For the better part of the past two years, the phrase “capacity expansion” in the PV manufacturing industry had been about as fashionable as a Nickelback t-shirt at an indie rock concert. That is, until recently.

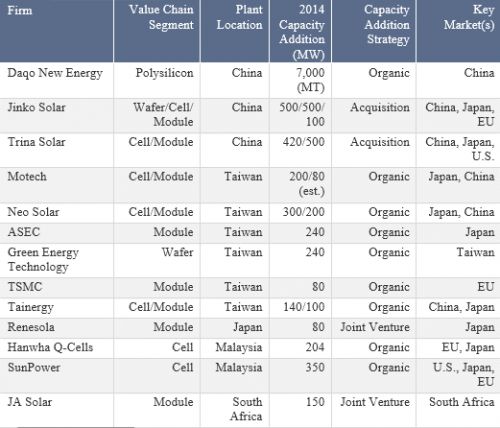

After a prolonged dry period, the past quarter has witnessed a spate of announcements by firms across the PV value chain for capacity additions in 2014, as shown in the table below.

It is worth noting that this is not a comprehensive list of 2014 capacity additions, just recently announced ones, and so it excludes most new polysilicon additions. Lead times for polysilicon plants are long, and almost all of the new capacity coming on-line in 2014 was announced more than a year ago.

Source: GTM Research Global PV Competitive Intelligence Tracker

In looking at the table above, one is reminded that most, if not all, PV manufacturers have only been back in the black for a couple of quarters; it was only a year ago that the PV manufacturing sector seemed firmly entrenched within the throes of overcapacity.

How, then, is one to interpret these announcements? Do they reflect irrational exuberance on the part of a few overly aggressive suppliers due to a recent period of stable pricing? Or do they signal that an inflection point has been reached in PV supply-demand balance, and that other well-positioned suppliers will follow the trend set by these early movers?

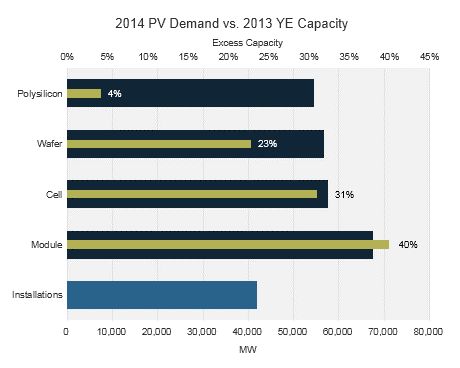

The chart below attempts to answer this question by comparing installed manufacturing capacity at the end of 2013 to expected PV demand in 2014, which, in terms of installations, GTM Research estimates at almost 42 gigawatts. Accounting for inventory effects across the PV value chain, we see that supply in terms of available capacity exceeds demand in 2014 by 16 percent for polysilicon, 20 percent for wafers, 19 percent for cells and 40 percent for modules.

One would be tempted to conclude from this that even with strong end-market growth of more than 20 percent expected in 2014, the PV market would still be oversupplied and new capacity additions in 2014 would be unwarranted.

Source: GTM Research Global PV Competitive Intelligence Tracker

How Much Capacity Is Too Much?

But supply simply being in excess of demand is hardly an accurate criterion for defining overcapacity. The question is, how much is too much?

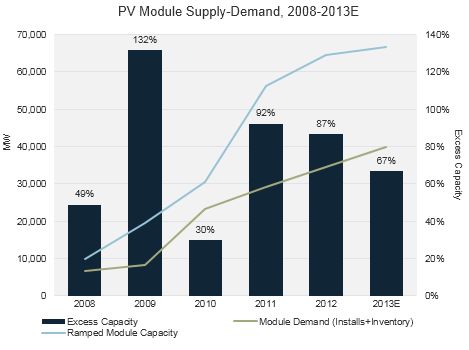

As with anything else involving data, the numbers themselves are useless without the context to correctly interpret them. Here, history can be our guide: as the chart below shows, even in relatively “tight” years such as 2010 when pricing was up and supply constraints limited installations, ramped module capacity exceeded end demand by as much as 30 percent.

Source: GTM Research Global PV Competitive Intelligence Tracker

How is possible that even with excess available supply of almost one-third, a market can still be balanced? There are multiple reasons for this.

Supply shortages for input materials like polysilicon can limit effective capacity levels, as was the case in 2010. Nameplate capacity is not always fully available due to downtime or labor shortages. Companies often over-report capacity figures (sometimes by orders of magnitude) to boost their profile. And during prolonged periods of overcapacity or price troughs, manufacturing lines can be idled and plants can be mothballed, as was the case for much of the past two years.

