If you are a decision-maker in the power sector, you have probably been grappling with a variety of perspectives on the disruption of the regulated utility business model. Undeniably, the convergence of innovations such as distributed energy resources, demand-side management and information technology has introduced a pace of change recently unimaginable in this historically slow-moving industry.

Looking beyond alarmist predictions and controversial debates, utilities are beginning to grasp the enormous value-creation potential of these changes. As power sector leaders work to overcome daunting challenges such as bureaucratic cultures, perverse regulatory incentives and the fear of self-cannibalization, we need an actionable roadmap for self-disruption. As a starting point, the utility industry needs a positive example to illustrate the process of disruption management.

A case study of successful self-disruption

The case study of IBM provides utility leaders with some actionable disruption management lessons. Up through the 1970s, IBM focused on mainframe computers and dominated the industry through vertical integration -- the company’s 70 percent market share was such that people talked about “IBM and the seven dwarves.” With the introduction of personal computers, IBM found that its business model had lost its advantage in this rapidly evolving industry. In 1993, IBM announced record losses of $8 billion and laid off 250,000 employees. Rather than remaining a latecomer in PCs, however, IBM pioneered the internet revolution and transformed itself into an integrated services company.

The transformation of IBM began in 1995 with a leap of faith into the internet era. Leveraging an internal grassroots movement, IBM coined the term “e-business” and communicated a wakeup call to Wall Street. This initial success was only the warm-up round. In a move that caused deep controversy within the company, IBM acquired PwC Consulting in 2002 for $3.5 billion. With a new integrated service model, the company repositioned itself to tackle tough business problems without forcing its customers to deal with a variety of vendors. These fundamental strategic shifts also had the beneficial effects of reforming IBM’s stiff culture and attracting new talent.

When cloud computing promised to revolutionize IT in unprecedented ways, IBM was ready to seize the opportunity with full force. In 2007, IBM made its first foray into cloud computing with “private cloud” solutions that leveraged the company’s capabilities to combine hardware, software, and advisory services. Grasping the magnitude of the cloud computing opportunity, IBM once again repositioned itself -- this time as the provider of a “smarter planet.” Facing tough competition from Amazon Web Services and other disruptive companies, IBM continues to innovate with internal projects such as the Watson supercomputer, partnerships such as IBM+Apple, and acquisitions such as SoftLayer.

Managing disruption with new capabilities

As evidenced by the experiences of IBM and others, the key to effective disruption management boils down to the development of new capabilities. According to Clay Christensen’s research, organizational capabilities can be defined as resources, processes, and priorities (RPPs):

- Resources are things that can be bought, sold, hired, fired, leased, or built

- Processes are patterns of interaction, communication, and decision-making

- Priorities are constraints such as profit models, value propositions, and culture

Based on this broad definition, organizational capabilities can refer to human capital, technologies, company policies and much more. In the face of disruption, the same capabilities that previously propelled an organization to succeed can become disabilities that constrain critical sources of new growth. Understanding an organization’s capabilities relative to the evolving business environment is an important first step in disruption management.

The development of new capabilities is a process that is still in its infancy for the utility industry. Most senior utility executives I have advised recognize that addressing the challenges of strategic leadership and organizational change is easier said than done. Fortunately, new capability development has been completed successfully in a range of industries. Combining those examples with management science, we can develop a “disruption management toolkit” for the power industry.

Tool #1: Managerial ambidexterity

In the face of disruption, organizations need to reconfigure themselves to match the changing environment. "Ambidexterity" is the ability to develop new capabilities while sustaining core businesses. Because disrupted companies often perform well financially until it is suddenly too late, ambidexterity can be neglected when it is needed most.

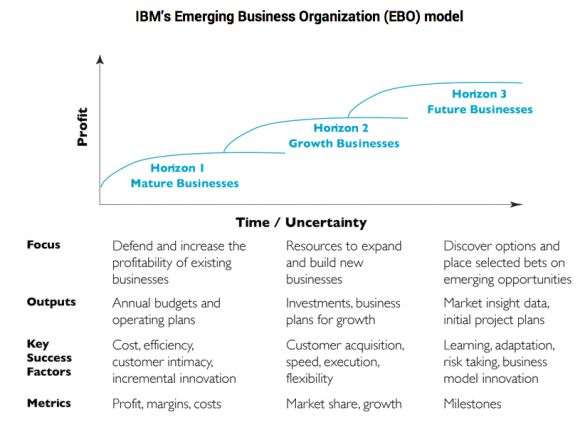

A good model for ambidexterity is IBM’s Emerging Business Organization (EBO) model. The basic idea of the EBO is to manage the company based on three distinct time horizons: mature businesses, growth businesses and future businesses. Based on their horizon, business opportunities are managed to optimize profit, growth or the attainment of milestones.

