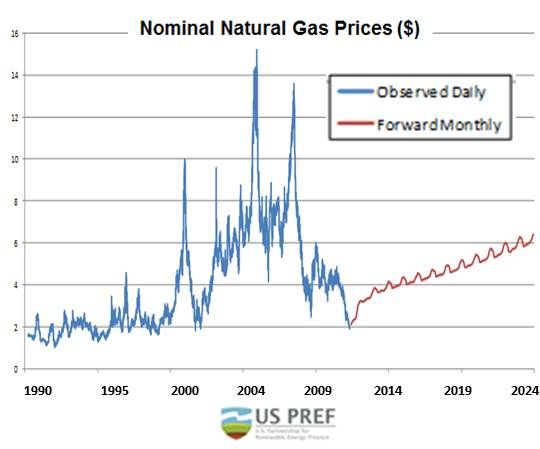

Any discussion about U.S. energy today inevitably turns to the new, abundant and cheap natural gas supplies being fracked from shale basins -- and how solar and wind can compete with it. But if you think of wind, solar and other renewable energy as an hedge against natural gas's price volatility, they start to look a bit more competitive.

That's how GE Capital’s Steven Taub explained one economic case for renewables during a session of the National Association of Regulatory Utility Commissioners (NARUC) summer committee meetings this week. Renewables may or may not be price-competitive with conventional generation right now, Taub said, but “one of the things you learn in Corporate Finance 101 is portfolio theory: Having assets in your portfolio that deliver a steady return can improve the overall risk-return of the whole portfolio, even if those assets offer a lower return than other things over time.”

So when GE thinks about renewables, Taub explained, “we think about them in terms of portfolio theory. Having a cost that is fixed, where variability is uncorrelated to the other variability in the portfolio, makes the portfolio as a whole more valuable.” For coal and gas, he said, the price of the fuel is much more of a factor. And because the price of fossil fuels can vary frequently and widely, depending on a range of energy related and non-energy related factors, “it is very difficult for people to have any certainty of what the costs are going to be.”

Indeed, as Duke Energy CEO Jim Rogers said (as quoted by ACORE CEO Dennis McGinn in introducing the NARUC panel discussion), “My number one fear is that we will be pushed to build natural gas at the expense of solar and wind. Ben Franklin said there are two certainties in life: death and taxes. To that, I would add the price volatility of natural gas.”

Taub started by explaining to his listeners, utility commissioners and staff from across the U.S. who will help set the state energy policies that may make or break renewables in next few years, how fully General Electric (GE) is committed to renewables. “We have a $20 billion portfolio and the biggest and fastest growing piece of that is renewables,” Taub said. “We have committed over $8 billion of the General Electric Company’s money to renewable energy projects in the past six years.”

Renewable energy “has become a mainstream part of the energy industry,” Taub told the regulators, many of whom may still see renewables as foreign and threatening. “In the last eight years, $300 billion have been invested in renewable assets in the United States. That is an average of $35 billion a year.” And that, he added, “is only a small piece of the $1.4 trillion the global energy industry has committed to renewable energy in that same time period."

More significantly, Taub said, people in the investment community who focus on energy know that “renewable energy is one of the main places where the money is going.”

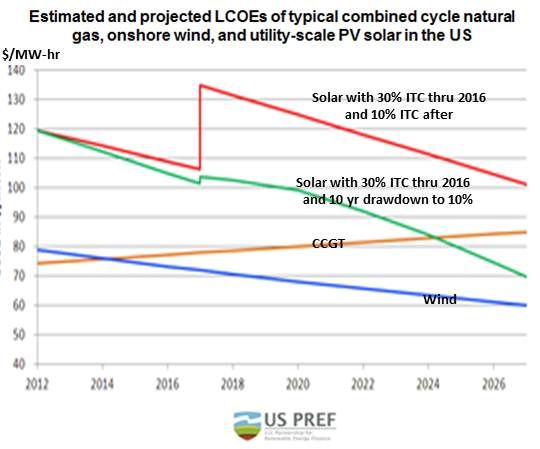

Wind and solar, Taub said, are in “a positive feedback loop.” As they become more competitive, they are deployed more and, as they are deployed more, costs decline and productivity increases, driving more growth, more cost declines and higher productivity.

“The capital cost of wind projects has gone down 40 percent in the last twenty years and, in that same period, productivity has more than doubled. Just in the last three years,” he added, “capital cost is down 20 percent and productivity is up 20 percent for a net 40 percent reduction in the cost of wind power. Three years!” The U.S. has been the second largest market for wind power in the last five years, he said, and ended 2011 with a cumulative installed capacity of 48 gigawatts.

There has been a 90 percent drop in solar’s capital cost, Taub said, though the improvement in solar productivity was “not quite as big” as wind’s. Nevertheless, he noted, 2011 saw 27 gigawatts of solar installed globally, including two gigawatts in the U.S. “You would have been hard-pressed to find anybody five years ago who would have said there would be 27 gigawatts of solar installed worldwide,” he added. “Then, the global market was less than 10 percent of that.”

The U.S. is still not one of the world’s biggest solar markets, he said, “but it is one of the most important, because it is one of the few places around the world where we are seeing market growth.”

The economics of renewables differs from the economics of other energy technologies, Taub explained, because the fuel is free. The capital cost of renewable projects drives the price utilities, consumers and businesses pay for the electricity they generate. “In the renewables business, the gold standard, what it takes to get a project financed and built, is a long-term, fixed-price contract with a creditworthy off-taker. Most of the time, that is an investor-owned or publicly owned utility.”