Maybe there is something to this battery component idea after all.

Amprius, a startup out of Stanford University that has crafted a highly efficient anode out of silicon nanowires for lithium-ion batteries, announced today that it raised $25 million from Kleiner, Perkins, VantagePoint, some guy named Eric Schmidt, and the Qian Neng Fund out of China, among others.

The interesting part is that Amprius may not make complete batteries. The company started in 2008 with a mission to make anodes and advanced materials that, presumably, it would sell to established manufacturers. Currently, Amprius is studying its options: it may produce anodes or it could go into the battery business. A final determination has yet to be made. But clearly, the component option is on the table.

Focusing on components rather than complete batteries makes sense on the surface. By just concentrating on components, Amprius could avoid the need to raise hundreds of millions of dollars to build massive factories and could focus instead on its core competency in science. Imara, another battery startup with a novel electrode, was felled in part by the need to build a battery factory. Boston-Power has raised a whopping $185 million and they haven't become a household name.

You could analogize the situation to the way Dell and Hewlett Packard buy their crucial PC components from Intel and Samsung. Everyone wins, yes?

Unfortunately, this is tougher than it sounds in batteries. Unlike PCs, batteries aren't a collection of independent components. They function as an organic whole. Change an electrode and you change the battery. Anodes and cathodes can give a battery its personality, similar to how an engine gives a car its personality.

To top it off, large Asian conglomerates -- which already employ extensive engineering teams and sponsor university research -- are generally reluctant to license crucial technology from startups. The large battery makers also fear losing a competitive advantage. If they license a third-party anode and their arch-rival does the same, their batteries might perform identically. The market would devolve into a price war.

Last year, we spoke to Envia Systems, which has invented an advanced cathode for batteries. Envia CTO Sujeet Kumar told us Envia didn't want to make batteries -- it just wanted to sell cathodes. While VC saw merit in the idea, they all said that the business model would be extremely challenging because of the reasons noted above.

A startup might be able to sell passive components such as separators -- something lithium air specialist PolyPlus and Porous Power have discussed -- but selling anodes and cathodes would be an uphill battle. (As a coda to this, PolyPlus this week at ARPA-E has been touting its complete lithium air battery: if they can't go the component route, who can?)

Still, the tide might be turning. In January, Envia raised $17 million and $7 million of the total came from General Motors. The VC group at General Motors operates at an arm's length from the automotive design group, but the talks indicate that GM might not be reluctant to suggest to a battery maker that maybe they should try the Envia cathode.

In the same month, Argonne National Labs announced that LG Chem and General Motors completed a licensing agreement for Argonne's composite cathodes. The license might just be a form of lawsuit insurance, but LG says it will make and use cathodes based on Argonne's design.

Electric car makers will also demand that battery makers reduce the weight and increase the performance of their batteries while expanding factory capacity. Orders will be flying in. To stay abreast of the competition, established manufacturers may have to reach out to third parties and startups.

Granted, the circumstances of the battery industry may dictate that a cathode or anode startup may only get one customer. But worse things than having Panasonic or Samsung as a strategic partner have happened to startups.

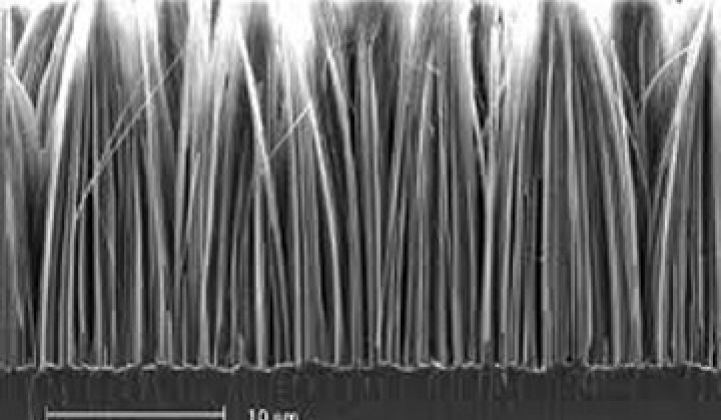

(Side note: silicon nanowires, love 'em. The pure spires of carbon-first championed by Harvard's Charlie Lieber are behind the waste heat generators under development at Alphabet Energy. Yi Cui, Amprius' founder, has said that silicon nanowire anodes could increase the capacity of existing batteries by 40 percent or more. Some have also said that silicon nanowires are much more amenable to mass manufacturing than things like single-walled carbon nanotubes.)