Source: California Management Review

The EBO model has allowed IBM to adapt iteratively while sustaining its core businesses. As it explored future growth options, the company solicited ideas both internally and externally. It then selected new business models and capabilities that could scale beyond $1 billion in revenues. IBM also emphasized strategic alignment and leveraged strengths from across the existing organization. In order to maximize success rates, new initiatives were led by experienced managers with successful track records scaling up major business units, and senior management provided dedicated support, including direct reporting and monthly reviews.

Tool #2: Discovery-driven planning and growth

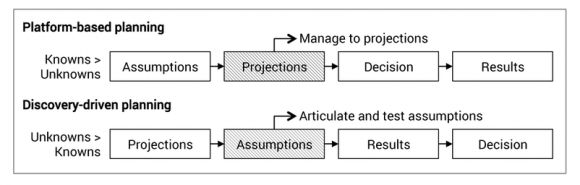

Traditionally, IBM’s planning process was effective for existing businesses, but stifling for new ventures. When disruptive innovation changed the business environment, IBM needed an explicit process to guide the development of emerging growth businesses. A key lesson from the EBO model was the need to measure future businesses around carefully defined and monitored “milestones” rather than traditional financial metrics and forecasts.

Source: Harvard Business Review

Discovery-driven planning helps companies invest small amounts in a way that maximizes the ability to learn to scale ventures successfully. It could be described as the mature corporation version of the “lean startup” approach to entrepreneurship. Discovery-driven planning acknowledges that, contrary to existing businesses, early-stage projects operate in a context where little is known and much is assumed. It can be done following a five-step process:

- Start with a reverse income statement that calculates the amount of revenue required to achieve the needed profit

- Calculate the allowable costs by laying out all activities required to produce, sell, service and deliver to customers

- Identify all the assumptions that need to be true in order for profit, revenue and allowable costs to occur as planned

- Revise the reverse income statement after obtaining better data for critical assumptions and re-evaluate the plan

- Test assumptions at milestones to guide resource allocation, make adjustments and enhance learning

When applied correctly, this approach to planning allows large organizations to develop emerging opportunities with a startup mentality. Additionally, managers can leverage these methods to scale successful ventures incrementally and learn systematically from failures.

Tool #3: Adaptive strategic partnering

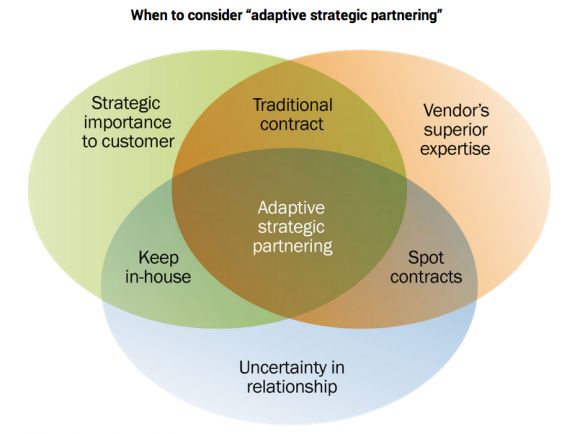

Typically, large companies such as electric utilities base their relationships with external partners on rigid contractual agreements. In evolving environments, those partnerships often lack the flexibility to last. Companies seeking new capabilities need to develop partnerships that will still be meaningful as the market changes.

