On Friday, ALTe announced a $200 million joint venture with China’s MESA Century New Energy Technology, aimed at building its company’s electric drive train components into hybrid-electric vehicles for China’s roads.

The deal includes a $70 million contract to support ALTe’s engineering work in the United States, CEO and co-founder John Thomas said in an interview. The company has raised about $23 million to date, but needed more capital to scale, and was targeting about $100 million in new investment, as well as a request for a $65 million Department of Energy loan, he said.

But ALTe recently gave up its quest for DOE backing and turned to China. The new cash injection that comes with the MESA JV will reduce ALTe’s future capital-raising needs to about $50 million total, compared to $100 million, he said.

The deal helps ALTe overcome a Catch-22 it faces as a new entrant to the automotive market. As Thomas put it, without mass production in place, it can’t get the financing to scale up to mass production volumes.

The new JV, formally named 'MESA Industrial Technology Corp.,' aims to solve that by churning out about 240,000 hybrid drive trains per year for “medium-duty” vehicles for China’s market. Medium duty includes everything down to vehicles with a displacement weight of 8,000 pounds or so, which could include vans and light trucks as well as buses and heavy-duty trucks, Thomas noted.

China, which expects the number of vehicles on its roads to triple between now and 2030, recently announced plans to spend up to 2 billion yuan ($315 million) per year to boost its number of “alternative-energy” vehicles to 500,000 by 2015 and 5 million by 2020.

Several big automakers, including General Motors and Volkswagen, are planning EV or PHEV vehicles for China’s market. They’re joined by domestic giants like BAIC, First Automotive Works (FAW) and Dongfeng, along with Chinese startup BYD, which is backed by U.S. billionaire investor Warren Buffett. Meanwhile, Los Angeles-based startup Coda Automotive is building electric cars for U.S. markets in Chinese factories.

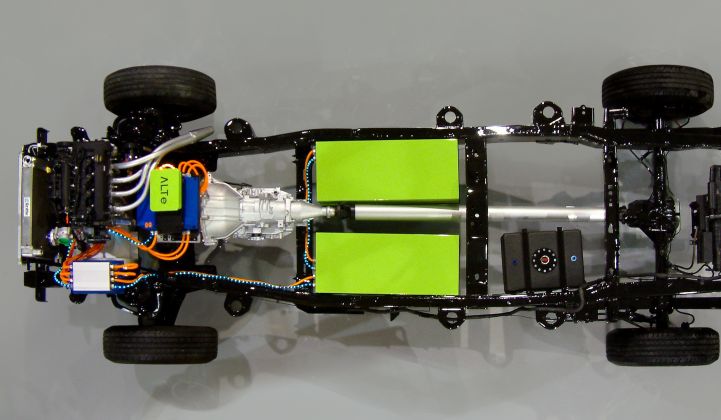

ALTe, for its part, has retrofitted Ford F150 trucks and E350 vans with all-electric and hybrid electric drive trains, and has tested them out with utility and corporate clients like Frito-Lay and Pacific Gas & Electric.

The MESA deal is concentrating on series hybrid-electric drive trains, Thomas said -- a nod to the fact that range anxiety still plays a role in buying decisions of government and corporate fleet buyers, as well as individual consumers -- though it could extend to all-EV units in the future, he said.

While the U.S. fleet has a lot more heavy passenger cars than does China’s, trucks and buses account for about 47 percent of China’s transportation fuel consumption, making heavier vehicles a good target for investment, he added.

Interestingly, ALTe gets its batteries from A123, the struggling lithium-ion battery maker that’s now trying to escape insolvency via a $450 million rescue deal with China’s Wanxiang Group. If approved by both governments (a big 'if'), Wanxiang would assume roughly 80 percent ownership in the company, at a price steeply discounted from the Waltham, Mass-based company’s IPO share price some two years ago.

Another Massachusetts-based lithium-ion battery maker, Boston-Power, announced this month that it’s supplying battery systems to Beijing Electric Vehicle Co.(BJEV), the electric vehicle delivery arm of Beijing Automotive Industry Company (BAIC). At the same time, China-focused Boston-Power investor GSR Ventures has taken a stronger role in the company, with GSR managing director Sonny Wu taking over CEO duties from founder Christina Lampe-Önnerud, who is expected to depart by year’s end.

ALTe currently buys its electric motors from supplier Remy, but has another deal with an as-yet-unannounced major OE for the supply of the engines that it will retrofit for hybrid vehicles in North America. Thomas said that “one of the big five auto companies in the world” has agreed to sell its four-cylinder engines to ALTe for four years for use in North America, while the company is working on a parallel engine supply deal for Asia.