining market share in California, the future of energy storage in the U.S. promises to be more diverse in terms of markets and applications, triggering the growth of existing suppliers and the emergence of new players.

***

About the U.S. Energy Storage Monitor

Delivered quarterly, the U.S. Energy Storage Monitor report is the industry’s only comprehensive research on energy storage markets, deployments, policies and financing in the U.S. These in-depth reports provide energy industry professionals, policymakers, government agencies and financiers with consistent, actionable insight into the burgeoning U.S. energy storage market. Learn more at www.energystoragemonitor.com.