Our estimates show about 14.1 gigawatts of ramped module capacity were not active in 2013 -- much of it not competitive in an environment of $0.60 per watt average selling price. This explains why module pricing over the course of 2013 was stable-to-up for the most part despite module capacity exceeding demand by 67 percent.

Where and How Will New Capacity Be Added?

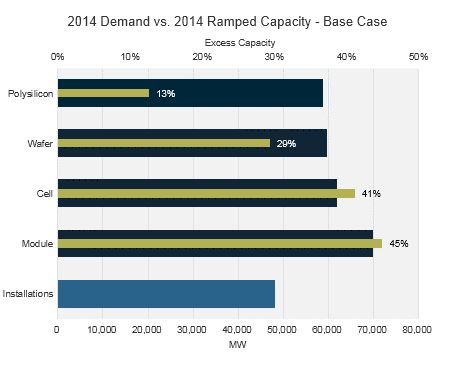

Equipped with a rough guideline that excess capacity of under 30 percent represents a supply-constrained market, we can now begin to understand the case for capacity expansions in 2014, at least for well-positioned, cost-competitive firms. Assuming, then, that capacity additions become an industry trend in 2014, we can factor in expansions for other well-positioned suppliers over and above the announcements that have been made so far. To do so, some educated guessing must be involved, since whether a given firm decides to add capacity depends on a variety of hard and soft factors, including its competitive positioning, the availability of capital for expansion, and its confidence in future market conditions.

Due to the Chinese Ministry of Industry and Information’s restrictions on “pure” PV capacity expansion projects, capacity additions in China are likely to stem from acquisitions of smaller, weaker firms by established top-tier suppliers, something we have already seen with Jinko’s acquisition of Topoint and Trina’s ownership of NESL Solartech. While such acquisitive expansions will not technically add to the bottom-line supply figure, they will transform previously inactive capacity to active capacity.

Producers in other PV manufacturing regions, such as Taiwan, Malaysia and Japan, are likely to do so with new equipment purchases or even greenfield projects. And finally, larger incumbents are also likely to establish small greenfield plants in key demand markets in the form of joint ventures with local partners, as we have seen with ReneSola in Japan and JA Solar in South Africa.

2014 Supply-Demand: The Base Case

After having accounted for likely expansions in 2014, a clearer picture of supply-demand for 2014 emerges, as shown in the chart below, where additional supply comes on-line to meet expectations of strong demand growth. Under this scenario, available supply for wafers, cells and module exceeds demand by 30 percent to 45 percent, implying a stable and balanced market. It is only in the case of polysilicon, where excess supply is just 13 percent, that we appear to be headed for a real supply shortage: this is the driving factor behind GTM’s previously expressed view that polysilicon pricing will climb back to levels of $25 per kilogram by the end of the year.

Source: GTM Research Global PV Competitive Intelligence Tracker

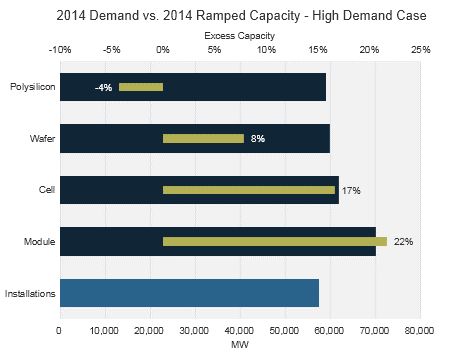

2014 Supply-Demand: The High Case

Before rushing to conclusions, it is worth remembering a final point. Much of the analysis above ultimately comes down to our 2014 end-demand estimate of 42 gigawatts. But time and time again, early-year PV market sizing forecasts have proven to be conservative in the final analysis.

As with previous years, the forecast risk for 2014 seems to lie very much on the upside, with GTM’s high-case installation estimate for 2014 in the neighborhood of 50 gigawatts. In this case, the market would be grossly undersupplied, and significantly more manufacturing capacity than we currently forecast would have to be added to meet demand. Given China’s new PV regulations, still-prevailing constraints on capital spending and equipment lead times, it is unclear if suppliers would be able to react in time to meet such an upswing in demand, especially in the case of polysilicon.

Source: GTM Research Global PV Competitive Intelligence Tracker

In conclusion, there are definite signs that at long last, balance between supply and demand in the PV market has not just been restored, but is beginning to trend in the opposite direction from the past few years -- with the very real possibility of a supply shortage in the offing. Once again, it is a reminder that when it comes to the PV market, the winds of change can blow very quickly.

***

Shyam Mehta is Lead Upstream Analyst at GTM Research and author of the recently published report Global PV Pricing Outlook 2014. Join Shyam and other indutsty leaders at the upcoming Solar Summit in Phoenix.