To date, the short history of behind-the-meter energy storage systems for commercial buildings has been one of brand names and wraparound services. Startups like Stem, Green Charge Networks and Coda Energy, and of course, Tesla and sister company SolarCity have put together battery and power electronics packages, control hardware and software, financing and performance guarantees, and other aspects of the business under one roof -- and there's no real way for customers to mix and match different pieces of those offerings from different vendors.

That’s a logical way to bring a novel energy technology to market. But eventually, one could imagine behind-the-meter battery systems becoming just another piece of a broader building product portfolio -- albeit one that requires plenty of behind-the-scenes support for the contractors or energy services companies installing and maintaining them for their customers.

Last week, U.S. electrical equipment distributor Gexpro launched a new integrated battery product aimed at taking on this role. It’s a first-of-its-kind approach to bundling batteries, power converters and software for wholesale distribution -- and it’s a potentially important breakout deal for Growing Energy Labs Inc. (Geli), the San Francisco-based startup that’s providing the software to make it all run.

Gexpro, the former GE Supply distribution business bought by French electronics wholesale giant Rexel in 2006, is bundling lithium-ion batteries from South Korea’s LG Chem and bidirectional inverters from Texas-based Ideal Power in its new battery energy storage solution (BESS). Its first product, a 30-kilowatt, 40 kilowatt-hour unit designed for commercial building demand charge reduction, is expected to be available for purchase and/or lease later this year, with California as its initial target market, Mike Seavey, national solar product manager for Gexpro, said in an interview last week.

“We’re calling on and representing all the major commercial contractors in the state of California -- that is our bread and butter, that’s our customer base,” he said. “So it made perfect sense for us to offer them a product. But we can’t just offer them a battery and an inverter. We have to offer them a solution.”

That’s where Geli steps in. As an energy storage management software vendor, it has provided on-site control hardware and a cloud-based management platform to projects including battery startup Aquion’s first commercial-scale project, Coda Energy’s electric-vehicle-plus-solar-panel battery project in Benicia, Calif., two California Energy Commission-funded microgrid projects, and most recently, Bright Power’s microgrid project in New York City, which combined solar PV, battery storage, and combined heat and power.

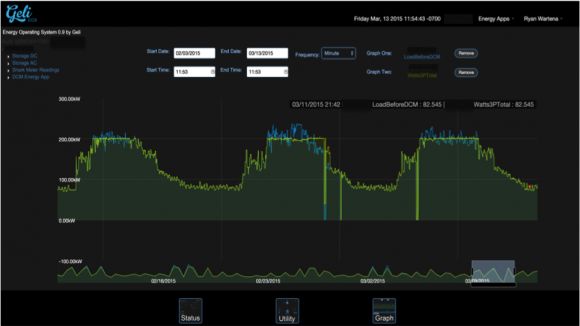

“I want thousands of little businesses popping up to own and operate, essentially, micro-utilities, with energy storage systems,” Geli CEO Ryan Wartena said in an interview last week. “Backing into that is a lot of data analysis. We right now have analyzed over 300 different facilities for demand-charge management, microgrid, and storage with solar, and with load control aspects as well.”

“That analysis is the basis of what’s used for financing,” he said. “We go ahead and make models for performance, financials, and health of the system -- and we’re able to fit those models directly into our energy control software. And we run a service, as part of our annual maintenance, of what’s essentially back-end validation.”

“That’s one of the big bottlenecks for financing energy storage systems,” Wartena added. As a former battery researcher at the Naval Research Lab and MIT, he’s familiar with how closely batteries’ effective life spans are linked to how deeply they’re discharged and recharged, how quickly and how often they’re required to undergo these cycles, and how often they’re allowed to rest in optimal states. Knowing what any battery system will be asked to do in each setting -- and managing the other energy loads in the system the battery is part of -- is an important part of planning out a cost-effective battery strategy, he said.

This is the same kind of lifecycle analysis that software vendors like Greensmith and Younicos perform for utility-scale energy storage projects. It’s also an important part of how behind-the-meter storage vendors like Stem and Green Charge Networks prove to their customers -- and financing partners -- that their installations are performing as expected, while avoiding the kind of improper use that would shorten their money-making lifespan. Any company trying to turn battery systems into products for others to use, as Gexpro is doing, will have to take on this challenge.

“The Geli system will be monitoring these systems, and then we’re working on programs for maintenance of the systems in the field, and also service processes,” Seavey said. “The beauty of the Geli system is, if there is a problem with the system, Geli’s going to know about it probably before the end user will know about it,” since it’s being monitored both on site and in the cloud at second-by-second intervals.

That’s important for batteries that inject power into buildings to help them avoid peaks in power usage, which trigger demand charges that can add up to half or more of utility bills in certain markets like California and New York. “We have to make sure this system is on-line 100 percent of the time, because we could miss that window,” he said.

Beyond demand charges, the Geli platform can also integrate into a building automation system, or link multiple buildings in a customer’s property portfolio in order to aggregate sites as demand response or grid services assets, Seavey said. That’s a valuable extension of the energy services work that’s already a big part of Gexpro’s business, he said.

“We work with our contractors and our partners to get to net-zero energy. We can do energy through lighting, through controls, through motors. [...] Solar is a big piece to what we do already. Storage is kind of the last piece of that puzzle.”

Wartena noted that Geli’s software is also being linked with solar systems at several existing projects. Others in New York and California are using the startup’s software to manage on-site power generation and consumption in ways that could allow utilities to avoid investments in grid infrastructure -- an important part of new regulatory frameworks being developed in both states.

Of course, these are all future business cases. Gexpro’s BESS systems will have to gain the confidence of installers and contractor partners in the initial demand-charge management business model first. Wartena said that Geli is already working with California contractors including Bass Electric, Rosendin Electric and Pacific Data Electric, and has tested the Gexpro/Ideal Power/LG Chem storage system in commercial and industrial facilities in California.