Think of this as a fine single malt nylon.

Modular Carpet Recycling (MCR), a startup out of Delaware, says it has come up with a precipitation process to efficiently recycle nylon fibers in old carpet, a material we’re swimming in even with the stall in construction.

Four billion pounds of carpet enter waste streams in the U.S. each year, says CEO Ron Simonetti. Five pounds of oil go into a single pound of nylon, so annually the U.S. could curb oil exports by millions of barrels via recycling.

“Two percent to three percent of the waste streams in California are carpet,” he said. “Every person in the U.S. uses 10 pounds of carpet a year.”

Just as important, MCR says it can produce recycled nylon, branded as Renewlon, for more than ten percent less than the cost of comparable virgin materials. Virgin nylon costs around $1.10 a pound to produce, according to industry pricing reports, and the price rises with spikes in oil. It then sells it for less than the $1.40 a pound going rate and its margins increase as oil prices rise. The numbers would begin to break down financially if oil dropped to $50 a barrel or lower, but oil right now is in the $80 range.

A very large fiber manufacturer has signed a right of first refusal to obtain the output from MCR’s factory, which can produce 5 million pounds of nylon a year. MCR hopes next to build more modular factories.

Recycling, like water and agriculture, is one of those green technology markets long on potential but short on actual profits, progress or interest from investors -- but that could change. New waste regulations combined with improving technology are making it more economical to refurbish.

Garbage giant Waste Management leads the charge on gritty green. It is transitioning from a trash company to a lifecycle services firm as well as investing in startups and experimenting with technologies like landfill-to-methane. Meanwhile, Autodesk is helping manufacturers to design with recycling in mind and investors such as Steve Jurvetson have spoken more enthusiastically about discards.

Startups to watch include Ostara (fertilizer from human waste), Lehigh Technologies (old rubber), Bioplastech (plastic recycling through microbes), Electronic Recyclers and iGPS (plastic pallets).

Carpet is already benefiting from legislation. California has passed a law that places a recycling fee on carpet. Delaware, Pennsylvania, New Jersey and Maryland are contemplating similar legislation. The EU has a ban on carpet in landfills. But instead of recycling, many people burn it, and a pound of carpet contains 15,000 BTUs. Talk about Eurotrash.

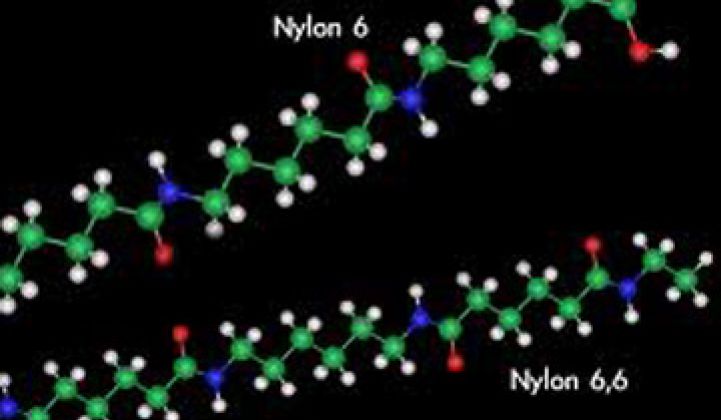

The key to MCR’s technology is a precipitation/distillation process it calls DynaSep. First, carpet goes to a recycler where it gets shaved. The backing, made of calcium carbonate, goes to one company and MCR takes the fibers.

MCR dissolves the fiber in formic acid to make a nylon soup. Then comes the secret precipitation process. The process occurs at room temperature, but at an elevated pressure. In the end, the process fleeces out the dirt so that the company is left with 99 percent pure nylon and a reusable tub of formic acid.

“It is not a very energy-intensive process,” Simonetti said. “If we couldn’t reuse the chemicals we’d be dead in the water.”

The process was invented by co-founder Brian Waibel, an expert on separation and drying.

Other nylon recyclers with different processes achieve a 95 percent to 98 percent level of purity, but in this environment that’s enough to offset the economics. MCR’s next step involves boosting purity to 99.8 percent. It also working on a shaving process to get more fiber from old carpet: conventional techniques only yield about 50 percent of the fuzz.

Perhaps the biggest challenge that MCR faces is the stinginess of the American consumer. The MCR process only works with nylon and many manufacturers have begun to produce carpet out of PET.

“PET is technically recyclable, but economically, it doesn’t make sense,” said Simonetti.

MCR has received funds from Musea Ventures, a small firm with stakes in Kateeva (equipment for OLEDs), HelioFocus (superheated solar thermal) and Designer Energy (sugar), but is seeking more for expansion.