A brawn versus brains battle is brewing in the solar market.

Asia and Europe currently dominate the $50 billion solar market, which itself is dominated by silicon crystalline panels. By contrast, most of the thin-film market is concentrated in the U.S. If thin film lives up to the promise of its proponents, the U.S. could conceivably upend the balance of power.

Then again, U.S. companies will have to establish their technologies quickly and fend off growing expertise in thin film by Honda, BP, Sharp and others.

"Thin-film players have got to get into the industry in the next few years, and you got to move to scale," said Nathan Furr, a Greentech Media consultant and co-author of a new market research report by Greentech Media surveying the North American solar industry (see summary).

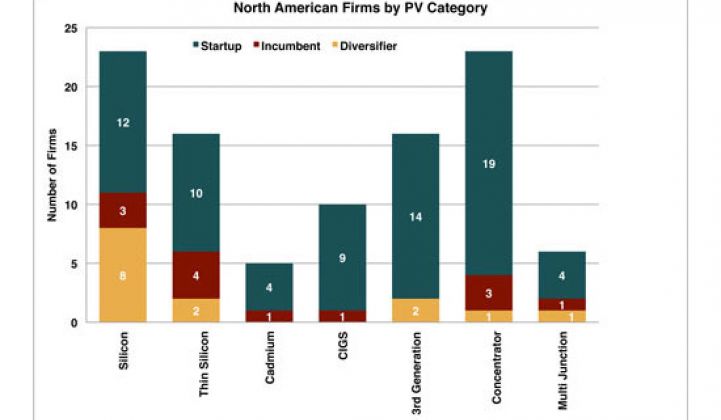

The report divides solar technologies into four areas: crystalline silicon, thin film, concentrating solar and everything else (organic cells, dye-sensitized solar cell, etc.)

In some ways, the nature of the competition differs between the crystalline solar cell and thin-film market. The crystalline market is fairly mature. Thus, the manufacturers Japan, China and Germany largely compete on manufacturing scale, building large factories and nailing the science of producing lots of products cheaply.

By contrast, the thin-film market barely exists, particularly with solar panels that don't rely on silicon. First Solar in Tempe, Ariz. is one of the few companies have achieved that all-important milestone of producing products in high volumes with a non-silicon product. (It uses cadmium tellurium.)

As a result, competition revolves around raising capital, landing patents, building a management team and establishing prototype plants. About 4.3 billion in venture capital has gone into solar technologies between 2005 and the third quarter of 2008, with majority of the money going to North American companies.

"The North American PV industry as a whole represents a strongly diversified technology portfolio," Furr wrote in the report. "There are more PV technology developers in North America than in Europe and Asia combined."

The main thin-film technologies today use cadmium tellurium, amorphous silicon or copper indium gallium selenium (CIGS) as the main ingredients the cells. Meanwhile, some others such as Stion and Bloo Solar say they will come out with panels made of entirely new materials or structures for trapping light better than conventional cells. (Stion is said to be working with quantum dots.)

Furr pointed to Solyndra and Nanosolar as good examples of thin-film startups with the potential to become large players. Both California companies make CIGS panels and have begun commercial production of their products.

Competition between the two also has become intense. Nanosolar CEO Martin Roscheisen just wrote a long blog refuting claims made by Solyndra about its unusual solar panel designs (see Nanosolar: Tubular Thin Films Are Overrated).

"North America's small, entrepreneur-driven PV companies stand to emerge well-positioned globally following the resetting of credit markets in 18 to 24 months," the report said.

Nonetheless, these companies must move quickly. Q-Cells is funding a cadmium telluride company while Honda has one of the world's biggest CIGS efforts underway.

"It's a wonderful thing to increase cell efficiency, but you've got to be able to do it in scale and ramp up," Furr said.

Of course, the world versus America line invariably begins to get hazy in a global market. First Solar achieves some of its lowest manufacturing costs in its factories in Malaysia while SunPower manufactures heavily in the Philippines.

Meanwhile, SolarWorld from Germany is building what it says will be the largest solar cell factory in Hillsboro, Ore., (see Q&A: Will U.S. Become a Solar World?). Sanyo Electric from Japan is building a factory Salem, Ore.