Adaptive strategic partnerships break some traditional rules of business relationships. By being somewhat loose in specifying what their partners are expected to do, companies can build new capabilities through each other. For example, IBM’s partnership with Apple combines trusted enterprise services with design excellence. Building adaptive partnerships requires three important features:

- Establishing holistic incentives that focus the efforts of partners on joint value creation (i.e., profit sharing) rather than distributing value or guaranteeing performance

- Sharing information extensively so the company and its partners can move beyond transactional interactions to solve problems together and anticipate customer needs

- Creating collaborative processes to promote learning, trust and adaptability to a changing competitive environment (i.e., keeping contracts flexible and embracing ongoing negotiation as a value-creation dialogue)

Source: MIT Sloan Management Review

When designing the ground rules for an adaptive strategic partnership, a minimum governance framework can serve as the foundation for trust and flexibility. Ideally, it will include:

- Exit options that enable partners to commit more fully to each other by limiting the damage in case of failure -- much like a prenuptial agreement

- Noncompete clauses that facilitate complete collaboration while allowing partners to scale new capabilities across their respective customer bases

- Rights of first refusal that keep opportunities within the partnership and reinforce the trust necessary to sustain the relationship

Tool #4: Reinvention through acquisition

Successful self-disruptors continuously develop or acquire the new capabilities they need for the evolving market. The decision to acquire is a question of whether it is faster or more economical to buy something that could, given enough time and resources, be built in-house. While most acquisitions fall short of expectations, sometimes the right deal can transform a company’s growth prospects.

According to the Harvard Business Review, more than $2 trillion is spent on acquisitions every year -- and those investments fail nearly 90 percent of the time. The vast majority of acquisitions fall short of expectations because companies often pay the wrong price and integrate acquisitions the wrong way. Successful integration is particularly important when building new capabilities. The difference is understanding whether an acquisition is meant to boost current performance or reinvent business models.

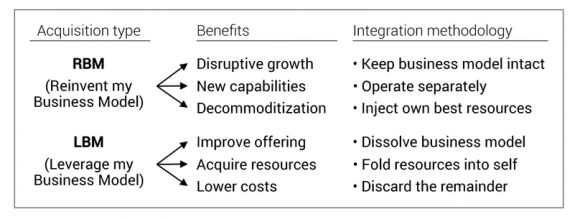

The following table identifies the distinguishing characteristics of two types of acquisitions.

Reinvent my Business Model (RBM) are acquisitions of a new business model that complements, extends, or replaces the current one (e.g., IBM and PwC Consulting).

Leverage my Business Model (LBM), on the other hand, are acquisitions of resources that do not fundamentally change the way a company competes (e.g., buying a competitor’s customers).

Source: Harvard Business Review

When the opportunity to acquire new capabilities arises, the type of acquisition should guide the approach to integration.

For RBM acquisitions, it is crucial to keep the acquired company’s business model intact, thus preserving its processes and priorities. Most commonly, this is done by operating the acquired company independently. To maximize the success of the investment, the buyer should then inject its best resources into it, including technology and growth capital.

For LBM acquisitions, the acquired company’s business model is usually dissolved -- as such, its processes and priorities are discarded. In these cases, it is assumed that new capabilities are not the goal of the investment. The acquired company’s resources are then folded into the buyer’s organization.

Tool #5: Engagement of senior leadership

According to Clay Christensen’s research, the most critical resource in the face of disruption is the CEO or another senior leader with comparable influence. Unfortunately, the mismatch between the scope of executive attention and the small-sized nature of disruptive opportunities often limits CEO awareness. Because the processes and values of large companies are naturally aligned with the inertia of current mature businesses, there is no alternative to senior leadership assuming oversight responsibility for disruptive growth. Senior leaders must:

- Actively coordinate action and decisions when no adequate processes exist to guide the organization

- Break the grip of established processes when a team is confronted with new patterns of communication, coordination, and decision-making

- Create processes to reliably guide and coordinate the work of employees involved in recurring activities and decisions

- Stand astride the new and emerging businesses to ensure that useful learning flows back into the mainstream and the right resources, processes, and values are being applied in each context

In addition to intervening within the organization, senior executives need to look to the horizon for signs that the business landscape is shifting. This allows changing circumstances to be viewed as an opportunity rather than a threat.

Several utilities are already self-disrupting

Despite the perception that regulated utilities are slow-moving and resistant to change, several prominent companies have already begun the process of self-disruption.

Duke Energy is assembling a “coalition of the willing” to provide smart grid technology vendors a platform for standards-based, secure interoperability. The company has built a test site for distributed energy technologies and is leveraging secure messaging protocols developed by the U.S. Navy to write its own algorithms for distributed intelligence. The result of Duke’s open-source project has been order-magnitude improvements in the time and cost required to deploy complex solutions for grid-edge challenges.

