“Maybe 97 percent or 98 percent of all projects don’t get financed,” explained CEO Haresh Patel of Mercatus (formerly SCS Renewables). “We claim we can improve the closure rate by 35 percent to 40 percent. That almost doubles the customer’s revenues without adding expense.”

Bank money that solar developers urgently need could be freed up by the just-released Mercatus digital deal room software, according to the company’s solar finance veterans.

The customer, Patel said, is “anybody on the buy side of the equation. We help anybody trying to put money to work in project finance.”

Developers’ financing gets rejected, Patel explained, because they don’t understand that banks assess technologies and projects from a risk and opportunity perspective. “The trick of bankability is learning to speak bankers’ language.”

Patel said the new software tool is informed by the Mercatus team’s “100-plus man-years of solar domain expertise” and “three-plus gigawatts of solar projects reviewed, appraised and scored.”

The software is “like an online application. It uses input from 40 leading investors and summarizes what they need to evaluate a project.”

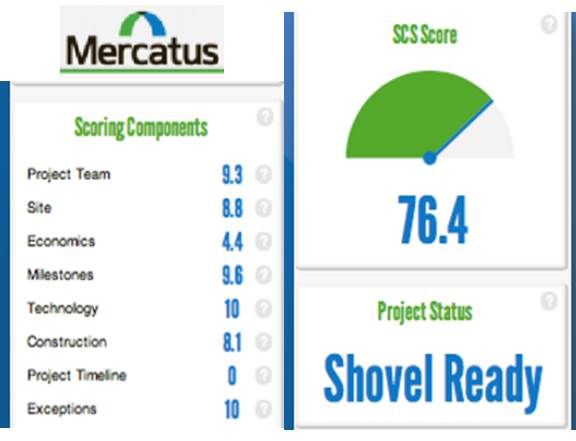

The software scores the application for completeness in eight different categories (project team, site, economics, milestones, technology, construction, project timeline, exceptions) and renders what Mercatus calls “the Single Point of Truth report.”

The idea is to provide something like a FICA score for the project, Patel said. “It allows investors to quickly decide. In business, yes is great, no is great, and maybe will kill you. We are trying to get out of this world of maybe.”

Both the developer and investor see the score. The developer’s “harvest rate” can be improved by adding missing information.

Using the tool’s data to evaluate projects, Patel said, can take three to six weeks off of investors’ due diligence process.

But the real power of the platform, he explained, is that it can look at an investor’s entire portfolio of projects or a developer’s entire deal book and group projects that are comparable in risk and return.

Over the last six months, it has become clear that large utility-scale projects are dead, Patel said, echoing something NRG Solar VP Randy Hickok also told GTM recently.

“That leaves banks stuck with large pools of money,” Patel explained.

They have put $250 million to $350 million tranches into residential third-party ownership deals with companies like SolarCity (SCTY) and Clean Power Finance. And now they are looking at distributed generation, commercial projects between 250 kilowatts and 20 megawatts, Patel said.

“But banks are trying to use a utility-scale template,” he said. Their diligence process is slowed by the complexity of assessing a pool of small projects because a bank doesn’t see all the projects in a developer’s deal book as equally investment-worthy.

“They are looking for ways to pool $2 million projects and create a $200 million portfolio. We have solved that,” Patel said. “We bring down the diligence cost and increase the speed of the decision-making. The Mercatus software can process in 48 hours what bankers say it takes them 60 to 75 days to assess. “

The Mercatus tool finds and aggregates similar projects. “Whoever can get them into a pool where the bank can process them quickly will get the money from the bank.”

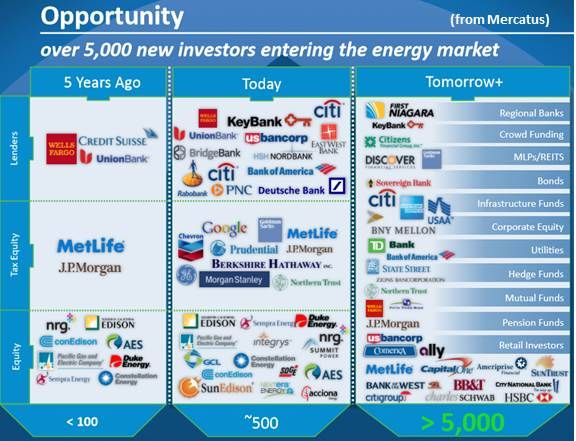

Solar is not an asset class now, Patel said. “There are only 300 to 400 players globally, and about ten or twelve investors in the U.S. control almost the whole thing. But that is about to change.” There are potentially some 5,000 players with an estimated $37 trillion to invest, he said. “We are positioning ourselves to bring that in.”

New financing tools just emerging in the solar sector like REITs, MLPs and securitization will also be easier to manage with the Mercatus tool, Patel added. “We are dealing in the basic building blocks, making diligence on a pool of projects faster and less costly. Today, investors can’t bring that under a million dollars,” he explained. “We believe we can cut one-third of that cost.”

“Digital deal rooms like theirs help,” observed Distributed Sun Co-Chair/Managing Director Jeff Weiss, “and are becoming more of a norm.” Distributed Sun is leading the industry-wide truSolar effort. “It is our hope that truSolar can help make deal room services more usable and reliable by connecting them to a widely adopted, accessible standard.”

Weiss said that truSolar anticipates inclusion of Mercatus and other closed-loop platforms later this year.

“When they publish their standard, we will be a superset of it,” Patel said, “so it will be easy for us to look at a project and decide if it is truSolar-compliant.”