The Fresnel reflector is going to take another crack at "crossing the chasm."

CLFR, which stands for Compact Linear Fresnel Reflector, is a concentrated solar thermal technology that proponents claim can generate 1.5 times to 3 times as much power from a square mile of desert versus power towers, trough systems, or arrays of thin-film photovoltaic panels, in part because of its unusual design.

The components and engineering behind the very modular CLFR have rapidly been improving as well, adds Bill Conlon, the vice president of engineering for AREVA Solar, the solar division of the French power giant that got into solar in February by buying CLFR champion Ausra.

The fourth line in construction at the company's Kimberlina facility near Bakersfield, California, for instance, will sport 13 reflective panels covering over 121,000 square feet, which represents a thirty percent increase over the previous 10-reflector (93,000 sq. ft.) system. But the new system will only require four structural piers per row rather than seven, potentially reducing cost and construction time.

"We can achieve economy of scale and economy of volume" as part of AREVA, Conlon said. "We can also innovate far more effectively," because the acquisition gives the solar group direct access to a worldwide network of metallurgists, heat transfer experts, control engineers and others.

Bankers should be far more comfortable after the merger, too. AREVA is 79%-owned by France.

In addition to solar power plants, CLFR modules can generate steam for use in oil fields or serve to boost the performance at coal and natural gas power plants. AREVA Solar estimates that 60 to 100 existing fossil plants in the U.S. could accommodate AREVA CLFR projects, adding up to 2 gigawatts of power to the U.S. grid.

What could go wrong? In solar thermal, the only answer to that question is "almost everything." The immense size of solar thermal plants -- most proposed commercial plants measure a few hundred megawatts -- combined with fact that they often must sit near environmentally sensitive tracts of land, make them regulatory and financial high-wire acts.

To top it off, AREVA's technology is something of the odd man out. To date, the thermal industry has been dominated by manufacturers of systems dependent on curved parabolic mirrors. AREVA Solar's mirrors employs standard glass (minimally curved during manufacturing) to focus solar heat onto water-filled tubes sixty feet up where the water is turned to steam, which is then used to turn a turbine and generate electricity.

The heliostat/power tower systems and parabolic dish/Stirling engine systems touted by BrightSource Energy and Stirling Energy System are relative newcomers too, but have put together a much larger pipeline of announced projects (over 4,000 MW combined vs. 144 MW for AREVA Solar). Of course, an announced pipeline isn't a guarantee that the projects will be built (for more on this topic, see the article on the CSP Summit recap). AREVA Solar would have a larger pipeline, but the 177-megawatt plant Ausra planned to build in California got sold to First Solar: it is now a potential PV project. AREVA Solar stressed that the sale was part of a strategic shift.

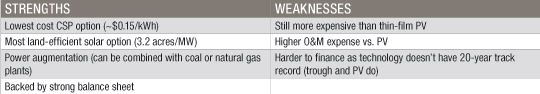

Strengths & Weaknesses

Here's a rundown of some facts and figures from Conlon and others on AREVA's system:

--50x concentration

--Heat transfer fluid: water/steam

--Can be wet or dry cooled

--Temperature: Up to 400°C now / Up to 482°C available in 2011

--Capacity factor: ~27%

--Solar-to-electricity efficiency: ~12% (GTM estimate, not confirmed by AREVA)

--Capital cost: <$3.00/W

--Modular technology allows for smaller-scale equipment sales at existing power plants

AREVA claims to have the "lowest cost and most land-efficient CSP technology," so shouldn't developers like NRG and NextEra be falling over themselves to purchase this equipment, and be rolling it out all over the deserts of the southwest? For whatever reason, this has not been the case thus far. Currently there are only two new projects using AREVA Solar's technology, and both are outside the U.S. (Kogan Creek in Australia and JOAN1 in Jordan).

Technology-agnostic developers are moving forward with CSP options; NRG is developing a project using eSolar's Power Tower technology, and NextEra is developing parabolic trough projects. In the past, there were three main reasons that may have prevented developers from selecting AREVA Solar's platform.

What's new at AREVA Solar that might help to address these issues?

1. Performance guarantees are much stronger with AREVA behind them

The recent AREVA acquisition of Ausra has made the case for using their CLFR technology much stronger from a developer's perspective. As part of the AREVA family, the old Ausra can now offer turnkey solar plants - leveraging AREVA's power block and EPC capabilities. More importantly, the performance guarantee that AREVA offers has real meaning, as AREVA is a multi-billion dollar, A-rated industrial giant, whereas standalone Ausra was just a startup with some venture money. In addition, AREVA can offer a wrap guarantee on the full project. So if a problem arises, the developer can look to just one player. This is a big plus, as the alternative would have all the parties involved pointing the finger at someone else, leaving the developer exposed to substantially more risk.

2. Track record

Lack of a 20-year track record remains an issue for CLFR. Would investment banks be comfortable loaning hundreds of millions of dollars to the first-ever large-scale CLFR plant? Maybe -- but if there are other, safer projects out there, they would probably fund those first.

3. Returns for project investors are higher now that AREVA Solar has lowered its cost/kWh

Another hurdle is providing sufficient returns for the project investor. Capital costs for the old Ausra solution were over $3.00/W, which may not have left enough on the table to attract a project equity investor (who may require nine percent to 11 percent unlevered returns).

Superheated steam = lower cost/kWh

In addition to its solar/coal-fired power augmentation facility in Australia, Areva has three complete prototype modules at Kimberlina and a fourth on the way. The first two rely on a circulating water system. That is, some of the water turns to steam, but the rest circulates. SSG3 was the company's first to achieve "once-through" performance for water to steam, which increases efficiency.

With number three, the company actually lowered the pressure from 1335 psia to 1010 psia, but achieved higher internal temperatures. In the end, both methods result in equal performance: 19.2 million BTUs per hour.

With the upcoming Solar Steam Generator line, the pressure will increase to 1535 psia and AREVA will run the system closer to 482°C. The higher pressures and temperatures, combined with the increase in reflectors, will boost output to 25 million BTUs per hour, a 30% increase on a platform that has some construction advantages over the previous one. This higher-temperature line should be operational in Bakersfield by this fall.

The combined effect of higher thermal output and lower construction costs should yield an installed cost below $3.00/W, and a levelized cost of electricity (LCOE) approaching ~$0.15/kWh. Perhaps this could change the math to make AREVA Solar projects more attractive to project investors -- and get developers to select AREVA over the alternatives.

Could this prove to be a turning point for AREVA Solar? Only time will tell.