AlertMe has landed £8 million ($12.8 million) in Series B funding for its ZigBee-based and web-enabled home energy management devices.

The funding from Good Energies, Index Ventures, SET Venture Partners and VantagePoint Venture Partners will help the United Kingdom-based home energy monitoring startup to push distribution of its products and develop new ones, it announced Wednesday.

In November 2007, AlertMe raised £5 million ($10.35 million at the time) from Cambridge Angels and an unnamed Boston-based firm.

Like some other startups in the crowded home energy management field, AlertMe got into the home energy management space through a different avenue. In AlertMe's case, it was home security gear – a similar tactic to that being taken by Palo Alto, Calif.-based startup iControl and security and home entertainment system maker Control4.

In March, AlertMe started selling its SmartPlug – a device that plugs into a wall socket to measure and control power for appliances or other devices that are plugged into it – for £25 ($40) apiece.

That's on top of the £149 ($239) and up for the hub that connects the sensors to a home's broadband connection and other peripherals, according to the company's website. A monthly fee of £9.99 ($16) is also charged for more extensive kits.

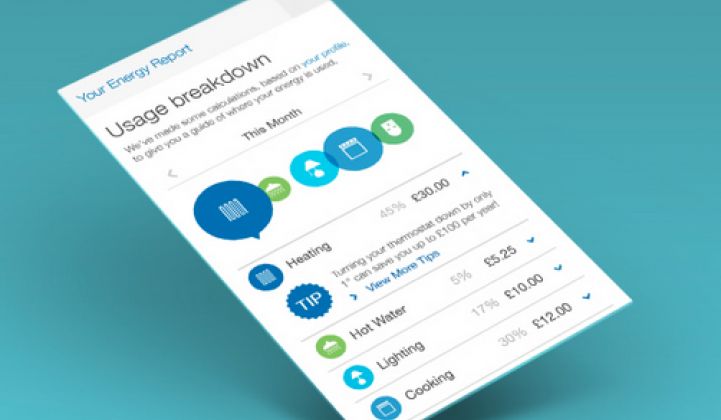

Next on AlertMe's list are home heating control via temperature sensors and controls, as well as electrical meter reading devices.

While AlertMe touts the advantages that utilities may see from linking its devices to smart meters, it doesn't have any utility partnerships, though the company says it is working with several undisclosed ones.

That's a different relationship to utilities than fellow U.K.-based energy monitoring startup Onzo, which has a tight arrangement with Scottish and Southern Energy. The utility has a £7 million order and rights to distribute them in the U.K. and Ireland, and holds a 49 percent stake in Onzo through a £2 million investment.

Whether to sell through utilities or directly to consumers is a question facing many developers of devices and services for home energy monitoring devices.

While some see utilities as natural leaders in paying for the devices that could help them control peak power demand, others fear that utilities won't move fast enough to satisfy the market (see Will Utilities or Customers Lead in Smart Grid?).

Tendril Networks, for instance, aims to sell to utilities, and has pilot projects underway with about 30 of them, including a 3,000-plus home pilot with New England utility NStar (see Tendril Lands $30M as Growth, Consolidations Loom in Smart Grid).

Join industry leaders and influencers at Greentech Media's Green Building Summit in Menlo Park, Calif., June 11.