Consolidated Edison is embracing New York’s unprecedented regulatory overhaul to develop the capabilities required to become the state’s designated DSPP (Distributed System Platform Provider). Through its Green Team, the utility has been closely engaged with customers to educate them and provide next-generation energy services. In July 2014, Con Ed announced that it would use batteries, microgrids, and efficiency to delay a $1B substation build in Brooklyn/Queens.

Exelon Corp., which is buying ComEd, BGE, PECO and Pepco, is leveraging Constellation Technology Ventures -- its venture capital arm -- to make some early bets on potentially revolutionary technology companies. Past investments have included SolarBridge Technologies, ChargePoint and C3 Energy. Interestingly, Exelon is one of C3 Energy’s largest customers. The utility conglomerate has also recently announced a partnership with Bloom Energy.

NRG Energy, the largest merchant generator in the U.S., is reinventing itself to mitigate the vulnerability of its emissions-heavy business to carbon rules. CEO David Crane has been vocal in rebranding his company as a provider of clean energy. Since 2010, NRG has developed the eVgo electric vehicle charging network, partnered with ConocoPhillips and GE for energy technology development, and acquired Roof Diagnostics Solar, the eighth-largest residential installer in the U.S.

RWE AG, Germany’s second-largest utility, has been in difficult financial circumstances for several years due to nuclear shutdowns and the rapid penetration of intermittent renewables. As a result, the company announced that it would restructure its business as a project enabler and system integrator of renewables and efficiency. In mid-2014, RWE partnered with Conergy to market commercial solar project leases.

Becoming a discovery-driven platform

Regulated utilities are well suited to their core business purpose of delivering electricity. This can be demonstrated by their organizational capabilities, including:

Building on these core competencies, we can apply the “disruption management toolkit” to develop a business model that provides regulated utilities the organizational capabilities needed to thrive in the rapidly changing power industry.

One way to leverage current capabilities is to become a “discovery-driven platform” that incubates innovation from third parties. For example, the low-risk nature of deploying pilot projects offers utilities an attractive way to create value. By applying a discovery-driven approach to the exploration and management of pilot projects, it may be possible to build new capabilities with limited financial risk.

A discovery-driven platform based on pilot projects would allow utilities to:

- Learn from the pilots that fail in the context of broader capability development

- Invest resources in successful pilots to scale them and capture profits

- Innovate by integrating new capabilities across the organization

Through this process, utilities can develop unique capabilities for the integration of innovative technologies into the broader electricity system. As pilot projects scale successfully, adaptive partnering and acquisitions can allow utilities to benefit from the risk-taking of third parties. Most importantly, regulated utilities are well positioned to champion regulatory reforms that can unleash the value of system innovations.

A final note: Making the leap of faith

In discussions with senior utility executives, I’ve been told countless times about conflicting stakeholder priorities and the insurmountable challenges of culture. As IBM’s experience has shown, leaders ultimately need to make the leap of faith toward a less predictable outcome -- especially when more of the same is not enough.

Before IBM made a public commitment to the unproven technology that was the internet, the decision was far from obvious. Wall Street investors rewarded IBM for pioneering the internet era. When the company contemplated a transition into a service-based business model, powerful internal factions fiercely opposed the idea. The acquisition of PwC Consulting ushered profound changes into IBM’s culture.

Much is at stake in today’s energy landscape -- more changes have occurred in the past ten years than in the 100 years prior. These shifts are redefining competitive dynamics in the industry and the traditional capabilities of regulated utilities are no longer sufficient for sustainable growth. With the right management tools, utility leaders have the means to bring third-party innovations within their castle walls. Some companies have already seen the opportunity and pushed ahead of their peers.

The future looks bright for those who have faith in the power of human ingenuity.

***

Erik Desrosiers possesses a deep curiosity about the limitless potential of energy to transform human society. Prior to his recent advisory roles with business and policy leaders in the global power sector, he worked at McKinsey & Company and co-founded Opsun Systems, a solar energy equipment manufacturer based in Ontario, Canada.

This piece was originally published at Eric's Energy Innovation blog and was reprinted with permission from the author.