Smart inverters are going to play an important role in the future of rooftop solar. They already are in Germany, and in the United States, a handful of bellwether utilities are already starting to deploy them. Now the question is whether state-by-state regulations and industry standards can evolve quickly enough to let more utilities and inverter makers join in.

Those are some of the top-line findings from a report released Thursday by the Solar Electric Power Association (SEPA) and the Electric Power Research Institute (EPRI). Taking a look at four key U.S. utilities, the report highlights the significant differences between today’s limited smart inverter rollouts, and the full spectrum of capabilities envisioned for the technology down the road.

The report, Rolling Out Smart Inverters, finds evidence that autonomous inverter grid support functions can be readily deployed at low cost today, and that retrofitting inverters for advanced capabilities can be effectively managed by utilities.

These enhanced capabilities, which include reactive power compensation, voltage and frequency ride-through, and real-time data connectivity, “could potentially offer utilities a least-cost tool for mitigating many grid management challenges" and “help defer or avoid certain distribution, transmission, and electric supply upgrades.”

At the same time, “unresolved issues related to the devices’ implementation and use have limited deployment. Ongoing revision of voluntary standards (e.g., IEEE 1547), grid codes (e.g., California’s Rule 21), interconnection procedures, and communications protocols are affecting utility rollout approaches.”

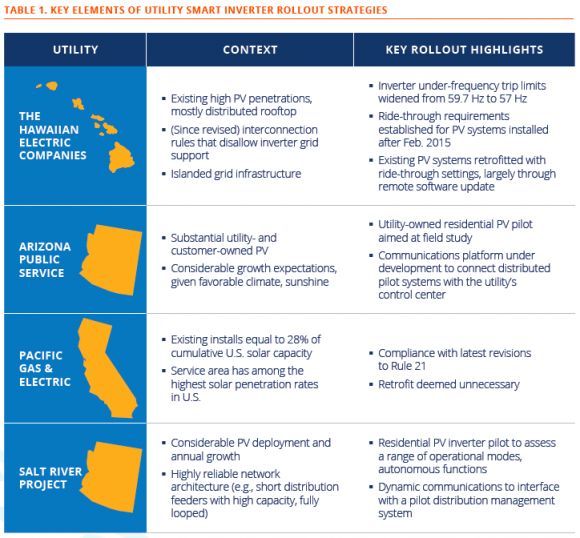

The four utilities -- Arizona’s Salt River Project (SRP) and Arizona Public Service (APS), The Hawaiian Electric Companies, and California’s Pacific Gas & Electric (PG&E) -- are in very different stages of deployment, with very different goals. At the same time, each utility’s work is in some ways interdependent on the others. California’s work on revising grid codes and industry standards to allow smart inverters to come to market will have an important influence on how quickly Arizona’s project can get started, for instance. On the other hand, Hawaii’s smart inverter deployments have in some cases gone ahead of the groundwork being done in California and helped to inform it.

Hawaii

Hawaii went first, because it had to. As of this year, the island of Oahu is getting a collective 500 megawatts, or 15 percent of installed generation capacity, from solar PV, and 97 percent of that is residential. And unlike mainland grids, the “small, isolated nature of the islands’ grids” makes inverter response to voltage and frequency events much more important, “because each grid network must be self-sufficient; it cannot rely on neighboring electricity systems for support.”

By 2011, Hawaiian Electric was working with inverter installers to widen the frequency trip limits on their PV-connected systems, to avoid the threat of lots of rooftop solar tripping offline during a frequency excursion and making the problem worse. It also asked that inverters be able to switch to “must ride through” settings if utility grid operators determined they needed the solar to get through the problem.

In 2014, Hawaii demanded more of their inverters, making ride-through capabilities mandatory for systems installed after February 2015. It has since played host to a number of smart inverter pilots, featuring industry players such as SolarCity and Enphase, that have shown how residential solar inverters can be upgraded remotely to meet these requirements.

California

PG&E also has a lot of rooftop solar to contend with. Total distributed generation penetration on the distribution system is about 10 percent of peak load, and 80 percent of that is PV, the report found. But individual feeders range from nothing to beyond 200 percent of the feeder’s peak load, and many circuits are expected to reach 100 percent of peak load in the coming years.

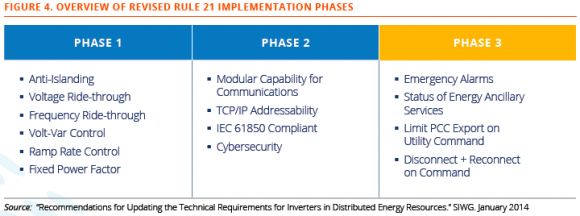

But where Hawaii has pushed ahead of industry standards to some degree, “PG&E’s strategy is essentially rooted in compliance with new state-level requirements,” the report noted. That includes revisions to the California Public Utilities Commission’s Rule 21, led by the Smart Inverter Working Group, formed by the CPUC and the California Energy Commission in 2013 to determine how key advanced inverter capabilities could be aligned with state grid codes, interconnection procedures, and industry technology standards and safety certifications.

By next year, new solar systems are expected to come with so-called “Phase 1" autonomous capabilities, including expanded ride-through settings such as those being used in Hawaii, as well as adjustable volt/VAR settings that could be activated by the utility. Phase 2, which will deal with communications capabilities being defined in standards such as IEC 61850 and SEP 2.0, and Phase 3, which will implement more dynamic controls and dispatchability, are further out.

While smart inverter pilots are underway in California, PG&E hasn’t yet taken its own pilots out of its test facilities at present. “Utilities in California have the flexibility to implement Rule 21 before the effective deadline, and PG&E may do so on a case-by-case basis as feeder conditions warrant. The utility has not yet implemented any inverters in compliance with Phase 1. Despite the vast deployment of PV in PG&E’s service territory to date, the utility has no plans to retrofit inverters on previously installed systems.”

Arizona

The two Arizona utilities rounding out the report haven’t yet deployed smart inverters, but both are in the midst of designing utility pilots to test them out. These plans include automated features like ride-through settings, but they also include a communications and control component.

As part of its Solar Partner Program, APS is seeking permission to install smart inverters for about 1,500 home solar systems, totaling up to 10 megawatts, in the Phoenix metro area. Each customer will receive a $30 per month bill credit for turning over their inverters to utility data collection, and potentially to real-time controls.

APS’ control system is meant to “update settings, command inverter responses during contingencies, and leverage the inverters’ sensor data for feedback on operations and overall power quality,” the report notes. “To better align solar output with peak system demand, APS is targeting participants with west- or southwest-facing rooftops. Additionally, grid-tied battery storage will be installed on two feeders,” adding energy storage to the list of capabiltiies being tested.

SRP’s Advanced Inverter Project is also designed as a utility-controlled pilot, with a target of linking about 1,000 residential solar systems. Like Hawaii and California, it’s planning to test a certain number of inverters using only autonomous functions.

A second category of inverters will come with limited communications capabilities, mainly aimed at making seasonal adjustments to operations -- for example, matching summertime peak air conditioning loads to peak solar PV output. A third category of inverters, capable of dynamic communications capabilities linked with a pilot distribution management system, will be limited to a single circuit.